When it comes to reducing customer churn, the goal is to stop being reactive and start being proactive. It's a three-part process: first, you have to diagnose why people are actually leaving. Then, you learn to identify at-risk accounts before they hit the cancel button. Finally, you roll out targeted campaigns designed to prove your value and convince them to stay.

Why Ignoring Churn Is Sinking Your SaaS Business

Customer churn is so much more than a number on your dashboard—it’s a silent killer for SaaS companies. While everyone loves to talk about customer acquisition, retention is what actually builds a sustainable business. High churn slowly but surely sabotages your revenue, valuation, and growth by creating a classic "leaky bucket" that all your new signups just can't fill fast enough.

So many founders I've worked with underestimate the compounding damage. A 5% monthly churn might not sound like a five-alarm fire, but it means you're losing nearly half your customers over a single year. That’s a staggering hole to dig yourself out of, forcing you to run twice as hard just to stand still.

The True Cost of a Leaky Bucket

Think about everything that goes into acquiring one new customer: your marketing budget, your sales team's time, the effort spent on onboarding. When a customer churns, all of that investment vanishes. Poof. Even worse, you lose out on all their future potential—expansion revenue, word-of-mouth referrals, and invaluable feedback.

The financial bleed is severe and it compounds month after month. Let’s look at how small, seemingly innocent monthly churn rates can snowball into massive annual losses.

The Compounding Impact of Monthly Churn on Annual Revenue

This table shows just how quickly a "small" churn problem can spiral out of control for a SaaS business with 1,000 customers and a $50 Average Revenue Per User (ARPU).

| Monthly Churn Rate | Customers Lost Annually | Annual Recurring Revenue (ARR) Lost |

|---|---|---|

| 2% | 215 | $129,000 |

| 5% | 460 | $276,000 |

| 8% | 651 | $390,600 |

The numbers don't lie. Ignoring churn is like trying to fill a bathtub with the drain wide open. No matter how much water you pour in, you’re constantly losing ground. While the financial and credit sectors see some of the highest churn rates at 25% annually, even a fraction of that can be devastating. You can find more insights about customer retention rates to see how your industry stacks up.

Churn is the arch-nemesis of growth. It's the force that works against every new sale, every marketing campaign, and every product improvement. Getting it under control is the single most important thing you can do for your business's long-term health.

Moving from Reaction to Prevention

Here's the good news: churn isn't some unavoidable tax on doing business. It's a problem you can measure, understand, and ultimately solve. The real key is shifting your team’s mindset from panicked, reactive damage control to thoughtful, proactive prevention.

This playbook is all about giving you a framework for that shift. We're going to skip the high-level theory and get right into the practical, actionable steps you need to take to get churn under control.

You’ll walk away knowing how to:

- Diagnose the real reasons customers are leaving, not just the generic excuses they give in an exit survey.

- Identify at-risk accounts using simple health scores, long before they start shopping for alternatives.

- Deploy targeted retention campaigns that speak directly to their pain points and remind them of your value.

By the time you finish this guide, you’ll have a clear, step-by-step process for turning that leaky bucket into a fortress.

Diagnosing the Real Reasons Customers Leave

Before you can fix churn, you have to put on your detective hat. You need to dig past the surface-level excuses and figure out why customers really decided your product wasn't for them anymore. This isn't about guesswork; it's about a systematic diagnosis to uncover the root cause.

It all starts with measuring what actually matters. The first thing to get straight is that there are two kinds of churn—customer churn and revenue churn—and they tell you very different stories about your business's health.

Customer Churn vs. Revenue Churn

Customer churn, sometimes called logo churn, is simple enough. It’s the percentage of customers you lose over a given period. Start the month with 100 customers and end with 95? Your customer churn is 5%. This number gives you a good sense of your product's overall stickiness.

Revenue churn, on the other hand, tracks the percentage of monthly recurring revenue (MRR) that disappears with those cancellations. Frankly, this is often the more critical metric because it shows the direct financial hit.

Losing five tiny customers might be a 5% logo churn, but losing one massive enterprise client could also be a 5% revenue churn. Both numbers matter, but they point to completely different problems.

A high customer churn with low revenue churn probably means you're losing smaller, less-invested accounts. But high revenue churn with low customer churn? That's a five-alarm fire with your most valuable clients. You have to track both to get the full picture.

Getting Honest Feedback from People Who've Left

Once your metrics are in order, it's time to do some qualitative digging. You have to talk to the people who actually canceled.

Those generic exit surveys with multiple-choice answers like "Price" or "Missing Features" are a starting point, but they rarely get to the truth. Most people just click the easiest, least confrontational option to get it over with. To find insights you can actually use, you have to go deeper.

- Ask one open-ended question: When a user cancels, make them answer one simple, mandatory question: "What's the main reason you’re leaving us?" The unstructured text forces a real, human answer, not a canned response.

- Offer a quick chat: For your high-value customers, an automated email offering a brief call with a founder or product lead is gold. Frame it as a genuine request for feedback to make the product better, not a sneaky sales call to win them back.

- Dig through support tickets: Go back and review the last 30-60 days of support conversations for every single customer who churned. More often than not, the real reason they left is buried in a trail of unresolved frustrations or bug reports.

This process is how you move from vague assumptions to a concrete list of churn drivers. You'll start seeing patterns you can actually do something about.

Uncovering Hidden Patterns with Cohort Analysis

The final piece of the diagnostic puzzle is to stop looking at churn as one giant number. Lumping all your churned users together hides the most important trends.

This is where cohort analysis becomes your best friend. It lets you group customers by shared characteristics so you can see who is churning and when.

For example, you could slice your churn data by:

- How they found you: Do customers from Google Ads churn faster than those from organic search? Maybe your ad copy is setting the wrong expectations for what the product actually does.

- What they did first: Do customers who adopt Feature X in their first 30 days stick around longer? That might mean Feature X is your "aha!" moment, and you need to get every new user to it, fast.

- Which plan they were on: Is your entry-level plan a revolving door of new and churned users? It could be priced too low to attract serious customers, or maybe it's missing a key feature that proves its long-term value.

By segmenting your data like this, you transform a single, scary churn number into specific, solvable problems. You go from "our churn is too high" to "customers who don't integrate their calendar in the first week are 80% more likely to churn." Now that's a clear mission: get more new users to integrate their calendars.

Understanding these dynamics is a core part of calculating your overall customer retention rates, a process you can explore further by learning about the retention ratio formula in detail.

Spotting At-Risk Customers Before They Walk Away

Once you have a handle on why customers are leaving, it’s time to get ahead of the problem. The single most effective way to cut churn is to shift from being reactive to proactive. Don't wait for the cancellation email. You need to learn how to spot the warning signs that a customer is slowly drifting away.

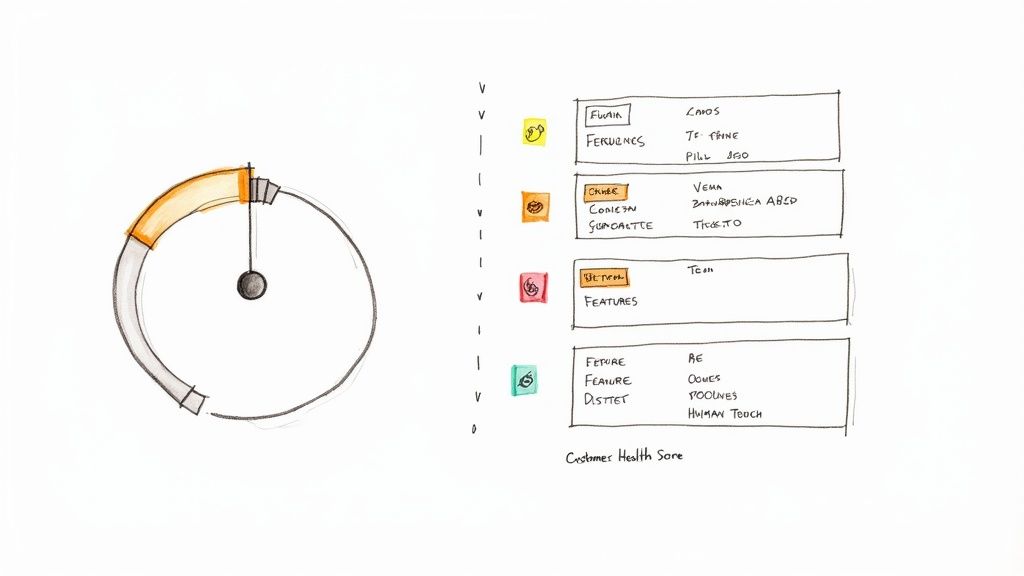

This is where a Customer Health Score becomes your secret weapon. It’s essentially a weighted score that rolls up a few key behaviors into one simple metric that tells you, at a glance, how stable an account is. The best part? You don't need a data science team to create one. You can start with the data you already have.

Building Your First Customer Health Score

A solid health score is built on the pillars of user engagement. While the exact metrics depend on your product, most SaaS companies can get a pretty reliable signal by tracking these three areas. Each one tells a piece of the story about how invested a customer really is.

- Product Usage Frequency: How often are they logging in? A daily-use tool will have a very different baseline than a monthly reporting app, but a sudden drop in login frequency is a universal red flag.

- Key Feature Adoption: What features do your stickiest, most loyal customers use? Pinpoint those and track whether new or struggling customers are using them. If not, they’re missing the core value.

- Support & Success Interactions: Are they flooding your support queue with tickets? Or, just as concerning, have they gone completely silent? Both extremes can signal trouble on the horizon.

Think of a health score like a car's check-engine light. It doesn't tell you the exact problem, but it alerts you that it’s time to look under the hood before you break down on the side of the road.

To put this into practice, just assign points. For example, logging in daily could be +10 points, but no logins for 30 days might be -20 points. Adopting your "Aha!" feature is +15 points, while having more than three unresolved support tickets is -10 points. Totalling these up gives you a score that lets you instantly sort customers into buckets: green (healthy), yellow (at-risk), and red (critical).

Don't Forget the Easy Wins: Involuntary Churn

Beyond tracking user behavior, there’s another, often-ignored source of churn that’s painfully easy to fix: involuntary churn. This is when a customer churns not because they want to, but simply because their payment fails. It’s wild, but it's estimated that 20-40% of all SaaS churn falls into this bucket, usually from an expired credit card, insufficient funds, or a bank decline.

This is a massive, preventable leak in your revenue bucket. The good news is that your payment processor, like Stripe, gives you everything you need to plug it.

You can set up simple alerts or use a dunning management tool to automatically flag accounts with payment issues. This instantly creates a prioritized list of customers who just need a gentle nudge to update their billing info. A simple, automated email sequence often recovers a huge chunk of this revenue without anyone on your team lifting a finger. If you want to get more technical on this front, we break down some advanced techniques in our guide to customer churn prediction.

By combining a proactive health score with a smart system for managing payment failures, you build a powerful early-warning system. This helps you focus your limited time and resources on the customers who truly need your attention, turning a potential cancellation into a saved relationship.

Putting Your Retention Plays into Action

Spotting an at-risk customer is one thing; actually convincing them to stay is the real challenge. This is where you move from passively monitoring data to actively saving accounts. A generic email blast won't cut it. You need a playbook of targeted campaigns designed for specific churn signals, each with its own timing and messaging.

The right move at the right moment can completely flip the script on a customer relationship. It’s about more than just damage control; it's your chance to remind them why they chose you in the first place and guide them back to that initial "aha!" moment.

For Customers with Low Product Adoption

When a customer's health score plummets due to inactivity, it’s a huge red flag. They haven't found the value yet. The good news? They're not angry or upset—they're just checked out. Your goal here is to re-engage them with gentle, educational nudges, not a hard sell.

A targeted email sequence is the perfect place to start. Forget the standard marketing fluff. This should be a short, automated series of emails triggered by a specific period of inactivity.

- Email 1: The Quick Tip. Send a simple, helpful email that highlights one specific, high-impact feature they haven't touched. Include a GIF or short video showing it in action. A subject line like, "A 30-second trick for [achieving X result]" works wonders.

- Email 2: The Case Study. Share a quick, one-paragraph success story from a customer just like them. Focus on the outcome, not the feature. For example: "How [Company X] saved 5 hours a week."

- Email 3: The Human Touch. If they're still MIA, have a real person (a founder or customer success lead) send a plain-text email asking if they need a hand getting started. No sales pitch, just a genuine offer to help.

In-app guides are your other secret weapon. With a tool like Appcues or Pendo, you can trigger a helpful tooltip or a quick product tour the next time they log in. This lets you guide them directly to a valuable feature they’ve been ignoring.

The key here is to be relentlessly helpful. You aren't selling anything new. You're simply helping them get the ROI they already paid for.

When Customers Start Questioning the Value

What about the customers who are using your product but still aren't convinced? Maybe their usage has flatlined, or they're dropping hints in support tickets about not seeing the expected results. This situation calls for a more direct, personal touch.

A personalized feature walkthrough can be incredibly effective. This isn't your standard sales demo. It's a proactive offer for a quick, 15-minute call to showcase an advanced feature that solves a problem you know they're facing. Your outreach can be as simple as: "Hey [Name], I saw you're using [Feature A] a lot. Did you know you can connect it with [Feature B] to automate your reporting? Happy to show you how."

This simple act shows you're paying attention and are invested in their success. It transforms your relationship from a simple software subscription into a genuine partnership. Remember, every touchpoint shapes the customer experience, which is a massive lever for retention. A landmark McKinsey study found that a European energy provider cut churn by 15% simply by improving their customer service. You can see the full customer service findings on Nextiva.com to understand just how powerful this is.

The Strategic Win-Back Flow

Let's be realistic: even with your best efforts, some customers will churn. But "canceled" doesn't have to be the end of the story. A smart, well-timed win-back campaign can recover a surprising number of these customers, especially if you act fast.

The best win-back emails are triggered the moment a customer cancels and are tailored to the reason they gave in your exit survey.

Win-Back Campaign Example (Reason: "Too Expensive")

- Timing: Send within 24 hours of cancellation.

- Subject: A quick question about your feedback

- Message: First, acknowledge their feedback. "Thanks for letting us know our pricing didn't work for you. We're always trying to get this right." Then, make a specific, time-sensitive offer. "As a thank you for giving us a try, here’s a 25% discount for your next 3 months if you’d like to come back. This offer is good for the next 48 hours."

This approach works because it isn't a desperate, generic plea. It’s a direct response to their problem with a compelling, urgent solution. You're proving that you listened and are willing to meet them halfway. Tailoring your response like this dramatically increases the odds of turning a lost customer into a loyal one.

Building Your Automated Churn Reduction Engine

Trying to manage customer retention manually is a losing battle. It feels like you’re constantly playing catch-up, and you just can't scale your efforts effectively. This is where you stop bailing water and start building a system that works for you around the clock.

To truly get ahead of churn, you need smart automation that triggers the right action at precisely the right moment—no human intervention required. The idea is to let the system handle the routine monitoring and initial pings that eat up so much time. This frees your team to focus on the high-value, complex conversations that actually save a customer relationship.

Connecting Health Scores to Automated Outreach

That Customer Health Score you built? It's more than just a number on a dashboard; it's a powerful trigger. By linking this score to your marketing automation or customer success platform, you can build dynamic outreach flows that kick in the instant a customer starts to drift away.

Let's say a customer's health score plummets from a solid 90 to a worrying 65 because they haven't logged in for a couple of weeks. Instead of discovering this during a quarterly check-in, your system can react immediately.

- The Trigger: A customer's health score drops below 70.

- The Action: An automated, plain-text email is sent from their dedicated Customer Success Manager.

- Example Email Copy: "Hey [Customer Name], just checking in. I noticed you haven't been as active in the platform lately and wanted to make sure you have everything you need. Are you running into any roadblocks I can help with?"

This simple, automated nudge feels personal and proactive. More often than not, it uncovers minor issues before they fester into reasons for cancellation. It’s all about bridging the gap between cold data and a real human connection. This is exactly what our platform, LowChurn, is designed to do—give your team the early warnings they need to act decisively.

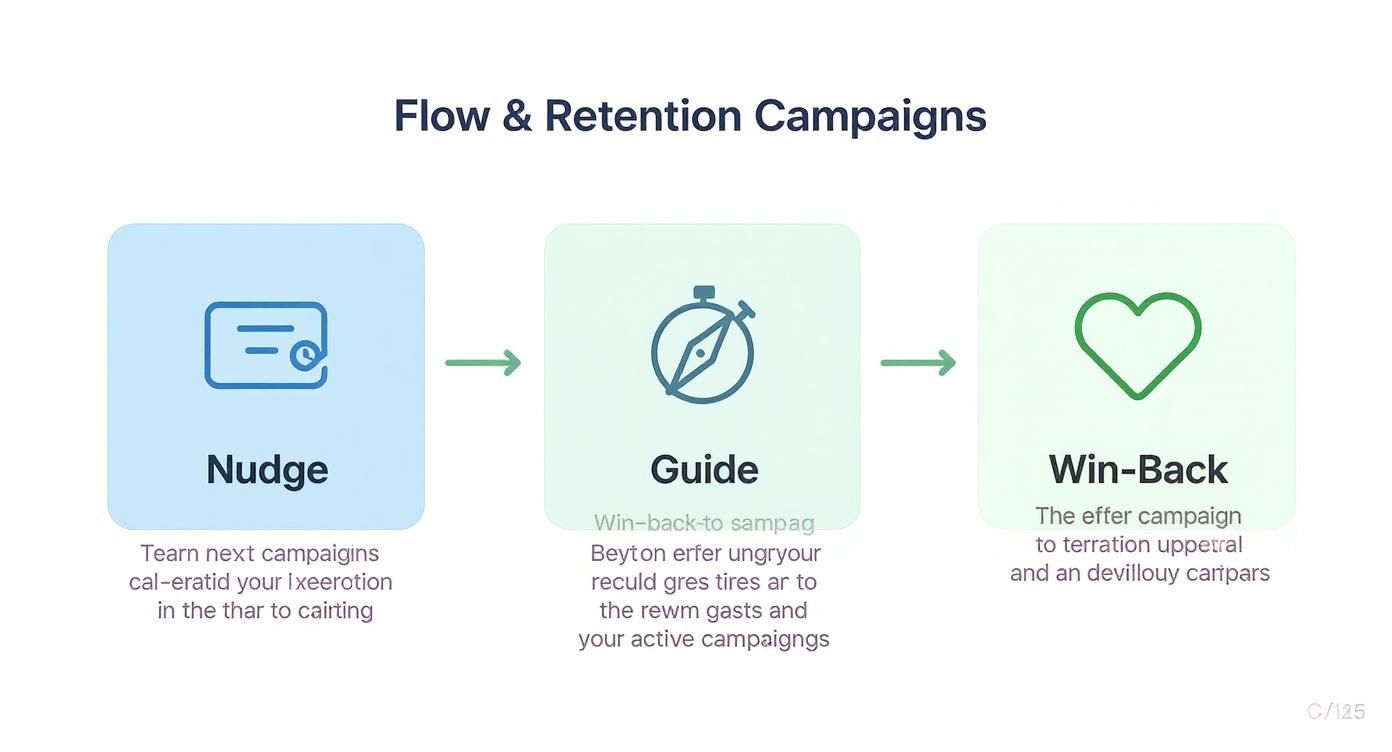

The flow below illustrates how these campaigns can evolve from a simple nudge to a full-blown win-back effort, depending on how at-risk the customer is.

As you can see, good retention isn’t a single action. It’s a staged, thoughtful process that adapts to where the customer is in their journey with you.

Tackling Involuntary Churn with Payment Webhooks

Some of the most frustrating churn is also the most preventable: failed payments. This "involuntary" churn from an expired credit card or a bank decline can quietly drain your MRR without you even realizing it. Luckily, tools like Stripe offer a powerful solution: webhooks.

Think of a webhook as an automated alert your payment processor sends to another app when something specific happens. You can set one up to instantly ping your team or kick off a dunning campaign the second a payment fails.

By using webhooks for failed payments, you shift from discovering involuntary churn at the end of the month to tackling it within seconds. This proactive stance is the difference between losing a customer and a simple billing update.

To get a clearer picture of how this works in practice, here are some common triggers and the automated actions you can set up to get ahead of churn.

Automated Retention Triggers and Actions

| At-Risk Signal (Trigger) | Tracking Tool Example | Automated Action |

|---|---|---|

| Payment failed | Stripe, Paddle | Trigger a dunning email sequence asking the user to update their card. |

| Key feature not used in 30 days | Mixpanel, Pendo | Send an in-app guide or short tutorial video for that specific feature. |

| Login frequency drops by 50% | Customer Success Platform (e.g., ChurnZero) | Send a "checking in" email from their Customer Success Manager. |

| Support tickets unanswered | Zendesk, Intercom | Escalate the ticket and notify the account owner internally via Slack. |

These automated systems create a safety net, catching problems before they escalate. It’s about being there for your customers at the exact moment they need help, without them even having to ask.

Combining automated health score monitoring with real-time payment alerts gives you a two-pronged defense. You’re guarding against both voluntary churn (disengagement) and involuntary churn (payment failure), allowing your team to put their energy where it has the most impact: building relationships.

Common Questions About Reducing Churn

When you're in the trenches trying to cut down customer churn, it's easy to get lost in the tactics. Sometimes, the best thing you can do is zoom out and tackle the big questions that always seem to come up. Here are some straightforward answers to the things we hear most often from SaaS founders and managers.

What Is a Good Customer Churn Rate?

Honestly, there’s no magic number. Anyone who gives you a single figure is oversimplifying things. A "good" churn rate really depends on who you're selling to, how mature your company is, and what market you're in.

An early-stage startup selling to small businesses, for example, might find a 3-5% monthly churn rate perfectly normal as they're still nailing down their product-market fit. But for a more established company with large enterprise contracts, that number would be a five-alarm fire. They should be aiming for well under 1% monthly because those relationships are deeper and the cost of losing a single account is massive.

The metric that matters most isn't some universal benchmark; it's your own trend line. Are you getting better every quarter? That's the true sign of health. Context is everything—don't get distracted chasing an arbitrary industry standard.

How Can I Reduce Churn Without a Big Team?

This is a huge one, especially for bootstrapped founders and smaller businesses. The good news is you can absolutely move the needle on churn without a dedicated customer success department. The trick is to be smart, lean, and focused on automation and shared ownership.

Start with your systems. Tools like Userlist or Customer.io can help you set up triggered email campaigns that automatically guide new users to that "aha!" moment. A simple, one-question survey when someone cancels can also automatically funnel crucial feedback right where you need it. That data is gold for your product roadmap.

But most importantly, make retention everyone's job.

- Broadcast churn reasons: Pipe cancellation feedback directly into a shared Slack channel so everyone sees it.

- Talk about support trends: Make recurring support tickets a regular agenda item in your weekly team meeting.

- Connect engineers to customers: Give your developers direct access to customer feedback. It’s incredibly motivating when they can feel the real-world impact of the problems they're solving.

In a small company, everyone touches the customer experience. Leaning into that shared mindset is your most powerful weapon against churn.

Voluntary vs. Involuntary Churn: What's the Difference?

Getting this distinction right is crucial because the solutions are worlds apart. If you mix them up, you’ll waste time trying to fix a product issue when you really have a billing problem (or vice-versa).

Voluntary churn is when a customer actively decides to leave. They're unhappy, they found a better alternative, or they just don't need your tool anymore. You fight this by building a better product, creating a stellar onboarding experience, and offering great support—it’s all about proving your value.

Involuntary churn, also called delinquent churn, is purely mechanical. It happens when a payment fails because of an expired credit card, a bank decline, or insufficient funds. The customer didn't actually choose to leave. This can account for a staggering 20-40% of total churn for many SaaS businesses. You fight this with dunning tools, often built right into platforms like Stripe, that automatically retry payments and notify customers before their account gets shut off. It’s a process problem, not a value problem.

Where Should I Start My Churn Reduction Efforts?

If you're feeling overwhelmed, don't try to boil the ocean. The best place to start is always with the lowest-hanging fruit, and for most SaaS companies, that means tackling involuntary churn first. It's a technical problem that can often be significantly improved with a few small tweaks to your payment processor's settings.

Once you’ve plugged that leak, shift your focus to your onboarding experience. The first 30 days of a customer’s life with your product are make-or-break. If they don’t see clear value right away, their chances of sticking around plummet. Pour your energy into making that first month an undeniable success for every new user.

Ready to stop guessing and start predicting which customers are about to leave? LowChurn uses AI to identify at-risk accounts in Stripe 7–30 days before they cancel, giving you the time and tools to win them back. Get your early-warning system today.