Customer Lifetime Value (CLTV), at its core, is the total revenue you can reasonably expect from a single customer throughout their entire relationship with your company. It’s a powerful, forward-looking metric that pulls you out of the weeds of single transactions and forces you to focus on the long-term health and profitability of each account.

Beyond a Single Sale: The True Meaning of CLTV

Think about it this way. You run a coffee shop. One person walks in, buys a $5 latte, and you never see them again. Another customer comes in every single weekday for three years, also for a $5 latte.

The initial sale was identical, but that second customer is dramatically more valuable. That’s the essence of Customer Lifetime Value.

In the SaaS world, CLTV helps us answer a crucial question: What’s the total worth of an average customer over time? It pushes your thinking beyond immediate monthly recurring revenue (MRR) and reframes each subscriber as an ongoing revenue stream. This shift in perspective is the foundation of sustainable growth and shapes decisions everywhere, from marketing to product development.

Why CLTV Is a SaaS Superpower

Grasping CLTV gives you a powerful lens to view your entire business. It’s not some abstract number buried in a finance spreadsheet; it's a strategic guide for making smarter decisions.

For example, knowing your CLTV helps you:

- Justify Marketing Spend: If you know a customer will generate thousands over their lifetime, you can confidently decide how much you can afford to spend to acquire them.

- Identify Your Best Customers: CLTV immediately flags which customer segments are most valuable, so you can stop guessing and start finding more of them.

- Guide Product Development: High-value customers stick around for a reason. By understanding what they need, you can prioritize features that drive both retention and expansion revenue.

- Improve Customer Retention: When you realize a customer is worth $20,000 over their lifetime, investing in customer success to keep them happy isn't just a nice-to-have—it's a no-brainer.

This forward-looking approach is a vital part of managing the entire customer journey. To dig deeper, check out our guide to customer lifecycle management.

The Basic Formula Explained

At its simplest, CLTV is a prediction of future revenue. To get a quick handle on it, you can use a basic calculation.

Let’s say a customer pays you $10,000 per year and sticks around for five years. Their gross lifetime value is $50,000. If it costs you $15,000 in total to support them over that period (think support, success, and infrastructure costs), their net CLTV is $35,000. This simple math is incredibly useful for spotting high-value accounts and deciding where to invest your resources.

To help you get a handle on the moving parts, here’s a quick breakdown of the core components.

Core Components of CLTV at a Glance

This table breaks down the essential components that make up the CLTV calculation, providing a quick reference guide for SaaS leaders.

| Component | What It Measures | Why It Matters for CLTV |

|---|---|---|

| Average Revenue Per Account (ARPA) | The average monthly or annual revenue you receive from a single customer. | This is the starting point. Higher ARPA directly increases your potential CLTV. |

| Customer Lifespan | The average length of time a customer stays with your company before they churn. | The longer a customer stays, the more revenue they generate over time. |

| Gross Margin | Your revenue minus the direct costs of providing your service (COGS). | This adjusts CLTV to reflect profitability, not just raw revenue. |

| Churn Rate | The percentage of customers who cancel their subscriptions in a given period. | Churn is the enemy of CLTV. Lowering churn increases customer lifespan and value. |

Understanding these individual levers is the first step to actively improving your CLTV.

Ultimately, CLTV helps you build a more durable, profitable business by shifting your focus from one-off transactions to long-term relationships.

How to Calculate CLTV with Formulas and Examples

Alright, you get the "what" and "why" of CLTV. Now for the fun part: let's actually calculate it. You don’t need a data science PhD to get this done. With the right formula and a clear process, you can unlock some seriously powerful insights for your SaaS business.

We'll start with a simple, backward-looking method and then move on to a more predictive model that’s tailor-made for subscription companies. Each has its place, but both help you put a real number on the long-term value of your customers.

This diagram really nails down the core idea—connecting a single customer to long-term, profitable growth.

As you can see, the customer is the engine. They generate the long-term revenue stream that fuels everything else.

H3: The Simple CLTV Formula: A Historical View

The most straightforward way to calculate CLTV is to simply look at what’s already happened. This approach multiplies the average revenue you get from a customer by how long they typically stick around. It’s a great way to get a quick-and-dirty baseline.

The formula is as basic as it gets:

Simple CLTV = Average Revenue Per Account (ARPA) x Average Customer Lifespan

This calculation gives you a fast, high-level estimate based purely on past performance. It’s a solid starting point if you're just beginning to track CLTV or if your customer base is incredibly stable and predictable.

Let's make this real. Imagine a SaaS company called "SyncUp" that sells a project management tool.

- Average Revenue Per Account (ARPA): SyncUp charges a flat $50 per month.

- Average Customer Lifespan: Their data shows that the average customer stays for 36 months.

Plugging this into the simple formula, SyncUp’s CLTV is:

$50 (ARPA) x 36 months (Lifespan) = $1,800

What does this mean? It tells the team at SyncUp that, on average, every new customer they sign is worth $1,800 in gross revenue over the entire time they're a customer.

A More Accurate SaaS CLTV Formula: The Predictive Model

The simple formula is handy, but it has a weak spot: guessing the "average customer lifespan" is notoriously tricky, especially for younger companies. A far more reliable method for SaaS businesses uses churn rate—a metric you’re probably already obsessing over.

The predictive SaaS CLTV formula looks like this:

Predictive CLTV = Average Revenue Per Account (ARPA) / Customer Churn Rate

This formula is so effective because the inverse of your churn rate (1 / Churn Rate) is a fantastic stand-in for customer lifespan. Think about it: a 2% monthly churn rate logically implies that a customer will stick around for 50 months (1 / 0.02). Churn and retention are two sides of the same coin, and it helps to understand both—you can learn more about the retention ratio formula to get the full picture.

Let's run the numbers for SyncUp again using this sharper formula.

- Average Revenue Per Account (ARPA): Still $50 per month.

- Monthly Customer Churn Rate: SyncUp has a healthy 2% (or 0.02) monthly churn rate.

Now, let's see what the predictive formula tells us:

$50 (ARPA) / 0.02 (Churn Rate) = $2,500

See the difference? The predictive model puts SyncUp's CLTV at $2,500, a full $700 higher than the historical estimate. This figure is almost always more accurate for subscription models because it's directly tied to retention, which is the ultimate driver of long-term SaaS success.

Comparing CLTV Calculation Methods

There's no single "best" way to calculate CLTV for every business. The right method really depends on your business model, your data maturity, and what you’re trying to achieve.

To help you pick the right tool for the job, here’s a quick breakdown of the primary methods.

| Method | How It Works | Pros | Cons |

|---|---|---|---|

| Simple Historical | Multiplies average revenue per account by the average customer lifespan. | Very easy to calculate and understand. Great for a quick baseline. | Relies on historical data, which might not predict the future. Lifespan can be hard to estimate. |

| Predictive SaaS | Divides average revenue per account by the customer churn rate. | More accurate for subscription models. Uses a real-time metric (churn). | Sensitive to fluctuations in churn rate. Still an average—doesn't account for customer segments. |

| Cohort-Based | Groups customers by sign-up period and tracks their spending over time. | Incredibly insightful. Reveals trends and the impact of product/marketing changes. | Requires more sophisticated data tracking and analysis. Takes time to gather meaningful data. |

Ultimately, choosing the right method is about moving from a fuzzy guess to a clear, data-driven number. Whether you start simple or go straight for a predictive model, the goal is the same: to gain a clearer picture of your company's financial health so you can make smarter bets on growth.

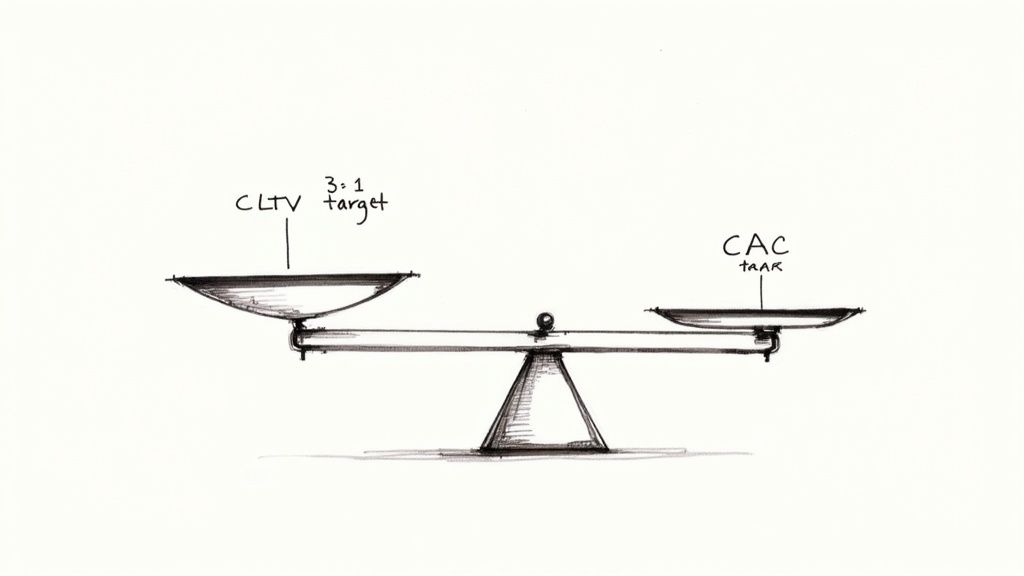

Why the CLTV to CAC Ratio Is Your North Star Metric

Knowing your CLTV is a huge win, but the number on its own is a bit like knowing the horsepower of a car without knowing its weight. Is a $2,500 CLTV good? What about $500? The answer is always: it depends.

It depends entirely on what you had to spend to get that customer in the first place.

This is where your Customer Acquisition Cost (CAC) comes into play. Simply put, CAC is the total sales and marketing cost you invest to land one new customer. When you put CLTV and CAC side-by-side, you get the single most powerful indicator of your SaaS business's health.

The CLTV to CAC ratio is basically your business model’s report card. It answers the one question that matters most: are you actually building a profitable company, or just burning cash?

What Is a Good CLTV to CAC Ratio?

For SaaS companies, the magic number is 3:1. This is the widely accepted benchmark for a healthy, sustainable business. A 3:1 ratio means that for every dollar you put into acquiring a customer, you can expect to get three dollars back over their lifetime. It’s the sweet spot that signals you have an efficient growth engine and a sticky product.

But other ratios tell a story, too. Understanding what the numbers are telling you is crucial for making the right moves.

Here’s a quick breakdown of what different ratios signal:

- 1:1 Ratio: This is a serious red flag. You're spending a dollar to make a dollar, which means you're losing money on every single customer once you factor in the cost of running the business. This model is broken.

- 3:1 Ratio: You’ve hit the target. This ratio shows you're making a healthy profit on your customer acquisition efforts, giving you plenty of margin to cover costs and plow back into growth. This is what investors want to see.

- 5:1 Ratio or Higher: This might look amazing, but it can actually be a sign that you're playing it too safe. A ratio this high often suggests you aren't investing enough in marketing and sales and could be growing much faster.

Key Takeaway: The CLTV to CAC ratio isn't just another metric to track; it's a diagnostic tool. It tells you when to hit the gas, when to pump the brakes and fix your model, and when to fine-tune your spending.

Connecting the Ratio to Your Payback Period

Your CLTV to CAC ratio is directly tied to another critical SaaS metric: the Payback Period. This is simply how long it takes (usually in months) to earn back the money you spent to acquire a customer.

A healthy ratio almost always goes hand-in-hand with a reasonable payback period. For most venture-backed SaaS businesses, the goal is to get your money back in under 12 months.

Think about it this way: if your CAC is $600 and a customer pays you $100 a month, your payback period is six months. After month six, every payment from that customer is pure profit. A shorter payback period means you get your cash back faster, which you can then reinvest to acquire the next customer.

This connection is fundamental. A solid 3:1 CLTV to CAC ratio gives you the confidence that even with a payback period of 6, 9, or even 12 months, a big return is waiting on the other side. It’s the ultimate proof that your growth engine isn't just fast—it's profitable.

How to Actually Increase Your SaaS CLTV

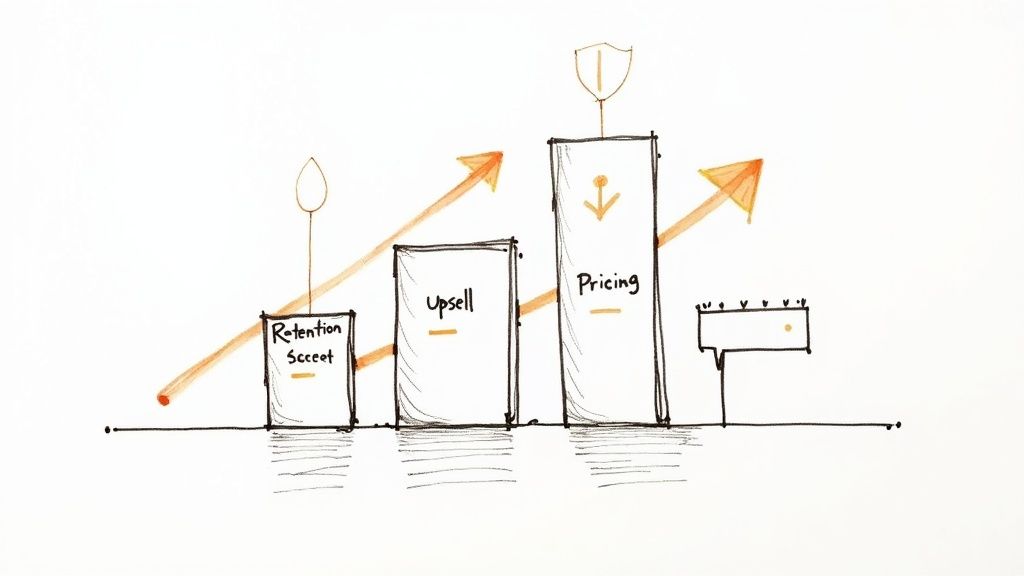

Knowing your CLTV is one thing; doing something about it is another. The real magic happens when you stop looking at it as just a metric and start treating it as a playbook for growth.

Growing your CLTV isn't about finding a single silver bullet. It’s about a deliberate, layered approach to making your product more valuable to your customers. When you do that, they stick around longer, spend more, and tell their friends. It’s the core of sustainable SaaS growth.

We’re going to walk through four powerful levers you can pull to make this happen.

These strategies aren't isolated tactics; they feed into each other, creating a powerful growth loop where every improvement builds on the last.

1. Stop Churn Before It Starts

The fastest way to boost CLTV is simply to keep customers around longer. Every single month you prevent a customer from leaving adds directly to their lifetime value. This is where your customer success team stops being a cost center and becomes a revenue engine.

Don't wait for the cancellation email. A proactive approach means you’re always looking for trouble spots and solving problems before they even register for your customer. You’re monitoring how they use the product, spotting friction, and reaching out the moment someone looks like they’re drifting away.

Here’s how to put that into practice:

- Track Customer Health Scores: Use your data to create a "health score" for each customer. A dipping score is your Bat-Signal—it's time to swoop in and help.

- Nail the Onboarding: A structured, automated onboarding flow is your best tool for getting new users to that "aha!" moment as fast as humanly possible.

- Schedule Regular Check-ins: For your most valuable accounts, get on a call. Quarterly business reviews (QBRs) are perfect for making sure they're hitting their goals and uncovering new ways you can help them.

Reducing churn is the foundation. It’s like plugging the leaks in your revenue bucket before you try to fill it up.

2. Grow Revenue from the Customers You Already Have

Once you’ve built a solid relationship, it’s time to grow it. Upselling (moving a customer to a better, more expensive plan) and cross-selling (selling them a new feature or product) are the most efficient ways to increase your Average Revenue Per Account (ARPA), which gives your CLTV a direct shot in the arm.

The trick is to make sure your offers are genuinely helpful. You aren't just trying to extract more money; you're actively helping them solve a bigger problem.

A successful upsell is rooted in empathy. It starts by understanding what a customer is trying to do and then showing them how a better version of your product is the clearest path to get there.

Think about a project management tool that sees a team constantly bumping up against its file storage limit. That's the perfect, value-first trigger to suggest an upgrade to a pro plan with unlimited storage. It’s not a pushy sales pitch; it's a helpful solution to a real problem. For a deeper dive, check out these practical tips on how to increase customer lifetime value in SaaS.

3. Let Your Pricing and Packaging Do the Work

Your pricing tiers have a massive impact on CLTV. Good pricing strategy isn't something you set and forget; it should create a natural, almost effortless, upgrade path for your customers.

The key is to anchor your pricing to a clear value metric—the "thing" your customers use more of as they grow. This could be users, contacts, projects, or API calls. As their business succeeds, their usage increases, and they naturally climb your pricing ladder.

This creates the ultimate win-win:

- Your Customer: They only pay for what they need right now but can easily scale up when the time is right.

- Your Business: You automatically capture more revenue from your most successful customers, boosting ARPA and CLTV without a single sales call.

Take a hard look at your packaging. Are there killer features trapped in your enterprise plan that could be offered as an add-on to smaller customers? Unbundling features can unlock entirely new revenue streams.

4. Build a Community, Not Just a Customer Base

Finally, never underestimate the power of genuine loyalty. Customers who feel connected to your brand and to other users are far less likely to churn and way more likely to expand their accounts. They become your most passionate marketers.

The numbers back this up. Research has shown that boosting customer retention by just 5% can increase profits by anywhere from 25% to 95%. That's because customers who stick around have a much higher lifetime value. A simple subscription service charging $20/month with a four-year average customer lifespan has a CLTV of $960—a number that absolutely justifies spending real money on keeping that customer happy.

This goes beyond just having good support. It’s about creating a community with webinars, user groups, and exclusive content. Celebrate your customers' wins. When they feel like they’re part of something bigger than just a software transaction, your product becomes a critical part of their success story.

Tools for Measuring and Acting on CLTV Data

Calculating your CLTV is a huge first step, but let's be honest—a number in a spreadsheet doesn't do you much good. The real challenge is pulling that metric out of a one-off report and embedding it into your team's daily workflow. That's where it can actually drive decisions.

The good news? You don't need a dedicated data science team to make this happen. Modern tools can connect the dots between raw data and genuine insights, turning CLTV from a historical report card into a predictive guide for the future.

Leveraging Your Existing Data in Stripe

For most SaaS companies, the raw ingredients for CLTV are already sitting in your payment processor. If you're using Stripe, you have a goldmine of the exact data points you need: subscription start dates, plan changes, payment amounts, and cancellation dates.

You can absolutely export this data and calculate the core components of CLTV by hand:

- Average Revenue Per Account (ARPA): Just pull it from your subscription payment records.

- Customer Lifespan: You can figure this out by looking at the time between a customer's first and last payment.

- Churn Rate: This comes from tracking cancellations over a set period.

This is a great starting point, but the manual approach is slow, easy to mess up, and always looks backward. It tells you what happened last quarter, not what’s likely to happen next week. To get proactive, you need to automate.

Automating CLTV with Specialized Platforms

This is where specialized platforms come into play. Tools like LowChurn are built to connect directly to your Stripe account and do all the heavy lifting for you. Instead of drowning in spreadsheets, you get instant, automated CLTV calculations. And more importantly, you get the context needed to do something about it.

These platforms go way beyond simple historical math. They crunch your data in real time to give you dynamic, predictive metrics that your whole team can actually use.

For example, LowChurn doesn't just calculate CLTV; it also monitors the leading indicators that influence it. You get a clear, live dashboard that shows you exactly what’s going on with customer value at a glance.

This dashboard instantly highlights critical metrics like at-risk MRR and customer health, connecting the dots between how customers are using your product and their long-term value.

What this really means is you can stop guessing and start intervening. A dedicated platform gives you several massive advantages:

- Automated Segmentation: Instantly see which customer segments have the highest (and lowest) CLTV, so you can focus your energy where it will have the biggest impact.

- Churn Prediction: Get ahead of cancellations by identifying at-risk customers before they leave, giving your success team a fighting chance to step in and save the account.

- Upsell Opportunities: Pinpoint accounts that are showing signs of growth, teeing up perfect opportunities for your sales or success teams to suggest an upgrade.

By blending subscription data with product usage signals, these tools help you understand the “why” behind your CLTV. You can dig deeper into customer well-being by tracking specific actions and behaviors. To get a better handle on this, check out our guide on building an effective customer health score.

Ultimately, the right tool transforms CLTV from a static number into a living, operational metric. It gets your finance, marketing, and success teams speaking the same language, all working together toward the shared goal of making every single customer more valuable over time.

Frequently Asked Questions About CLTV

Even after you've got the formulas down, putting Customer Lifetime Value to work in the real world brings up a few common questions. Nailing these details is what separates teams that just know about CLTV from those that actually use it to grow.

Let's dig into a few things that trip people up.

What Is a Good CLTV for a SaaS Business?

Everyone wants to know the magic number, but the truth is, there isn't one. A "good" CLTV is completely relative to what it costs you to get a customer in the first place.

Think of it this way: a $500 CLTV is amazing if you only spent $100 to acquire that customer. But that same $500 CLTV is a disaster if your Customer Acquisition Cost (CAC) was $600. You're just lighting money on fire.

The metric that really matters is the CLTV to CAC ratio. As we touched on earlier, a healthy SaaS business shoots for a ratio of at least 3:1. For every dollar you put into sales and marketing, you should be getting at least three dollars back over the customer's lifetime. That's the sign of an efficient, profitable growth model.

In short, don't fixate on the CLTV number in isolation. Instead, obsess over its relationship with CAC. That ratio is your true north star.

How Often Should We Calculate CLTV?

CLTV isn't a "set it and forget it" metric. Your business is always in motion—customers join and leave, pricing gets updated, churn rates tick up or down. Your CLTV calculation needs to keep pace.

For most SaaS teams, this cadence works best:

- Track it monthly. This gives you a near real-time pulse. You can quickly see how a price change or a new feature launch impacts the numbers.

- Review it quarterly. Looking at the data on a quarterly basis helps you see the bigger picture. It smooths out any random monthly fluctuations and lets you spot the more meaningful, strategic trends.

Calculating CLTV regularly means you’re always making decisions with fresh, relevant data about your business and your customers.

What Are the Biggest Mistakes to Avoid with CLTV?

Knowing the formula is one thing; using it wisely is another ballgame entirely. The single biggest mistake we see is treating all customers as if they're the same.

When you calculate one single CLTV for your entire user base, you're masking the most important insights. Your enterprise clients on the annual plan will have a completely different CLTV than the small startups on a self-serve monthly plan. Lumping them all together leads to bad decisions, like spending too much to acquire low-value customers or not investing enough to keep your VIPs happy.

Always segment your CLTV. Break it down by pricing tier, company size, or even how they found you. That's where you'll find the gold. The other major pitfall? Seeing CLTV as just a number to report on, rather than a target you can actively improve.

Ready to stop guessing and start growing your CLTV? LowChurn connects to your Stripe account in minutes, giving you automated CLTV calculations, churn prediction, and the actionable insights you need to keep your best customers. See how it works at LowChurn.