In the world of SaaS, your churn rate is the measure of how many customers—or how much revenue—walks out the door over a given period. It's more than just a metric; it's the ultimate health-check for any subscription business. A high churn rate is like trying to run a marathon with a ball and chain—it's a constant drag on your growth and profitability.

What SaaS Churn Rate Really Means for Your Growth

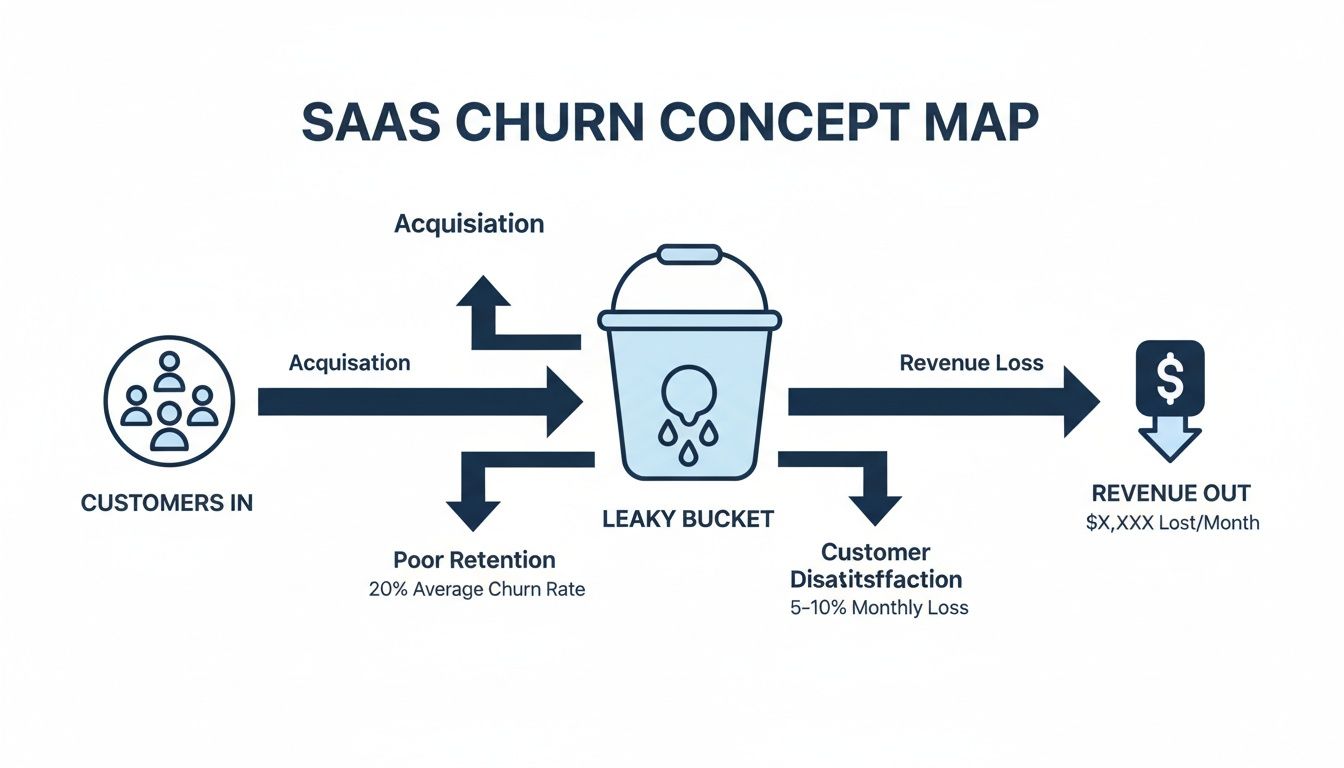

Think of your business as a bucket you're trying to fill with water (new customers). Every new sale pours more water in, raising your Monthly Recurring Revenue (MRR). But churn rate is the hole at the bottom of that bucket. No matter how fast you pour water in, a steady leak means you’re fighting a losing battle to ever fill it up.

This "leaky bucket" analogy gets to the heart of the SaaS growth challenge. A seemingly small churn rate, say 3-5% per month, isn't just a minor drip. It means you're losing a huge chunk of your customers and revenue every single year. This forces your sales team onto a treadmill, where they have to sprint just to replace who you've lost, never mind actually getting ahead.

The Silent Killer of Momentum and Valuation

Churn is so much more than a number on a dashboard. It's a direct signal about your product's health and whether you're delivering on your promises. When customers leave, it tells you there's a gap between the value they expected and the value they actually got.

High churn quietly undermines everything you’re working to build:

- It erases your acquisition wins: Bringing in new customers is expensive. When those customers leave quickly, you're essentially burning your marketing and sales budget, which tanks your Customer Lifetime Value (LTV) and makes it take much longer to earn back your Customer Acquisition Cost (CAC).

- It kills compound growth: The real power of the SaaS model lies in compounding revenue from a stable customer base. Churn shatters that compounding effect, forcing you into a difficult, one-step-forward-one-step-back style of growth.

- It spooks investors and crushes your valuation: For investors, churn is one of the first things they look at. A high rate is a massive red flag, signaling potential problems with your product-market fit or the overall customer experience.

Seeing Churn Before It Happens

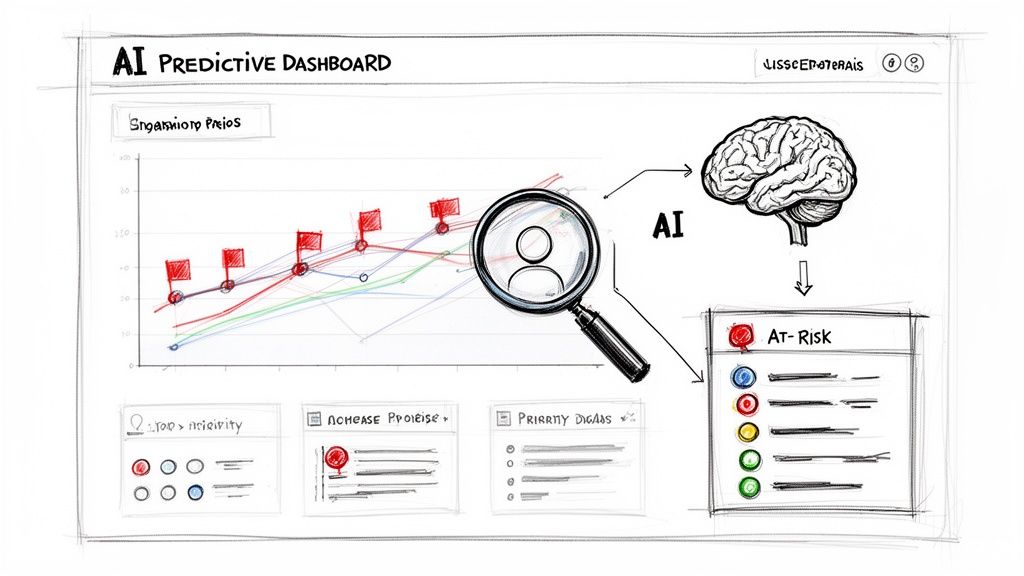

Modern churn prevention tools are designed to give you a heads-up before a customer decides to leave. This dashboard is a perfect example of how at-risk accounts are brought to your attention.

By tracking things like product usage and subscription changes, these systems assign a health score to each customer. This allows your team to stop guessing and start focusing their energy on the accounts that are quietly drifting away.

At the end of the day, getting a handle on your churn rate for SaaS is the first real step toward building a business that lasts. While a 'good' annual churn rate is often cited as being under 5%, the reality is that most companies struggle to get there. The good news? Even a small 5% drop in churn can increase profits by as much as 95%. This is why early-warning systems are no longer a luxury—they’re essential. As you can discover in these SaaS statistics on VenaSolutions.com, the goal isn't just to patch the leak, but to transform customer retention into your biggest growth engine.

How to Nail Your Customer and Revenue Churn Calculations

You can't fix what you don't measure. When it comes to churn, getting the calculation right is the absolute first step toward plugging the leaks in your business. But here's where many SaaS leaders trip up: they fixate on just one type of churn, giving them a skewed and dangerously incomplete picture of their company's health.

To truly understand what's happening, you need to track two core metrics: Customer Churn and Revenue Churn.

The classic "leaky bucket" analogy is perfect here. You're constantly pouring new customers in, but churn is the hole in the bottom where both customers and, more importantly, revenue are draining away.

This visual drives home a critical point: losing customers isn't just about a dwindling user count. It's a direct hit to your bottom line and your ability to grow.

Getting Started: Calculating Customer Churn Rate

Customer Churn, often called logo churn, is the most straightforward churn metric. It simply tells you what percentage of your total customers canceled their subscriptions over a set period. Think of it as your basic attrition scorecard—a vital sign for product stickiness and overall customer happiness.

The formula is as simple as it gets:

Customer Churn Rate = (Number of Customers Lost in Period / Number of Customers at Start of Period) x 100

Let’s put that into practice with a quick example.

Imagine a project management tool called "TaskFlow" begins April with 500 active, paying customers. Over the course of the month, 25 of them decide to cancel.

- Customers Lost: 25

- Starting Customers: 500

- The Math: (25 / 500) x 100 = 5%

So, TaskFlow's customer churn for April is 5%. That number gives you a clear headcount of who left, but it doesn't reveal the financial damage.

The Real Story: Why Revenue Churn Matters More

While customer churn tells you how many customers you lost, Revenue Churn (or MRR Churn) tells you how much money walked out the door with them. This is where the real insights are buried, because we all know not every customer's dollar is the same.

Losing a single enterprise client paying $10,000 a month is a completely different problem than losing ten startups paying $50 each. Customer churn sees them as 1 vs. 10. Revenue churn sees them as $10,000 vs. $500. It provides the financial context you absolutely need.

To get the full picture, we have to look at both Gross and Net MRR Churn.

Customer Churn vs Revenue Churn at a Glance

This quick comparison table breaks down the fundamental differences between these two essential churn calculations and what each one really tells you about your SaaS business.

| Metric | What It Measures | Primary Use Case | Key Insight |

|---|---|---|---|

| Customer Churn | The percentage of customers who cancel. | Gauging overall customer satisfaction and product-market fit. | "Are people finding value in our product?" |

| Revenue Churn | The percentage of revenue lost from cancellations and downgrades. | Assessing the financial health and impact of customer attrition. | "How much money are we actually losing?" |

Ultimately, you need both. One tells you about customer sentiment, the other about business viability.

Gross vs. Net MRR Churn

Digging a level deeper, you’ll find Gross and Net MRR Churn. Understanding the difference is non-negotiable for diagnosing the health of your revenue engine.

1. Gross MRR Churn

This is the raw, unfiltered measure of lost revenue. It adds up all the monthly recurring revenue you lost from both cancellations and customer downgrades within a period. It’s a pure metric of revenue leakage, ignoring any positive movement from your existing customer base.

Gross MRR Churn Rate = (MRR Lost from Cancellations + Downgrades) / MRR at Start of Period x 100

2. Net MRR Churn

This is arguably the single most powerful churn metric a SaaS company can track. It starts with your Gross MRR Churn, but then it subtracts any revenue you gained from your existing customers. This new revenue, called expansion MRR, comes from upgrades, add-ons, and cross-sells.

Net MRR Churn Rate = (MRR Lost - Expansion MRR) / MRR at Start of Period x 100

Net MRR Churn tells you about the true momentum of your customer base. A low, or even negative, Net MRR Churn is the holy grail. It means the revenue you're generating from happy, expanding customers is great enough to offset—or even completely erase—the revenue you're losing from those who leave.

If you want an even more detailed walkthrough, you can learn more about how to calculate the different types of churn rate with total precision.

Of course, churn is only half the story. To get a complete view, it’s just as important to master its inverse: the customer retention rate calculation.

Understanding SaaS Churn Rate Benchmarks

So you've finally nailed down your churn calculations. The next question is always the same: "Is my churn rate any good?" Without context, that number is just a data point floating in space. To give it meaning, you need to see how it stacks up against industry benchmarks. This is the only way to know where you stand and what a realistic goal actually looks like for your business.

You've probably heard the old rule of thumb that a "good" monthly SaaS churn rate should be below 3%, or that anything under 5% annually is solid. But those numbers are way too generic to be useful. The reality is, your ideal churn rate depends almost entirely on who you sell to.

Churn Is a Different Game for Different Customers

The single biggest factor that dictates your churn rate is your target customer. Are you selling to small businesses and scrappy startups, or are you closing deals with massive enterprise clients? The answer will completely change what you should consider an acceptable churn rate.

It’s a pretty simple relationship: the bigger the customer, the lower the churn. You can see this clearly when you break down churn rates by company size.

- Small and Medium Businesses (SMBs): These customers can be tough. They operate on tighter budgets, have fewer internal resources, and are much more sensitive to price changes. This means SaaS companies focused on the SMB market almost always see higher churn.

- Enterprise Customers: On the other hand, enterprise clients are much stickier. They have long, complex procurement cycles, sign multi-year contracts, and your software often gets deeply woven into their day-to-day operations. All of this makes switching a massive headache for them.

This difference creates a huge divide in the SaaS world. Businesses selling to SMBs often battle a brutal 3-5% annual churn rate, while those serving the enterprise can lock customers in at just 1-2% annually. That’s a massive advantage driven by the sheer complexity and inertia of large organizations.

Your Revenue Level Tells a Similar Story

Just as customer size plays a huge role, so does the amount of revenue you bring in. Industry data shows a clear pattern: as a company's Annual Recurring Revenue (ARR) grows, its churn rate tends to drop. This usually happens because as a company scales, it naturally starts moving upmarket to serve larger, more stable clients.

A startup with under $10M in ARR might see a monthly churn rate between 3-7%. That’s pretty common when you're still dialing in your product-market fit. In contrast, a more mature SaaS company pulling in over $10M ARR often gets that number down to a much healthier 1-2% per month.

This trend highlights a key strategic insight for growth. As you scale, focusing on higher-value customer segments doesn't just increase revenue—it automatically builds a stronger, more resilient retention foundation.

To put these benchmarks in perspective, here's a quick look at how churn rates typically evolve as a SaaS company grows its ARR.

Average Monthly SaaS Churn Rate by Company Stage

| Company Stage (ARR) | Average Monthly Churn | Key Churn Driver |

|---|---|---|

| Early Stage (<$1M) | 5% - 10% | Lack of product-market fit, onboarding friction |

| Growth Stage ($1M - $10M) | 3% - 7% | Scalability issues, competition, value proposition clarity |

| Scale-Up ($10M - $50M) | 1% - 3% | Moving upmarket, customer success maturity |

| Enterprise (>$50M) | <1% - 2% | High switching costs, deep integration, long-term contracts |

As you can see, what's considered "normal" churn changes dramatically as you mature. An early-stage startup trying to achieve a 1% churn rate is likely chasing an impossible goal, while an enterprise company with 5% churn is in serious trouble.

Setting Realistic Retention Goals

So, what does this all mean for you? It means you can't just pluck a generic 3% churn figure out of the air and call it your north star. Your benchmark needs to reflect your business.

Start by asking a few critical questions:

- Who is our Ideal Customer Profile (ICP)? Are we serving startups or Fortune 500s?

- What's our average contract value? Are we a high-volume, low-price tool or a low-volume, high-price platform?

- What industry are we in? Some sectors, like education or retail tech, naturally have more seasonal churn than others.

Answering these questions will help you find the right peer group to measure yourself against. For a deeper dive, check out our complete guide to SaaS churn rate benchmarks to see exactly how you stack up. This tailored approach is what turns a simple metric into a powerful tool for making smart, strategic decisions that drive real, sustainable growth.

So, Why Are Your Customers *Really* Leaving?

Knowing your churn rate is just the start. The real magic happens when you figure out why customers are heading for the exit. Churn isn't random; it's a flashing red light on your dashboard, signaling a disconnect between the value you promised and the experience you’re actually delivering. Digging into these root causes is the only way to build a retention strategy that sticks.

While every business is unique, most churn drivers fall into a few common buckets. By diagnosing which of these are hurting you the most, you can stop throwing things at the wall and start making targeted, effective changes.

The Critical First 90 Days and Onboarding Failures

You have a very short window to make a good impression. The moment a customer signs up, the clock is ticking. A clunky, confusing, or one-size-fits-all onboarding experience is probably the fastest way to lose someone before they've even had a chance to discover what your product can do.

If a new user can't get that first "Aha!" moment and see a quick win, their enthusiasm dies. Fast. Your tool goes from being an exciting solution to just another task on their to-do list. This early friction is a huge red flag and a leading cause of a high churn rate in SaaS.

Keep an eye out for these warning signs:

- Low feature adoption: They're stuck using only one or two basic features and ignoring the rest.

- A drop-off in logins: You see a flurry of activity in week one, followed by radio silence.

- A spike in basic support tickets: Customers are constantly asking how to do simple things that should be intuitive.

When the Product Doesn't Live Up to the Hype

Sometimes, the problem isn't how you introduce the product—it's the product itself. Customers will leave if your tool doesn't solve their core problem, is missing a must-have feature, or is just plain buggy. This often happens when the marketing team is writing checks the product team can't cash.

You might be brilliant at attracting new users with a compelling promise, but if the experience is clunky or a competitor offers a smoother workflow, they will find it. In today's crowded markets, a better alternative is always just one search away.

A classic mistake is treating churn as a customer success problem. More often than not, high churn is a product problem in disguise. It’s a direct signal that you’ve misunderstood user needs or fallen behind market expectations.

When Getting Help Becomes a Headache

Even the best software has hiccups. When users run into trouble, they expect quick, helpful, and human support. If your support system is slow, unhelpful, or buried five clicks deep, you’re not just failing to solve a problem—you're creating a new one. A single bad support experience can poison the well for good.

This goes beyond just fixing bugs. Great support is proactive. Things like a well-stocked knowledge base or helpful in-app tooltips empower users to find answers themselves. Without these resources, you’re creating friction and making customers feel like you've left them stranded.

Pricing Friction and the Value Disconnect

Your price has to make sense for the value a customer gets. It's that simple. If they feel like they’re overpaying for what they use, or if you roll out a price hike without clearly explaining the added value, you’re inviting churn. This all comes down to perceived value—people are happy to pay, but only if the investment feels worth it.

This gets especially tricky as a customer's needs evolve. A customer who downgrades their plan is waving a giant flag that says, "I'm not getting enough value for what I was paying." If you ignore that signal, you'll likely lose them completely in the next few months.

Involuntary Churn: The Silent Revenue Killer

Finally, not all churn is a conscious decision. A shocking amount of revenue just… disappears. This is involuntary churn, and it’s almost always caused by a failed payment—an expired credit card, an outdated billing address, or a simple bank decline. It’s a silent killer because these customers are often happy and have no idea they’ve churned until their access is cut off.

The good news? This is the easiest type of churn to fix. In the B2B SaaS world, the average monthly churn rate hovered around 3.5% in early 2024. Of that, intentional (voluntary) churn was 2.6%, while involuntary churn was only 0.8%. While it seems small, fixing it is a quick win. As you can see in these SaaS statistics at SellersCommerce.com, simple tools like dunning emails and smart payment retries can plug this leak and recover revenue almost effortlessly.

Actionable Strategies to Proactively Reduce Churn

Knowing your churn numbers is one thing, but actually doing something about them is where the real work begins. An insight without action is just trivia, after all. It’s time to stop diagnosing the problem and start applying the cure.

The best way to reduce churn is with a focused, systematic plan—not by throwing random fixes at the wall and hoping something sticks. You have to prioritize. Instead of trying to boil the ocean, focus on scoring a few quick wins to build momentum. These early successes will give you the breathing room (and the revenue) to tackle the more complex retention challenges later.

We'll start with the lowest-hanging fruit first.

Playbook 1: Target Involuntary Churn for Immediate MRR Recovery

Involuntary churn is the money you lose for seemingly silly reasons. It’s not about unhappy customers leaving; it's about mechanical failures like an expired credit card or a temporary bank decline.

Because it has nothing to do with customer satisfaction, this is by far the fastest and easiest type of churn to fix. Fixing it delivers an immediate boost right back to your bottom line. The goal is simple: put an automated payment recovery process in place to stop this preventable revenue leak.

Key Steps to Implement:

- Set Up Smart Retries: Don’t just hammer a failed card once and give up. A smart system will retry the card on different days and at different times. Sometimes the issue is just a temporary network glitch on the bank's end.

- Automate Dunning Emails: The moment a payment fails, a series of friendly, non-spammy emails should go out. Make it crystal clear what the problem is and include a one-click link for the customer to update their billing info.

- Use an In-App Notification: For active users, a banner inside your app is often way more effective than an email that could get buried in their inbox. A simple message like, "Please update your payment method to maintain access" works wonders.

- Implement a Grace Period: Instantly locking a user out after one failed payment is a recipe for frustration. Give them a grace period of 7-14 days to sort things out. This keeps their workflow uninterrupted and prevents a minor billing issue from becoming a reason to cancel.

Involuntary churn is a silent killer, accounting for a huge chunk of lost revenue in many SaaS businesses. Studies have shown that a solid recovery process can lift revenue by over 8% in the first year alone. It’s the closest thing to "free money" in the entire world of customer retention.

Playbook 2: Overhaul the First 90-Day Onboarding Experience

The first three months of a customer's journey are make-or-break. This is when they either fall in love with your product's value or quietly become disengaged and slip away. A clunky, confusing onboarding experience is the number one cause of early-stage churn.

Your entire objective here is to get new users to their first "Aha!" moment as fast as humanly possible. They need to see real results and start building habits around your tool right away.

Key Steps to Implement:

- Personalize the Welcome Flow: Start with a quick survey to ask about their role and what they're trying to accomplish. Then, tailor the product tour to show them only the features that help with that specific goal. Skip everything else.

- Create Interactive Walkthroughs: Passive product tours are boring and ineffective. Switch to interactive guides that force users to click, type, and complete key actions themselves. People learn by doing, not by watching.

- Establish Key Activation Milestones: Define what a "successful" user looks like. Have they invited a teammate? Created their first project? Integrated another tool? Track every new user’s progress against these concrete milestones.

- Trigger Proactive Check-ins: If a user hasn't hit a key milestone within a set timeframe (say, 7 days), have an automated email or an in-app message from your customer success team pop up to offer help. It shows you're paying attention and are truly invested in their success.

Playbook 3: Build a Proactive Customer Education Engine

Once a customer is onboarded, your job isn't done. Far from it. Your product will evolve, and so will their needs. Ongoing education is the glue that keeps them engaged, helping them discover new value over time and turning them from casual users into true power users.

This playbook is all about creating a system where customers can help themselves and continuously learn more about getting value from your product.

A Two-Pronged Approach:

- Develop a Robust Knowledge Base: This is your first line of defense against support tickets and frustration. Build a central hub with easy-to-search articles, how-to guides, video tutorials, and detailed FAQs. A great knowledge base empowers users to find answers instantly, which is a massive win for customer satisfaction.

- Produce Value-Driven Blog and Webinar Content: Don't just write "how-to" articles about your features. Create content that teaches customers best practices for their industry or role. When you help them get better at their jobs, you become a trusted advisor, not just a software vendor. That’s how you build deep, long-term loyalty.

Using AI to Predict and Prevent Customer Churn

The strategies we've covered are solid, but they all have one thing in common: they're mostly reactive. You’re waiting for a bad NPS score or a sudden drop in logins to signal that something’s wrong. But what if you could act before the problem even surfaces?

This is where the modern approach to reducing your churn rate for SaaS completely changes the game. It’s about shifting from reaction to prediction.

Instead of waiting for red flags, AI-powered platforms act like a sophisticated early-warning system. These tools sift through thousands of data points—from product usage to subscription history—and spot the subtle patterns that humans would miss. Think of it like a smoke detector for churn; it picks up on the faintest signs of trouble long before you can see the fire.

This means your team can finally stop guessing which customers need a little extra attention and start making moves based on real data.

How AI Changes Retention Efforts

A predictive AI tool does more than just tell you who is likely to churn; it generates a health score for every single account. By analyzing everything from feature adoption and session frequency to tiny changes in subscription details, it can forecast which customers are slipping away days or even weeks in advance.

This insight ties directly back to the retention playbooks we talked about earlier. Instead of deploying your onboarding or support tactics across the board, you can now focus your energy with surgical precision.

A predictive system with 85%+ accuracy lets your customer success team dedicate their time to the specific accounts that are quietly disengaging. This isn't just about being efficient; it's about actively recovering MRR that would have otherwise vanished.

Turning Predictions Into Proactive Engagement

The real magic of AI here is how it equips your team with intelligence they can actually use. No more working off a hunch. Your team gets a clear, prioritized list of at-risk accounts, giving them the power to step in right when it counts.

This new workflow brings a few huge advantages:

- Saves valuable time by automatically highlighting the accounts that need you most.

- Increases efficiency by aiming your retention efforts where they'll make the biggest difference.

- Enables data-driven decisions so you can stop relying on guesswork or old, lagging indicators.

- Recovers lost MRR by reaching customers before they've already decided to cancel.

For those wanting to dig deeper, understanding the nuts and bolts of a churn prediction model shows how these systems translate raw data into revenue-saving action. And beyond simply identifying at-risk accounts, it's also worth exploring how AI chatbots increase customer retention in SaaS companies as another way to get ahead of problems.

By bringing AI into your process, you're building a smarter, scalable retention engine that not only protects your growth but also strengthens your customer relationships for the long haul.

SaaS Churn FAQs

Even after you've got the basics down, some specific questions about churn always seem to pop up. Let's tackle a few of the most common ones I hear from SaaS founders and product leaders.

What’s a Good Churn Rate for a SaaS Company?

This is the million-dollar question, and the honest answer is: it depends entirely on your customer base. There isn't one magic number, but we can look at some solid benchmarks.

For most, a monthly customer churn rate under 3% is a great place to be. But the target shifts dramatically depending on who you sell to:

- SaaS for Small & Medium Businesses (SMBs): A monthly churn of 3-5% is pretty standard here. SMBs have smaller budgets and can switch tools more easily, so you see more movement.

- Enterprise SaaS: The game is completely different. These companies are gunning for an annual churn of just 1-2%. Think long-term contracts, deep integrations, and high switching costs.

Your real goal shouldn't be to hit an arbitrary industry number, but to consistently beat your own historical performance.

The benchmark that truly matters more than your churn rate is your Net Revenue Retention (NRR). If your NRR is over 100%, it means the revenue you're gaining from upgrades and expansions is bigger than what you're losing from churn. That's the holy grail of sustainable SaaS growth.

How Can I Tell the Difference Between Voluntary and Involuntary Churn?

To fix churn, you first need to know why it's happening. The first step is splitting it into two buckets: customers who chose to leave versus those who left by accident.

Voluntary Churn is exactly what it sounds like—a customer makes a conscious decision to hit the cancel button. This is a direct signal that something's wrong. Maybe their onboarding was confusing, the product didn't deliver on its promise, or a competitor swooped in.

Involuntary Churn is purely mechanical. It's when a subscription ends because a payment fails—think expired credit cards, a lack of funds, or a simple bank glitch. The customer usually has no idea it's even happened. This is your low-hanging fruit; it's the easiest churn to recover with the right dunning and payment recovery tools.

When Should a Startup Start Tracking Churn?

Day one. Seriously. From the moment you have your very first paying customer.

I know the numbers will feel tiny and erratic at the beginning, but you're not just tracking a metric; you're building a habit. Creating a data-focused culture from the get-go is critical. It helps you catch bad trends before they snowball into existential threats and gives you a clear baseline to see if the changes you're making to your product or pricing are actually working.

Ready to stop guessing and start predicting? LowChurn uses AI to identify at-risk customers 7-30 days before they cancel, giving you the time and insights to save them. Connect Stripe in 60 seconds and see your churn risks today. Learn more about LowChurn's AI-powered predictions.