The real debate around customer retention vs acquisition cost boils down to a simple truth: it's far cheaper and more profitable to keep a customer you have than to find a new one. While acquiring new users is what fuels top-line growth, retention is what drives sustainable, long-term profitability by getting the most out of every customer you've already won. This isn't an either/or situation; it's a strategic balancing act, and getting it right is the secret to long-term SaaS success.

The SaaS Growth Dilemma: Retention Vs. Acquisition

Every SaaS founder and executive faces the same fundamental challenge. Where do we put the next dollar? Do we invest it in hunting for new customers, or do we double down on keeping our current ones happy? Both are critical, of course, but the unit economics behind them couldn't be more different. Your answer to this question fundamentally shapes your growth trajectory, your path to profitability, and even your company's valuation.

To really get to grips with this dilemma, you have to understand the core metrics that act as the vital signs for any SaaS business. These numbers tell the real story, going much deeper than surface-level revenue.

- Customer Acquisition Cost (CAC): Simply put, this is the total amount you spend on sales and marketing to get one new customer to sign on the dotted line.

- Customer Lifetime Value (LTV): This is a projection of the total revenue you can expect to earn from an average customer throughout their entire time with you.

- Churn Rate: This is the percentage of customers who leave or cancel their subscriptions in a given period. Churn is the silent killer that directly eats away at your LTV and revenue base.

At its heart, the retention vs. acquisition debate is a question of efficiency. Acquisition is an expensive, front-loaded investment with an uncertain payoff. Retention is a compounding investment that protects and grows your most valuable asset: your existing customer base.

This guide is designed to give you a data-driven framework for navigating this balancing act. We'll skip the high-level theory and get straight to the actionable insights you need to make smarter, more profitable decisions for growth.

Comparing Acquisition and Retention at a Glance

Before we dive deep, it helps to see a side-by-side comparison of these two growth engines. Looking at them this way really drives home why a blended strategy is non-negotiable for a healthy, sustainable business.

| Dimension | Customer Acquisition | Customer Retention |

|---|---|---|

| Primary Goal | Generate new leads and first-time sales | Increase customer lifetime value and reduce churn |

| Typical Cost | High; includes ad spend, sales commissions, marketing salaries | Low; focuses on customer success, support, and loyalty programs |

| ROI Timeline | Slower; requires time to recover initial CAC | Faster; builds on an existing, profitable relationship |

| Key Metrics | CAC, Conversion Rate, Lead Velocity | Churn Rate, LTV, Net Promoter Score (NPS) |

| Business Impact | Fuels top-line revenue growth and market share | Drives bottom-line profitability and enterprise value |

Understanding The Unit Economics Of Growth

If you really want to settle the retention vs. acquisition debate for your SaaS, you have to get comfortable with unit economics. These aren't just vanity metrics like sign-ups or traffic; they're the core numbers that tell you if your business is actually healthy and built to last.

Think of it this way: your business is built on a foundation of three key metrics—Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), and the constant pull of churn. Getting these right isn't optional. It’s the only way to make smart decisions about where your next dollar should go.

Decoding Customer Acquisition Cost (CAC)

Let's start with the cost side of the equation. Customer Acquisition Cost, or CAC, is simply what you pay, on average, to get a new paying customer through the door. Properly mastering your customer acquisition cost calculation is step one. And I don’t just mean your ad spend—a true CAC rolls up all the related costs.

To get an accurate CAC, you need to tally up everything over a set period:

- Marketing Expenses: This includes all your ad campaigns, content creation, SEO efforts, and event costs.

- Sales Expenses: Think salaries, commissions, and bonuses for your entire sales team.

- Tooling Costs: The monthly subscriptions for your CRM, marketing automation platforms, and any other tools in your sales and marketing stack.

- Overhead: A slice of the salaries for anyone on the marketing and sales teams who contributes to bringing in new business.

For example, if you spend $50,000 in a quarter across all those categories and you land 500 new customers, your CAC is $100. That number is your baseline for growth.

The Power Of Customer Lifetime Value (LTV)

While CAC tells you what it costs to get a customer, Customer Lifetime Value (LTV)—sometimes called CLV—tells you how much that customer is worth over their entire time with you. It’s the other side of the coin, representing the long-term payoff from that initial acquisition cost. LTV shifts your focus from just making a sale to building real, lasting value.

LTV is the ultimate report card on your customer relationships. A high LTV tells you customers are sticking around, spending more, and truly getting value from your product month after month.

Knowing your LTV is critical for figuring out just how profitable your customers are. There are a few ways to calculate it, but a straightforward method for SaaS is to divide your Average Revenue Per Account (ARPA) by your customer churn rate. For a much deeper dive, we have a complete guide on what CLTV is and how to calculate it.

The LTV:CAC Ratio: The Ultimate Health Metric

On their own, LTV and CAC are useful. But put them together, and you get the LTV:CAC ratio, which is arguably the single most important metric for any SaaS business. This ratio answers one simple question: "Are we making money from the customers we're acquiring?" It directly compares what a customer is worth against what it cost to get them.

As a rule of thumb, a healthy LTV:CAC ratio is 3:1 or better.

- A 1:1 ratio means you’re essentially breaking even on the acquisition, and once you factor in other business costs, you're actually losing money.

- A 3:1 ratio is the sweet spot. It suggests you have a solid, profitable business model.

- A 5:1 ratio or higher is fantastic. It often means you’ve found a winning formula and could probably afford to spend more on marketing and sales to grow even faster.

This ratio is the lens you should use to view the customer retention vs acquisition cost discussion. It's not about which one is cheaper in a vacuum; it’s about how they work together to build a sustainable company. When you invest in retention, you directly increase your LTV. That, in turn, juices your LTV:CAC ratio, making every single dollar you spend on acquisition more productive.

After all, data shows that acquiring a new customer can cost anywhere from 5 to 25 times more than keeping an existing one. That makes retention an incredibly powerful lever for improving your most important unit economic ratio.

A Strategic Comparison Of Retention And Acquisition

When you get down to it, the customer retention vs acquisition cost debate isn’t about picking a winner. It's about understanding that you're managing two different engines for your SaaS company. One fuels growth, the other fuels profitability. A smart leader knows how to tune both.

Acquisition is your top-line growth engine. It’s how you expand your footprint, enter new markets, and bring fresh revenue in the door. Retention, on the other hand, is what drives profitability and, ultimately, enterprise value. It’s how you get the most out of every single customer you’ve already fought hard to win.

Cost Efficiency And Immediate Impact

The most obvious difference between the two is the price tag. Getting a new customer is expensive. You're pouring cash into marketing campaigns, paying sales commissions, and spending time and resources on onboarding. That’s just the cost of entry to get someone's attention in a noisy market and convince them to sign up.

Retention efforts feel completely different. We're talking about customer success check-ins, loyalty perks, or a quick tutorial on a new feature. These activities are almost always cheaper on a per-customer basis because you're nurturing a relationship that already exists, not trying to spark one from thin air. The leverage you get here is massive.

A foundational study first highlighted by Bain & Company revealed that a mere 5% increase in customer retention can lift company profits by an astonishing 25% to 95%. This isn't magic; it's a powerful multiplier effect. Retained customers tend to buy more over time, and that initial acquisition cost gets spread across a much longer, more profitable journey. You can find more data on retention's bottom-line impact at Yotpo.com.

This single data point should reframe your thinking. Small, focused investments in keeping your current customers happy can deliver an outsized return compared to spending the same amount chasing new ones.

Scalability And Market Perception

While retention wins on cost-efficiency, acquisition has a clear advantage in one area: raw scalability. Once you find a marketing channel that works—one where your CAC is healthy—you can often dump more money into it and watch your customer base grow almost overnight. This is absolutely critical for early-stage companies trying to carve out a space or for established players expanding into new regions.

But a strong retention game builds something that money can't always buy: a stellar reputation. Happy customers who stick around for years become your best marketing asset. They leave glowing reviews, give you priceless feedback for your product roadmap, and, most importantly, they start talking. This word-of-mouth is one of the most powerful and cheapest acquisition channels you could ever ask for.

Retention Focus vs. Acquisition Focus A Strategic Comparison

To really crystallize the trade-offs, let's put these two strategies side-by-side. The table below breaks down how focusing on acquisition versus retention impacts key areas of your business, giving you a clearer picture of the strategic implications.

| Metric | Acquisition-Focused Strategy | Retention-Focused Strategy |

|---|---|---|

| Primary Goal | Drive top-line revenue and market share growth. | Maximize LTV and bottom-line profitability. |

| ROI Potential | Slower return as CAC must be paid back over time. | Faster, compounding return from existing customers. |

| Cost Efficiency | High cost per customer; often requires significant ad spend. | Lower cost per customer; leverages existing relationships. |

| Risk Profile | Higher risk; performance can be volatile due to market changes. | Lower risk; builds on a predictable, recurring revenue base. |

| Brand Impact | Increases brand awareness and reaches new audiences. | Builds brand loyalty, advocacy, and a strong reputation. |

| Scalability | Highly scalable when a profitable channel is found. | Scales through customer expansion and advocacy over time. |

This side-by-side view shows it's not a simple choice. Each path offers distinct advantages and serves a different strategic purpose.

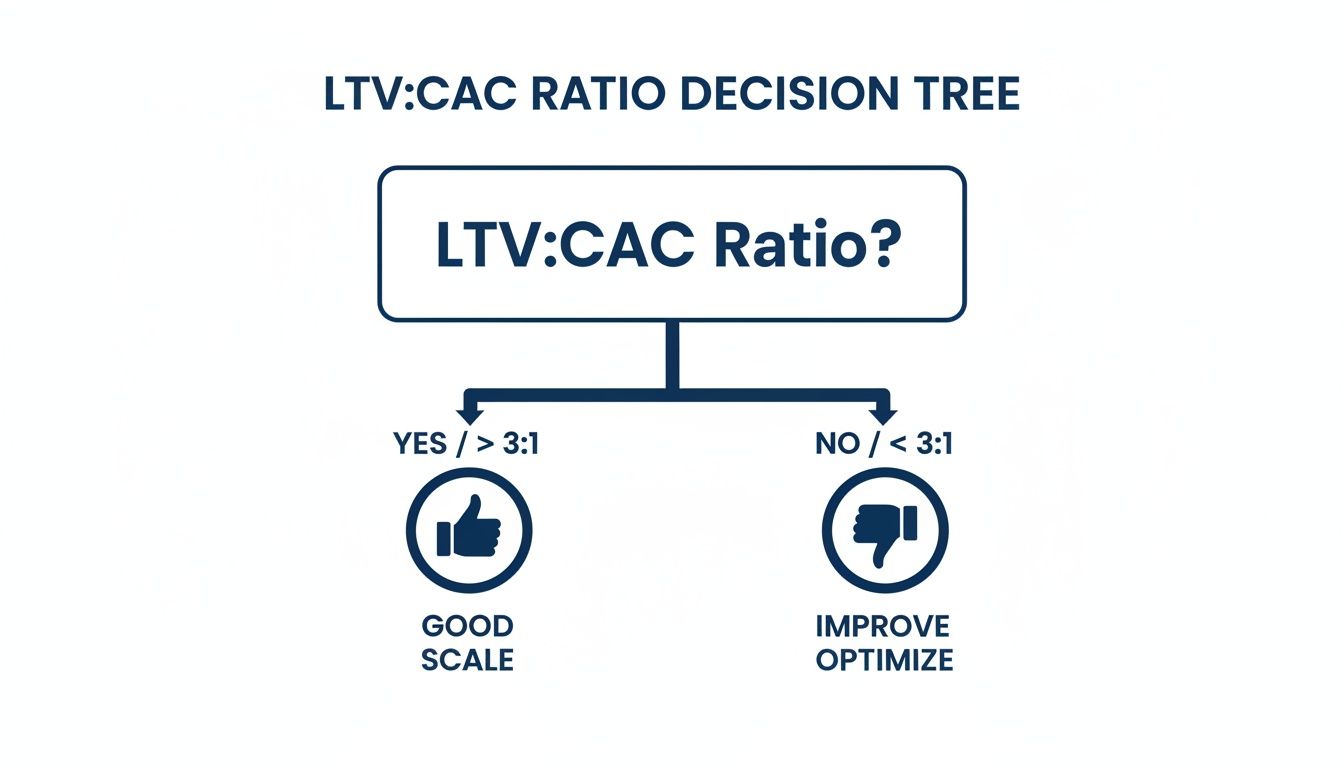

This simple decision tree below uses the LTV:CAC ratio—a vital health metric for any SaaS business—to give you a quick gut check on your growth strategy.

The takeaway here is pretty clear. A healthy ratio (ideally 3:1 or better) means your growth model is sustainable and you can afford to press the accelerator. If you're below that benchmark, it's a sign that your unit economics are broken. The fastest way to fix that is often by shoring up retention to increase your LTV.

In the end, it’s all about balance. Acquisition fills your funnel, but retention is what stops it from leaking. You need both to build a business that not only grows but endures.

While keeping customers happy is the bedrock of a healthy SaaS business, there are absolutely times when you need to go all-in on finding new ones. The whole customer retention vs acquisition cost debate isn't about picking a side and sticking with it forever. It's about knowing when to pivot your focus—and your budget.

Forgetting about acquisition can lead to stagnation, especially when you're just starting out and fighting for every eyeball. In those early days, growth isn't just a metric; it's what keeps the lights on.

Building An Initial Customer Base

When your company is brand new, your first job is simply to get on the radar. You have to exist. Without that first group of users, you have nothing—no product feedback, no revenue, and certainly no data to build a retention strategy around. The mission is to prove your product-market fit by getting your software into the hands of as many people as possible.

In this phase, you'll almost certainly have a higher Customer Acquisition Cost (CAC), and that's okay. Your LTV:CAC ratio might even temporarily drop below the classic 3:1 benchmark. This is a calculated risk. You're not just buying a single user; you're investing in the insights needed to sharpen your product and prove your business model actually works.

Entering New Markets Or Territories

Expanding into a new country or a totally different industry is a lot like starting over. Your brand means nothing there, and you don’t have an army of happy customers spreading the word for you. Here, acquisition has to lead the charge.

You have to get aggressive with your acquisition strategy to:

- Establish a Presence: You need to spend on awareness just to let a new audience know you exist.

- Win Over Early Adopters: Getting those first few customers in a new market builds crucial social proof and gives you local success stories to share.

- Learn the Local Landscape: Your first customers are your best source of feedback on what the region really needs, how much they're willing to pay, and who you're up against.

A perfect example is a US-based SaaS company trying to break into Europe. They have to pour money into localized marketing and sales just to get a foothold. Only then can they even begin to think about a retention-focused playbook.

When you're entering a new market, you're not trying to make a profit on every single customer from day one. The goal is to reach a critical mass that makes you a sustainable player in that market, creating a launchpad for real growth down the line.

Launching A Disruptive Product

If you're launching something that carves out a whole new category or depends on network effects to work—where the tool gets better as more people use it—then speed is everything. Think about how tools like Slack or Figma got their start. Their value was directly tied to how many people in a company or a community were on the platform.

In these cases, the game is all about scale, and fast. You'll see companies offer incredibly generous freemium plans, create viral referral loops, or spend a fortune on marketing to flood the market. The high upfront customer acquisition cost makes sense because you're building a strategic advantage—a moat. By becoming the go-to platform early, you make it incredibly difficult for anyone else to catch up, locking in your leadership position for years.

When to Double Down On Customer Retention

While aggressive customer acquisition has its place, especially in the early days, the real engine of long-term, profitable growth for any SaaS company is retention. The debate over customer retention vs acquisition cost almost always lands in favor of retention as a business matures. Once you’ve moved past the initial scramble for market validation, your focus has to shift from pure growth to sustainable, profitable growth.

This transition point is critical. It’s the moment you realize that the leaky bucket of high churn will drown even your most successful acquisition campaigns. Doubling down on retention isn’t just a defensive move; it's a powerful offensive strategy to build a durable business.

Thriving In A Mature Market

When your market gets crowded, the cost of acquiring new customers inevitably skyrockets. Suddenly, every competitor is bidding on the same keywords, targeting the same audiences, and fighting over the same sliver of attention. In this environment, your existing customer base isn't just a revenue stream—it's your most powerful competitive advantage.

Mature companies get this. They know that happy, long-term customers build a powerful moat around the business. This moat is built from a few key materials:

- Brand Loyalty: Loyal customers just aren't as tempted by a competitor's shiny new offer or a price cut.

- Deep Product Integration: The longer a customer uses your tool, the more it becomes part of their DNA, making the pain of switching enormous.

- Advocacy and Word-of-Mouth: Your most loyal users become your cheapest and most effective sales channel.

In a head-to-head fight, the company with the lowest churn rate almost always wins. It can grow more efficiently and profitably, weathering market shifts that might cripple a competitor running on an expensive acquisition treadmill. For those moments when you need to focus on retention, a practical guide to improving customer retention can provide a data-driven approach.

When Profitability Becomes The Priority

There comes a time in every SaaS company’s journey—driven by market conditions, investor pressure, or just plain good sense—when the focus shifts from growth-at-all-costs to actual profitability. This is where retention truly shines. The unit economics are just undeniable.

Simply put, existing customers are more profitable. They’ve already paid back their initial acquisition cost, so every dollar of recurring revenue from them flows more directly to your bottom line. Even better, they tend to expand their usage over time through upgrades and cross-sells, a concept we call net revenue retention (NRR). A healthy NRR above 100% means you can grow revenue even without acquiring a single new customer.

Retaining a customer is the ultimate leverage for profitability. It transforms a one-time acquisition expense into a compounding asset that generates predictable revenue, valuable feedback, and powerful social proof for years to come.

The data backs this up consistently. Returning customers often account for 65% of a company's business, and these loyal buyers tend to spend up to 67% more than new customers. This spending gap shows exactly why acquisition is not only more expensive upfront but also yields less revenue per customer in the short term compared to re-engaging the people who already know you.

Maximizing LTV When CAC Is High

For some businesses, particularly those in niche or enterprise markets, a high Customer Acquisition Cost (CAC) is just a fact of life. When it costs thousands of dollars to land a single new customer, maximizing their Lifetime Value (LTV) isn't just a good idea—it's a matter of survival. You simply can't afford to lose customers you spent so much to acquire.

In these high-CAC scenarios, every single percentage point of churn reduction has a massive impact on your LTV:CAC ratio. Your entire strategy has to revolve around delivering an exceptional customer experience, from a flawless onboarding to proactive customer success management. You can find more detailed strategies in our guide on how to improve customer retention.

By focusing intensely on keeping these high-value customers happy, you ensure that your steep upfront investment pays dividends for years to come, securing the financial health of your business.

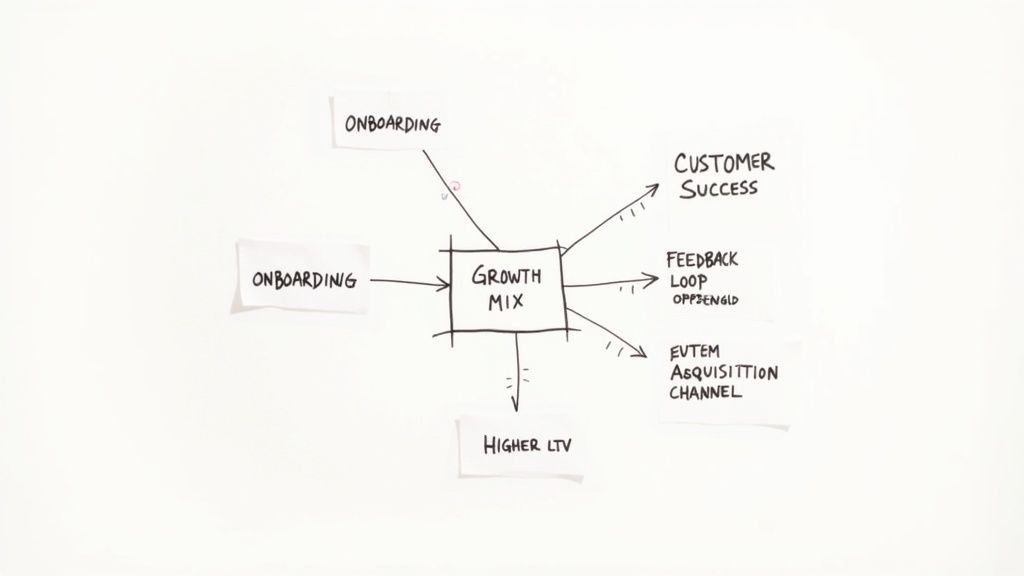

Practical Strategies to Optimize Your Growth Mix

It’s one thing to understand the theory behind customer retention vs acquisition cost; it's another thing entirely to put it into practice. The real goal isn't to pick a side but to build a powerful growth engine where retention and acquisition fuel each other.

This isn't just about balancing a budget. It's about creating a virtuous cycle. When you invest in your current customers, their LTV goes up. That, in turn, makes every dollar you spend on acquisition more efficient and profitable. You’re not just plugging a leaky bucket—you’re using the water you save to fill it up even faster.

Fortifying Your Customer Retention Efforts

Great retention doesn’t start when a customer is about to cancel. It begins the second they sign up. It’s a proactive game of delivering undeniable value at every turn, making sure customers don't just stick around, but actively grow with your product.

Here are three non-negotiable pillars for any world-class retention program:

Nail the Onboarding Process: You only get one chance to make a first impression. A clunky, generic onboarding is the fastest way to kill a new user's enthusiasm. The key is to guide them to their "aha!" moment as fast as humanly possible by showing them exactly how to solve their problem, not by giving them a boring tour of every single feature.

Get Proactive with Customer Success: Don't just sit back and wait for the cancellation email. Use customer health scores and product usage data to spot at-risk accounts before they even know they're unhappy. Often, a quick, helpful check-in from a customer success manager can untangle a small issue, reinforce the product's value, and turn a potential churn statistic into a raving fan.

Use Feedback to Steer the Ship: Your existing customers are a goldmine of product intelligence. You have to create tight feedback loops—think in-app surveys, customer interviews, and combing through support tickets. Acting on this feedback doesn't just make your product better; it sends a powerful message to your customers that you’re listening and are invested in their success. That’s how you build real loyalty.

Optimizing Your Acquisition Channels

While strong retention locks down your revenue base, smart acquisition is how you expand your footprint. The secret is to stop chasing raw sign-up numbers and start focusing on acquiring the right customers—the ones who look like your best, most successful users.

This means getting surgical with your data to find and scale the channels that actually deliver a positive return on investment.

The best acquisition strategies are always built on a crystal-clear understanding of your ideal customer profile (ICP). Once you know exactly who you're after, you can stop wasting money and focus your budget on the channels where they actually hang out. The result? A lower CAC and a much higher LTV.

To really dial in your acquisition engine, you need to:

- Find Your Most Profitable Channels: religiously track the LTV:CAC ratio for every single channel. You’ll probably find that while paid ads bring in a ton of volume, customers from organic search might stick around twice as long, making them far more valuable.

- Double Down on What’s Working: Once you’ve identified your winning channels, you have to be disciplined. Funnel more budget and talent into scaling them instead of spreading your resources thinly across a dozen mediocre efforts.

- Align Marketing with Customer Success: Make sure your marketing promises are something your product can actually deliver on. Acquiring users with flashy claims you can't back up is a surefire recipe for sky-high churn and a trashed reputation.

In the end, the most potent growth mix always treats retention as a force multiplier for acquisition. Every single customer you keep adds to your average LTV, which in turn justifies and powers more ambitious acquisition campaigns. By investing in tools and strategies that drive down churn, you're not just patching up leaks; you're fundamentally improving the entire economic model of your business. For any SaaS leader, improving customer lifetime value isn’t just a nice-to-have—it’s one of the most direct paths to building a sustainable, high-growth company.

Common Questions About Acquisition And Retention

Even with a solid framework, you’re bound to hit some tricky questions when you're in the trenches balancing customer acquisition and retention. Nailing the answers is what separates a good strategy from one that actually drives sustainable growth.

Let's walk through some of the most common—and critical—questions SaaS leaders grapple with.

What Is A Good LTV To CAC Ratio For SaaS?

For most SaaS companies, the gold standard for a healthy LTV:CAC ratio is 3:1. Think of it this way: for every dollar you put into acquiring a customer, you should expect to get three dollars back over their lifetime with you.

- A ratio below 3:1 (say, 1:1 or 2:1) is a red flag. It usually means your unit economics are shaky. You could be spending too much to get customers, they might be churning too quickly, or your pricing is off. Whatever the cause, profitability will be a serious challenge.

- A ratio above 3:1 (like 4:1 or 5:1) is a fantastic sign. It signals a highly efficient growth engine and often means you have the green light to invest more aggressively in marketing and sales to grab more of the market.

The 3:1 ratio isn't just a vanity metric; it's the ultimate health check for your business model. It proves you're not just covering your acquisition costs but are actually generating enough margin to fund operations and, eventually, make a profit.

How Often Should I Re-evaluate My Growth Budget?

Your growth budget can't be a "set it and forget it" affair. The market changes, competitors make moves, and your own campaign data will tell you what’s working and what’s not.

A quarterly review hits the sweet spot. It's frequent enough to let you pivot based on performance data but long enough to avoid knee-jerk reactions. Make sure you tie these reviews directly to your core metrics—LTV, CAC, and churn—so you can make smart, data-backed decisions on where your next dollar should go.

What Are The First Steps To Improving Customer Retention?

Before you rush into tactics, you have to start with a diagnosis. The first step to improving retention is always figuring out why customers are leaving in the first place.

Here are three practical things you can do right away:

- Analyze Your Churn Drivers: Get into your data. More importantly, talk to the customers who actually canceled. Look for patterns in their behavior or product usage right before they decided to leave.

- Improve Your Customer Feedback Loops: You can’t fix what you don’t know is broken. Use simple in-app surveys (like NPS or CES) at key points in the customer journey. The crucial part? Create a real process for your team to act on that feedback.

- Perfect Your Onboarding Experience: A user's first few moments with your product are make-or-break. Your onboarding absolutely must guide them to their "aha!" moment as fast and frictionlessly as possible.

At LowChurn, we built the AI-powered early warning system to get you ahead of these problems. Our platform predicts which customers are likely to churn and gives your team the actionable playbooks to save them. Protect your MRR and improve your unit economics by visiting https://www.lowchurn.com.