If you want to get ahead of customer churn, you have to stop playing defense. For too long, SaaS teams have treated churn as damage control, only reacting once a customer has already decided to leave. The real key is to get proactive by using your own data—product usage and subscription details—to spot at-risk customers before they even think about canceling. This isn't just about saving accounts; it's about building a powerful engine for growth that protects your revenue and boosts customer lifetime value.

Why Churn Prediction Is a Growth Multiplier

It’s easy for SaaS founders to see churn as just another metric on the dashboard—a necessary cost of doing business. But that mindset is a huge mistake. Churn isn't just lost revenue; it's a silent killer of your growth momentum. It keeps you stuck on a customer acquisition treadmill, where you're constantly spending money just to replace the customers walking out the door.

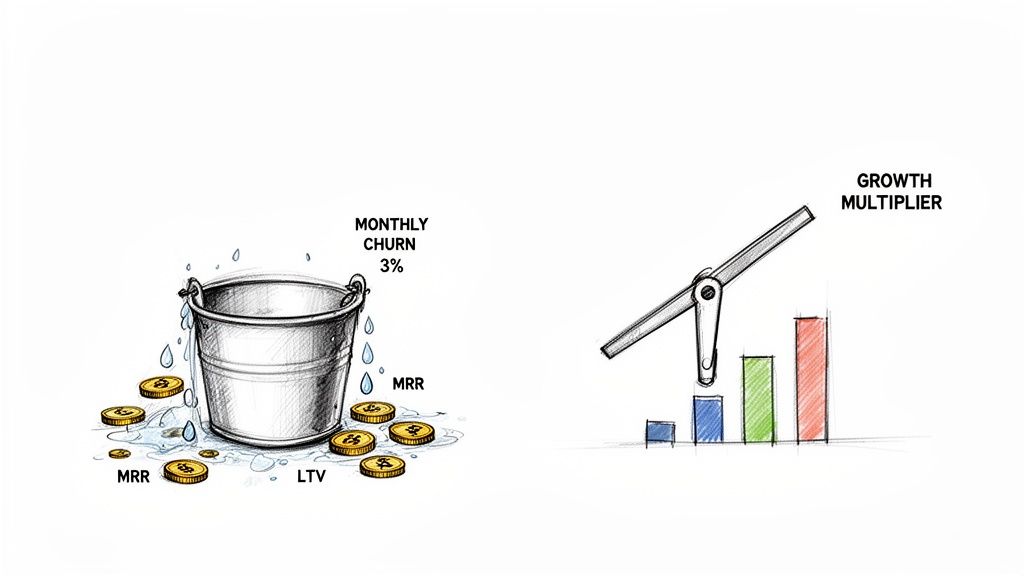

Think about it like a bucket with a small hole. A 3% monthly churn rate doesn't sound like a crisis, but it compounds. Over the course of a year, that tiny leak means you've lost more than 30% of your customers. This puts immense pressure on your sales and marketing teams, forcing them to run at full speed just to keep the business from shrinking.

The True Financial Drag of Customer Attrition

The real cost of churn goes way beyond the lost Monthly Recurring Revenue (MRR). It tanks your Customer Lifetime Value (LTV) and stretches out how long it takes to pay back your Customer Acquisition Cost (CAC). When a customer leaves, they take all their future potential with them—no upgrades, no expansion, no referrals.

The scale of this problem is massive. U.S. businesses lose a staggering $136.8 billion each year from customer churn that could have been prevented. For companies running on platforms like Stripe, the stakes are even higher, since data shows that existing customers tend to spend 31% more than new ones. Every single percentage point you shave off your churn rate goes directly to protecting your MRR and multiplying the value of your entire customer base. You can dig into more of the data behind retention's impact on Sprinklr's blog.

Churn prediction shifts your entire strategy. You stop asking, "How do we replace lost customers?" and start asking, "How do we get the most value from the customers we already have?" Retention stops being a guessing game and becomes a data-driven science.

Moving From Reactive to Proactive Retention

Without a solid system for predicting churn, you're always a step behind. You typically find out a customer is leaving the moment they hit the cancel button, which is far too late to do anything meaningful. A proactive approach, on the other hand, gives you the foresight to intervene when it actually counts.

This strategy is all about spotting the early, subtle warning signs. Things like:

- A slow but steady drop in the usage of key features

- Fewer team members logging in each week

- Recent downgrades or other changes in their Stripe subscription

When you can catch these signals weeks ahead of time, your team can reach out with genuinely helpful, targeted support—not last-minute, desperate discount offers. The goal isn't to save every single account at all costs. It's to build a sustainable growth engine where customer success and revenue growth are one and the same.

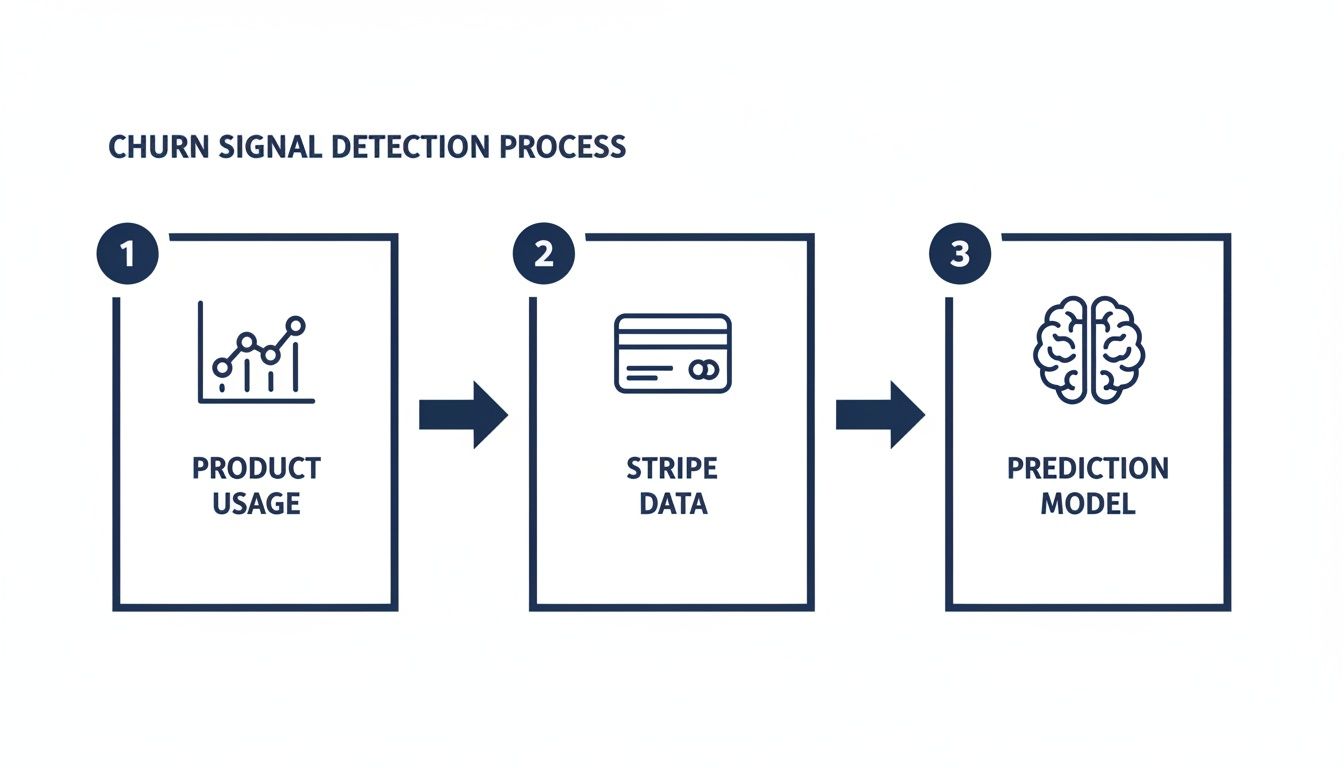

Gathering the Right Signals for Churn Prediction

To get serious about predicting churn, you have to move beyond gut feelings and start listening to your data. A genuinely effective prediction model is built on the right signals, and for SaaS teams, that almost always means combining two powerful data streams: product usage and Stripe subscription metadata.

One tells you if customers are actually getting value; the other reveals their commercial commitment. Relying on just one leaves a massive blind spot in your understanding of customer health.

What Your Product Usage Data is Telling You

Product usage is your most honest indicator of customer value. It's simple: if people are using your software, they're getting something out of it. An account that logs in daily and leverages key features is deeply embedded. On the flip side, a slow decline in activity is often the first whisper of an impending breakup.

You don't need to track every single click to get a clear picture. The trick is to focus on the handful of actions that truly correlate with long-term retention.

- Feature Adoption: Are customers using the sticky features that solve their biggest problems? If they ignore a core part of your platform, that’s a major red flag.

- Session Habits: How often are they logging in? How long do they stick around? A steady drop-off in session frequency is a classic precursor to churn.

- Workflow Completion: Think about the main "jobs-to-be-done" in your app. Tracking whether users are actually completing these critical workflows is a fantastic way to measure the real value they're getting.

Getting a handle on these patterns is fundamental. To really dig into these metrics, our guide on how to measure customer engagement breaks them down in much more detail.

Tapping into Your Stripe Subscription Data

While usage shows engagement, your Stripe data tells the financial side of the story. This isn't about snooping on payment details. It's about looking at the metadata around the subscription, which provides hard evidence of a customer's commitment level and any potential friction.

Think of Stripe metadata as the contractual handshake. It confirms the health of the business relationship and can flag a wavering commitment long before a customer gives you a "cancellation reason."

This table breaks down the essential signals you should be pulling from Stripe. Combining these with usage data creates a much clearer, more reliable picture of churn risk.

Essential Signals for Churn Prediction

| Signal Category | Specific Data Points | Why It Matters |

|---|---|---|

| Subscription Status | Plan changes (upgrades/downgrades), upcoming renewal dates, trial conversions. | A downgrade is a direct signal of reduced commitment or budget constraints. |

| Payment History | History of failed payments, dunning status, number of retries. | Involuntary churn due to payment failures is common; a history of issues is a huge risk factor. |

| Billing Cadence | Monthly vs. annual plans, recent switches between the two. | A switch from an annual to a monthly plan often indicates a customer is testing the waters before leaving. |

Putting these two data sources together is where the magic happens. A drop in usage is one thing, but a drop in usage combined with a recent failed payment? That’s a five-alarm fire.

A Privacy-First Approach is Non-Negotiable

Connecting these data sources might sound intimidating, but it doesn't have to be a security nightmare. The entire process should be built on a privacy-first foundation. You should never need to handle sensitive financial data or personally identifiable information (PII) to build an accurate churn model.

The right way to do this is with a read-only API key. This is a critical distinction.

A read-only integration means a system can only view the necessary subscription metadata—like plan type, renewal dates, and payment status. It can never modify subscriptions or access sensitive details like full credit card numbers.

This approach gives you the powerful insights you need without creating a compliance headache. By focusing only on essential, non-sensitive signals from both your product and Stripe, you can build a highly effective and responsible early-warning system right from the start. That secure foundation lets you focus on what really matters: acting on insights to keep your customers happy and your revenue growing.

Building a Churn Prediction Model That Actually Works

Once you have your data streams connected, it's time to build the engine that turns all those signals into something truly useful: a reliable, forward-looking churn prediction model. The goal isn't just to hoard data; it's to create a system that can flag a customer at risk of leaving before they actually hit the cancel button.

The basic idea is to feed both your product usage data and Stripe financial signals into a predictive model. This process generates the churn risk insights your team needs to act decisively.

It’s this combination of usage and subscription data that packs a punch. One without the other gives you an incomplete picture. The good news? You can start with a simple, practical approach and build up from there as your team and resources grow.

Starting with Rule-Based Systems

You don't need a data scientist and a complex algorithm to get started. Honestly, the most impactful first step for most SaaS teams is a straightforward rule-based system. This approach is exactly what it sounds like: setting simple, logical "if-then" thresholds based on known churn indicators.

Think of these as your early-warning tripwires. They’re dead simple to implement, easy to understand, and you won't have to spend a week explaining them to your sales team.

Here are a few classic rules I’ve seen work wonders:

- Login Inactivity: Flag any account with fewer than four logins in the last 30 days.

- Key Feature Neglect: Identify users who haven't touched a core, "sticky" feature in over two weeks.

- Support Ticket Surge: Alert the team when a customer opens more than three support tickets in a single week.

- Failed Payments: Immediately flag accounts with two or more failed payments in a row. This is a massive red flag for involuntary churn.

These rules give you immediate value by catching the low-hanging fruit—the most obvious at-risk customers. Sure, they won't catch every subtle sign, but they establish a baseline for proactive intervention that beats having no system at all.

Leveling Up with Machine Learning Models

When you’re ready for more predictive muscle, machine learning (ML) models are a serious upgrade. Unlike the rigid logic of a rule-based system, ML algorithms can sift through massive combinations of data points to find complex, non-obvious patterns a human would likely miss.

An ML model, for example, might uncover that customers who downgrade their plan after a period of low feature engagement are 90% more likely to churn in the next 45 days. That’s a multi-layered insight that simple rules just can't provide.

A common hang-up here is the belief that you need a dedicated data science team to get into ML. That's old-school thinking. Modern platforms can automate much of the heavy lifting, from feature engineering to model training, so you can focus on the results.

The power to predict churn with this kind of precision is a game-changer. Industries like telecom and financial services, which can see churn rates as high as 25%, have been using these models for years. When a seemingly small monthly churn of 5% can cost you nearly half your customers annually, getting a 7–30 day advance warning is incredibly valuable.

The Best of Both Worlds: A Hybrid Approach

For most SaaS teams, the sweet spot lies in a hybrid model. This approach combines the crystal-clear logic of rules with the sophisticated predictive power of machine learning. You get the best of both worlds.

Here’s the breakdown:

- Rules for Clarity: You still use straightforward rules to catch the obvious, high-priority churn signals (like a customer who hasn't logged in for 60 days). These are your easy wins.

- ML for Subtlety: Then, you layer a machine learning model on top to score every other customer based on their combined usage and billing behaviors. This model is your secret weapon for surfacing at-risk accounts that don't fit neatly into a simple rule.

This combined method ensures you never miss the glaringly obvious signs while also benefiting from the deeper, algorithmic insights. For a real-world look at how this works, check out this case study on a Customer Churn Prediction AI that was able to flag at-risk accounts weeks ahead of time.

No matter which path you take, the end goal is the same: transform raw data into a predictive score. This score becomes the cornerstone of your retention strategy, helping your customer success team focus their energy where it matters most. To get deeper into the mechanics, take a look at our guide on using predictive analytics for customer retention. By starting simple and adding complexity over time, any SaaS company can build a powerful churn prediction engine.

Turning Churn Predictions Into Actionable Insights

Building a solid churn prediction model is a massive achievement. But let’s be honest, a prediction is useless if it just sits in a spreadsheet somewhere. The real win comes when you turn that foresight into concrete actions that actually save accounts and protect your revenue.

This is all about putting your model to work in the real world—evaluating its performance and, most importantly, embedding its insights directly into your team's daily grind.

A great model isn't just about nailing raw accuracy; it’s about striking the right balance. You'll need to get comfortable with the trade-offs between two critical metrics:

- Precision: Out of all the customers your model flagged as "at-risk," how many actually churned? High precision ensures your team isn't chasing ghosts and wasting time on perfectly happy customers.

- Recall: Of all the customers who did churn, how many did your model successfully catch? High recall means you're not getting blindsided by unexpected cancellations.

There’s always a push-and-pull here. A model tuned for maximum recall might flag too many healthy accounts, completely overwhelming your team. On the other hand, a model obsessed with precision might miss subtle churn signals, letting precious revenue slip right through the cracks. The sweet spot is finding a balance that aligns with your team's capacity and your business goals.

From Data Points to Daily Workflows

Once you've tweaked your model, the real work begins: operationalization. Your insights need to be visible, accessible, and actionable for the folks on the front lines—your Customer Success team. This is where a real-time dashboard becomes their command center.

An effective dashboard does more than just list names. It should surface a dynamic customer health score for every single account, blending all those different signals into one simple, easy-to-digest metric. This score needs to update in real-time as new product usage data and Stripe info flows in. Our complete guide on building a customer health score takes a much deeper look into the specific metrics you should be tracking.

The goal here is to create a prioritized "at-risk" list that your team can start their day with. This single change transforms their role from reactive firefighting to proactive, strategic intervention. They can immediately focus their limited time on the accounts that truly need it.

This shift is a game-changer. Instead of just waiting for a cancellation email to drop into their inbox, the team gets an early warning. This gives them a real chance to engage with customers while there's still time to demonstrate value and turn the entire relationship around.

Understanding the *Real* Reasons for Churn

To make your interventions count, you have to look past the surface-level reasons customers give for canceling.

For example, consumer behavior research shows that involuntary churn from payment failures is a huge recovery opportunity—a whopping 70% of it is successfully recovered. At the same time, 33% of customers might cite "budget issues" as their reason for voluntary churn, but this often masks deeper frustration with the product. A powerful churn prediction model analyzes product usage to see who is truly disengaged, even if they're pointing the finger at their budget. You can dig into more stats like this in the State of Retention 2025 report.

By arming your team with these deeper insights, they can tailor their outreach.

Is a customer's churn risk driven by failed payments? The playbook is a simple dunning campaign. Is it because of a steep drop-off in feature adoption? The playbook should trigger a targeted training session or a personal check-in call.

This level of specificity is what makes a churn prediction system a true revenue-saver, not just a fancy analytics tool. It finally bridges the gap between knowing there's a problem and knowing exactly how to solve it.

Deploying Your First Retention Playbooks

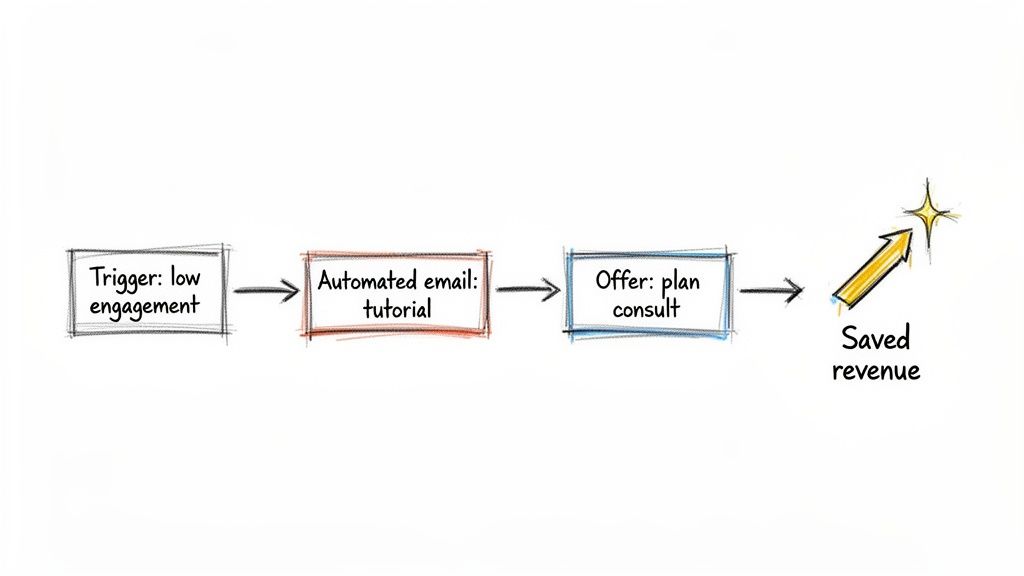

Spotting a customer who's about to churn is a massive win, but it’s only half the job. Your prediction model is just a fancy alert system until you actually do something with its insights. The real magic happens when you turn those predictions into immediate, targeted action—that’s what saves accounts and protects revenue.

This is where retention playbooks come into their own. Think of a playbook as a ready-to-go action plan for your team. When a specific churn signal pops up, you're not scrambling to figure out what to do. You have a proven, repeatable campaign locked and loaded.

Matching the Playbook to the Problem

Not all churn risks look the same, so a one-size-fits-all response is guaranteed to fail. Blasting a generic "We miss you!" email to a customer wrestling with a technical bug is just going to annoy them. The secret is to diagnose the underlying problem your model has flagged and match your outreach to it.

For example, if you predict customer churn because a team’s use of a key feature just fell off a cliff, they aren't seeing the value anymore. The right move isn't a discount; it's a helpful, educational intervention. On the other hand, if Stripe flags multiple failed payments, the problem is purely mechanical, and the fix is much more direct.

The most effective playbooks feel less like a sales pitch and more like a helpful, proactive check-in. They anticipate a customer’s needs and offer a solution before the customer has to ask for it, which is the hallmark of a great customer experience.

By tailoring your response, you show customers you’re paying attention to their specific situation, which makes a world of difference. Once you've identified the risk, you can deploy a range of customer retention strategies to pull them back from the brink.

Playbook 1: The Low Engagement Nudge

This is the bread-and-butter playbook for virtually any SaaS company. It's designed to re-engage users who have gone quiet or stopped using the core features that make your product sticky.

- The Trigger: A customer's health score takes a dive because their weekly logins or key feature usage has dropped by 30% or more over the last 21 days.

- The Action Plan:

- Automated Email: Immediately fire off an automated, plain-text email that feels like it came from a real person. Ditch the glossy marketing template.

- Subject: Quick question about [Your Product Name]

- Body: "Hi [First Name], I noticed you haven't used [Key Feature] in a little while. We just released a short tutorial video that shows how other teams are using it to [achieve specific outcome]. You can check it out here. Let me know if you have any questions!"

- In-App Guide: If they log back in, greet them with a subtle in-app tooltip or a quick walkthrough that reminds them how to use the exact feature they’ve been neglecting.

- CSM Alert: If you get radio silence for five business days, it's time for a human touch. Automatically create a task for their Customer Success Manager (CSM) to pick up the phone.

- Automated Email: Immediately fire off an automated, plain-text email that feels like it came from a real person. Ditch the glossy marketing template.

Playbook 2: The Billing Friction Fix

Involuntary churn from failed payments is a silent killer. It’s revenue slipping through your fingers for no good reason. This playbook stops the bleeding by making it dead simple for customers to update their payment details.

- The Trigger: The Stripe API reports a second consecutive failed payment.

- The Action Plan:

- Automated Dunning Email: Send a crystal-clear email right away with a direct link to their billing page. Frame it as helping them avoid service interruption, not as a demand for cash.

- In-App Banner: For all account admins, display a clean, non-intrusive banner at the top of the app: "Please update your payment information to ensure uninterrupted service."

- Grace Period Communication: If there's still no update after three days, send a follow-up explaining their grace period and the exact date their service will be suspended. No one likes surprises when it comes to billing.

Playbook 3: The Budget Concern Consultation

Sometimes the churn signals point to financial pressure. Maybe a customer just downgraded their plan or sent a pricing question to your support team. This playbook is about proactively finding a middle ground that works for them and for you.

- The Trigger: A customer downgrades from an annual to a monthly plan, or from a premium tier to a basic one.

- The Action Plan:

- Personal CSM Outreach: This is a major red flag that requires a personal touch, fast. Their CSM should send an email within 24 hours.

- Subject: Checking in on your plan change

- Body: "Hi [First Name], I saw you recently switched your plan. Just wanted to quickly check in and see if there's anything we can do to help you get the most value out of [Your Product Name]. If you have a few minutes next week, I'd love to hop on a call to better understand your needs."

- Offer a Consultation: The goal of this call isn't to strong-arm them back into their old plan. It's to listen. You might find they genuinely don't need the premium features. Or, you might be able to offer a temporary discount or a more flexible payment schedule to help them through a rough patch.

- Personal CSM Outreach: This is a major red flag that requires a personal touch, fast. Their CSM should send an email within 24 hours.

Putting even just these three simple playbooks into practice can have an immediate, measurable impact on your churn rate. They close the crucial gap between knowing there's a problem and actually solving it.

Common Questions About Predicting Customer Churn

Diving into churn prediction can feel like a massive undertaking, and it's natural to have questions about the timeline, the resources you'll need, and what you can realistically expect. Let's tackle some of the most common concerns I hear from SaaS founders and their teams.

The great news? Getting started is a lot faster and more straightforward than you might think. This isn't a six-month data science project anymore.

How Long Until I See Accurate Churn Predictions?

With a modern platform, you can actually get your first predictions within a few hours of connecting your Stripe account and adding a simple tracking snippet to your app. The model starts learning from day one, but the real magic happens as it observes your specific user patterns over a bit of time.

You'll see the system's accuracy improve steadily over the first few weeks as it ingests more historical data. For most SaaS businesses, this means you'll have reliable, actionable predictions identifying at-risk customers 7–30 days in advance, all within the first month.

The key is how quickly you start seeing value. You don't have to wait a full quarter to act. The system gives you an early warning signal almost immediately, and that signal just gets smarter and more accurate every day.

This rapid time-to-value is a game-changer. It lets your team switch from being reactive to proactive about retention way faster than if you were building a custom model from scratch.

Do I Need a Data Scientist to Do This?

Nope. Absolutely not. While you could certainly have a data scientist build a custom model, today's AI-powered platforms are designed specifically for the rest of us—product managers, founders, and customer success teams. They handle all the heavy lifting behind the scenes.

These systems automate the most complex parts of the process:

- Data Integration: They securely pull in your product usage data and Stripe metadata.

- Feature Engineering: They automatically calculate meaningful metrics from all those raw signals.

- Modeling: They handle all the training and deployment of the machine learning algorithms.

You end up with a sophisticated prediction engine that's delivered through a simple dashboard. This frees up your team to focus on what actually matters: acting on the insights to save customers, not wrestling with Python libraries and data pipelines.

What Kind of Prediction Accuracy Can I Realistically Expect?

This is the big one, because accuracy determines how much you can trust the system. Top-tier churn prediction platforms built specifically for SaaS typically report accuracy rates of 85% or higher. That means for every ten customers, the model correctly predicts whether they will churn or stay for at least eight of them.

But it’s important to look beyond that one number. You also need to consider precision and recall. A well-balanced system will correctly identify a high percentage of the customers who are actually going to churn (high recall) without incorrectly flagging too many healthy customers (high precision).

How Is Customer Privacy and Data Security Handled?

Any legitimate platform will be built with a privacy-first mindset. For example, they should use a read-only Stripe API key. This is a critical detail. It means the system can only view the necessary subscription metadata—it can't make any changes to your plans, billing, or customer information.

Even more importantly, these systems should not access or store sensitive financial details or Personally Identifiable Information (PII). The analysis is focused entirely on subscription status, relevant metadata, and anonymized usage patterns. This approach keeps the process compliant with privacy regulations like GDPR and CCPA, giving you complete peace of mind.

Ready to stop guessing and start predicting? LowChurn gives you an AI-powered early warning system for Stripe, identifying at-risk customers weeks in advance. Get started in under a minute and see a tangible reduction in churn. Learn more about how LowChurn works.