At its core, predicting customer churn is all about spotting the customers who are likely to cancel their subscriptions before they actually do. For any SaaS business, this isn't just about playing defense. It's a fundamental growth strategy that shifts your team from putting out fires to proactively protecting your revenue. It means using the customer data you already have to build a powerful early-warning system.

Why Predicting Customer Churn Is a SaaS Superpower

Watching your hard-won Monthly Recurring Revenue (MRR) drip away is a SaaS founder's recurring nightmare. You pour so much time, energy, and money into acquiring new customers, only to watch those gains get wiped out by cancellations. It can feel like you're running on a treadmill, working hard just to stay in the same place.

The real problem here is that churn is a lagging indicator. By the time a cancellation pops up in your Stripe dashboard, the damage is already done.

The financial stakes are incredibly high, especially in the fast-paced SaaS world where small improvements in retention can fuel massive growth. Let’s say your business has 75,000 monthly customers and loses 300 of them. That's a churn rate of just 0.4%. It sounds tiny, but remember that acquiring a new customer costs 5 to 25 times more than keeping an existing one. That seemingly small leak can easily turn into millions in lost MRR over a year. As IBM calculates the costs of churn, the financial hit becomes painfully clear.

Shifting from Reactive to Proactive

Reacting to churn after the fact is both expensive and incredibly ineffective. You're left scrambling with last-ditch efforts like exit surveys or desperate discount offers, but by then, the customer has already mentally checked out.

This is where a proactive approach changes the entire game. It’s about catching the subtle, almost invisible warning signs that show up long before a customer hits the "cancel" button.

- Declining Product Usage: A user who used to log in daily now barely shows up once a week.

- Payment Issues: That one failed payment might seem like a fluke, but it’s often the first domino to fall in involuntary churn.

- Feature Disengagement: They've stopped using the key features that once made your product indispensable to them.

- Subscription Changes: Are they constantly downgrading their plan? That's a huge red flag for declining perceived value.

"Churn is a symptom, not the disease. The disease is your customer not getting the value they expected from your product. A churn prediction system is your stethoscope; it lets you hear the problem before it becomes fatal."

By pulling together these signals from your product analytics and Stripe data, you can build that crucial early-warning system. Instead of constantly fighting fires, you start preventing them. You can pinpoint an at-risk account, figure out why they're struggling, and then step in with a targeted playbook to get them back on track.

This isn't just about saving one account. It's about fundamentally strengthening your customer relationships and protecting the engine that drives your growth.

The True Cost of Churn vs The Power of Prediction

Here’s a quick look at how these two approaches stack up. The difference isn't just tactical; it's a completely different way of thinking about your business.

| Metric | Reactive Approach (No Prediction) | Proactive Approach (With Prediction) |

|---|---|---|

| Timing of Action | After the customer cancels | Weeks or months before a churn risk appears |

| Team Focus | Damage control and exit surveys | Value delivery and success planning |

| Typical Tools | Billing dashboards, support tickets | Product analytics, CRM, predictive models |

| Cost to Business | High (lost MRR + high acquisition costs) | Low (retention efforts are cheaper than acquisition) |

| Customer Relationship | Transactional, often ends on a sour note | Partnership-focused, built on proactive support |

| Growth Impact | Stagnant or slow, "leaky bucket" syndrome | Compounding, higher LTV and stable MRR |

Ultimately, a predictive model gives your team the foresight to act when it actually matters, turning potential losses into opportunities for deeper engagement and long-term loyalty.

Uncovering Insights in Your Stripe and Product Data

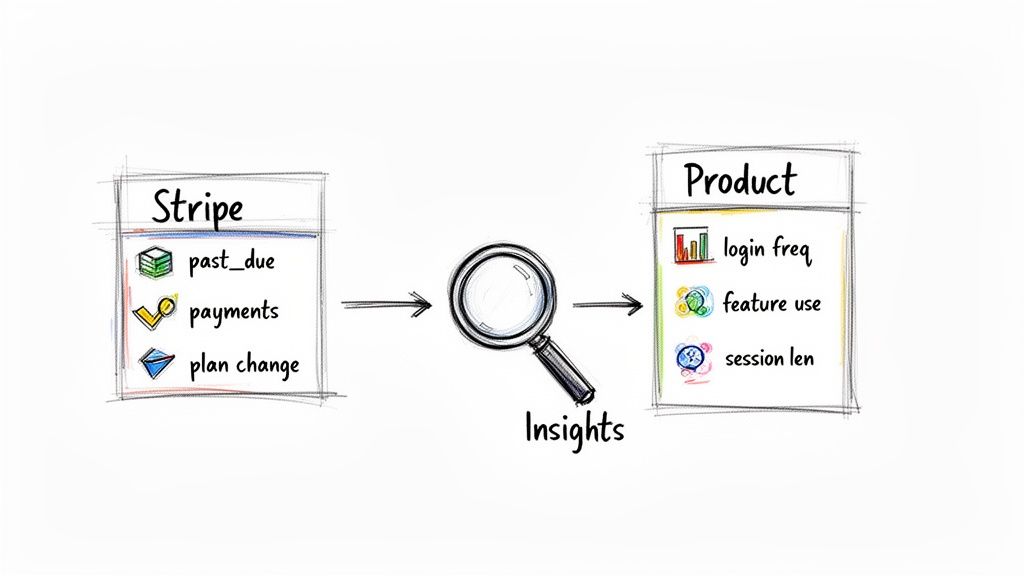

You don't need to hunt for complex, external datasets to predict churn. The most powerful indicators are already sitting right inside your own systems. The real gold is found in two places you already have access to: your Stripe subscription data and your product usage analytics.

When you bring these two sources together, you get a clear, multi-dimensional view of customer health. Think of it like this: Stripe tells you what a customer is paying for, while your product data shows you the value they're actually getting. A growing gap between those two is almost always the earliest sign of churn risk.

Decoding Your Stripe Subscription Data

Your Stripe account is far more than just a way to process payments; it's a treasure trove of behavioral signals. Too many SaaS founders just watch top-line MRR, but the real story is buried in the details of individual subscriptions. A few key data points can tell you so much.

Start by looking for patterns in these areas:

- Subscription Status: A status of 'past_due' or 'unpaid' is an immediate, high-priority red flag. This is often the canary in the coal mine for involuntary churn from payment failures, something a smart dunning strategy can often fix.

- Plan Changes: Did a customer just downgrade from a premium tier to a basic one? That’s a classic signal that they no longer see the same value in your product. They're actively looking to spend less, which is frequently a step before canceling entirely.

- Failed Payments: Don't just write off a single failed payment. While it could be an accident, a pattern of them can point to deeper financial issues or a customer who has simply disengaged and no longer cares enough to update their card.

- Trial Conversions: It’s just as important to analyze the trials that don't convert. This data gives you powerful clues about which user segments might be a poor fit or struggle to find value from the start.

By connecting these financial signals to real-world behavior, you shift from simply processing transactions to actively understanding your customer's journey. A customer who downgrades their plan and then has a failed payment is sending an unmistakable message.

This billing data gives you the "what." To understand the "why" behind it, you have to look at how they're actually using your product.

Tapping Into Product Usage Signals

How your customers interact with your application is the single best predictor of long-term retention. A customer who pays on time every month but hasn't logged in for 60 days is a massive churn risk. You don't need to track everything; a lightweight approach focused on a few key behaviors can tell you all you need to know about engagement.

Focus on metrics that reflect genuine value, not just vanity stats like page views.

| Signal Category | Key Metrics to Track | Why It Matters |

|---|---|---|

| User Activity | Login Frequency, Session Duration | Shows how often and for how long users are active. A sudden drop-off is a major warning sign. |

| Feature Adoption | Core Feature Usage, New Feature Discovery | Reveals if users are using the "sticky" features that deliver the most value and solve their core problems. |

| Engagement Depth | Number of Key Actions per Session | Measures whether users are performing high-value actions (e.g., creating a report, sending an invoice) versus just browsing. |

| Support Interaction | Number of Support Tickets, Ticket Sentiment | A sudden spike in support tickets, especially with negative sentiment, can signal growing frustration with your product. |

Gathering this intelligence doesn't require a massive data engineering project. Many product analytics platforms let you start tracking these signals with a simple JavaScript snippet. The goal is to build a complete picture of customer health while respecting user privacy by focusing on anonymized events and metadata. To see how this fits into a broader strategy, check out our guide on how to reduce customer attrition.

Beyond your own first-party data, exploring additional methods to collect customer loyalty analytics can add even more depth to your prediction models. By weaving these different data streams together, you create a powerful foundation for building a churn prediction model that is both accurate and, more importantly, actionable.

Choosing the Right Churn Prediction Model

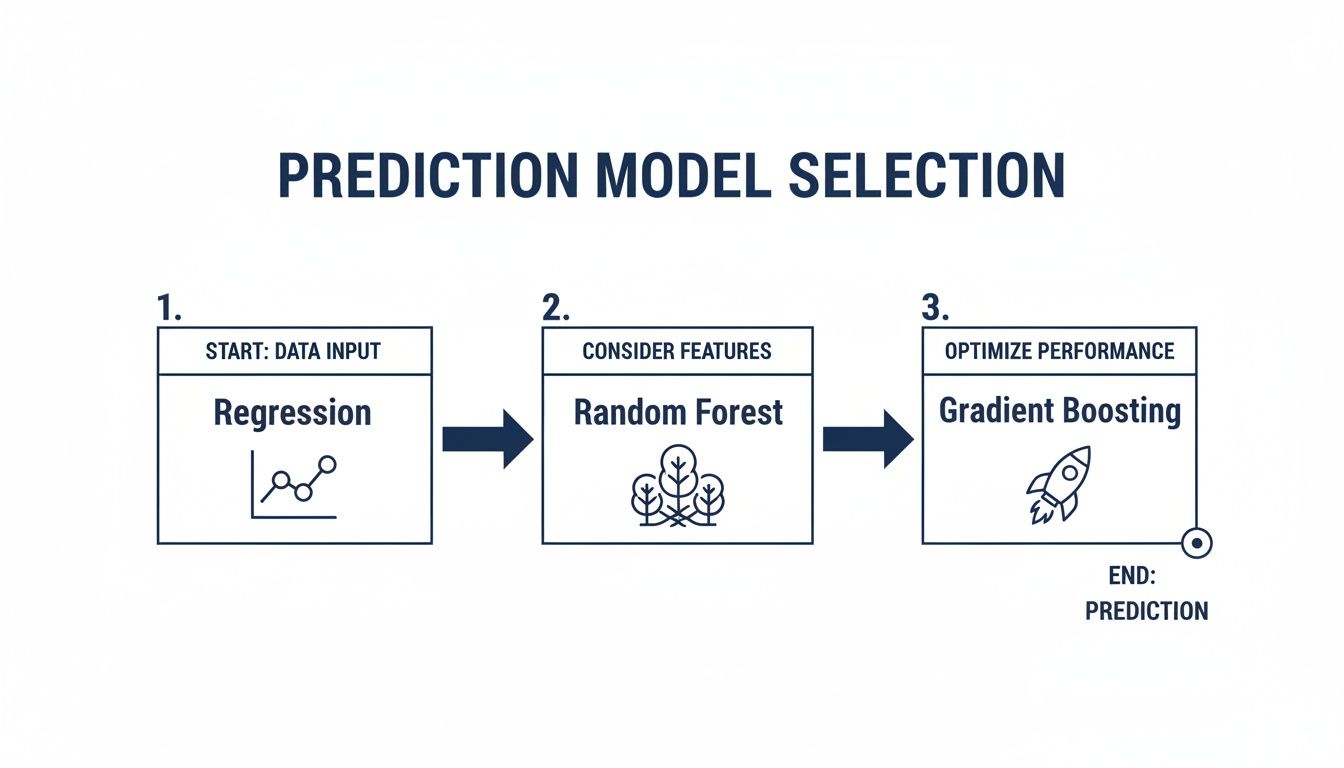

Okay, you’ve wrangled your data from Stripe and your product analytics tools. It’s clean, it’s organized, and it’s ready for the main event: choosing a machine learning model.

This part can sound intimidating, but you absolutely don't need a Ph.D. in data science. The real goal isn't to find the most complicated algorithm with a fancy name. It's about finding a model that gives you accurate, actionable predictions for your specific SaaS business.

Think of it like choosing a tool for a job. You wouldn't use a sledgehammer to hang a picture frame. We're going to look at the most common and effective models for predicting churn, starting with the simplest and working our way up.

Start with a Strong Baseline: Logistic Regression

For most SaaS companies, Logistic Regression is the perfect place to start. It's a workhorse statistical model designed for binary classification—which is just a technical way of saying it predicts a simple "yes" or "no" outcome. In our case, that’s "churn" or "no-churn."

Its biggest selling point? It's not a black box. You can actually understand why it makes a certain prediction.

The model takes all your features (like days_since_last_login or failed_payment_count) and crunches the numbers to spit out a probability score between 0 and 1 for every single customer. If a customer gets a score of 0.85, it means they have an 85% probability of churning. This kind of clarity is gold for a customer success team trying to figure out who to call first.

While machine learning has opened up a world of possibilities for churn prediction, Logistic Regression remains a top contender because it's so straightforward. It uses historical data to produce these clear probabilities, which is a big advantage over more complex models that might be slightly more accurate but are impossible to interpret. For a deeper dive, Pecan.ai published a great analysis of the best ML models for churn prediction that's worth a read.

Leveling Up to More Advanced Ensemble Models

Sometimes, churn isn't caused by one or two obvious things. It's driven by subtle, interconnected patterns in user behavior. When Logistic Regression isn't quite cutting it, that's when you bring in the heavy hitters: ensemble models like Random Forest and Gradient Boosting.

Random Forest: Picture a panel of experts all voting on whether a customer will churn. A Random Forest does something similar by building hundreds of individual "decision trees" and then taking a majority vote. This approach is fantastic at spotting complex interactions between features that a simpler model would likely miss.

Gradient Boosting (like XGBoost): This is another powerful ensemble method, but it learns sequentially. It builds one tree, figures out where it went wrong, and then builds the next tree specifically to fix those mistakes. It’s like a student who reviews their quiz, learns from their errors, and aces the next one.

These models are especially useful in SaaS because they can identify nuanced signals. For instance, they can flag a customer who shows a gradual decline in using a key feature, followed by a sudden spike in support tickets—a classic, but complex, sign of impending churn.

The chart below shows a typical output, highlighting which features are most influential in the model's predictions.

As you can see, something like the 'number of products' a customer uses can be a huge predictor, giving your retention team a clear area to focus on.

How to Make the Right Choice

So, which model is right for you? It really boils down to a classic trade-off: accuracy vs. interpretability.

| Model Type | Primary Strength | Best For |

|---|---|---|

| Logistic Regression | Simplicity and Interpretability | Teams that need a clear, straightforward way to prioritize at-risk users. |

| Random Forest | High Accuracy and Stability | Capturing complex, non-linear relationships in user behavior without getting thrown off by noise. |

| Gradient Boosting | Top-Tier Performance | Squeezing out every last bit of predictive accuracy when every percentage point matters. |

A good rule of thumb is to start simple. Kick things off with Logistic Regression. It will give you a solid baseline and actionable scores right out of the gate. If you find it’s missing the mark or you suspect there are deeper patterns at play, then it’s time to experiment with Random Forest or Gradient Boosting.

Ultimately, the goal isn't just to build a model; it's to build one that gets used. For more on turning predictions into action, our complete guide to building a churn prediction model walks through the entire process. The best model is the one your team understands, trusts, and uses to proactively save customers and protect your MRR.

Turning Raw Data Into Powerful Churn Signals

The raw data you pull from Stripe and your product analytics is just a pile of facts; it isn't intelligence. The real magic in predicting churn happens when you transform that raw data into meaningful signals. This process is called feature engineering, and frankly, it's what separates a decent predictive model from a truly great one.

Think of it this way: knowing a customer's last login date is a single data point. It’s useful, but it’s static. A far more powerful signal is a feature you create from it, like days_since_last_login. This simple transformation turns a date into a dynamic metric that clearly shows declining engagement.

This is how you give your model the context it needs to spot trouble on the horizon. I’ve seen time and again that high-quality features have a much bigger impact on prediction accuracy than the choice of machine learning model itself.

From Raw Events to Predictive Features

So, let's get practical. Instead of just dumping a log of every click into your model, you need to create new, more insightful features that tell a story about user behavior and subscription health. This is where your deep knowledge of your own product comes into play.

Here are a few concrete examples I’ve seen work wonders:

- Login Trends: Don't just look at the last login. Create a feature like

7-day_login_trendthat compares logins this week to the previous week. A sharp negative trend is a massive red flag. - Subscription Volatility: A customer who has downgraded, upgraded, then downgraded again in the last six months is showing signs of uncertainty. A simple

subscription_change_countfeature can capture this instability. - Feature Adoption Rate: Instead of just noting which features a user has tried, calculate the percentage of core features they’ve actually adopted. A low adoption rate tells you they aren't getting the full value from your product.

The goal is to move beyond simple counts and timestamps. You want to create features that represent concepts like engagement decay, value perception, and even user frustration. These are the signals that truly precede a cancellation.

Building these kinds of signals is the heart of an accurate model. If you want to go deeper on how these features roll up into an overall account status, our guide on calculating a customer health score is a great next step.

Combining Financial and Usage Signals

The most powerful features almost always come from blending your Stripe data with product usage analytics. This combination gives you a complete, 360-degree view of a customer’s relationship with your business.

For instance, you can combine payment history with activity level. A customer with a recent failed_payment who also has a low_login_frequency is at a much higher risk than someone who had a failed payment but is still highly active in your app. One is a billing hiccup; the other is a sign of disengagement.

Historical data shows just how critical these nuanced calculations are. Back in 2015, Shopify realized its traditional churn formulas were unreliable. By switching to a probability-based model fed by better features, they stabilized their monthly churn estimate at a razor-sharp 0.05%, giving them a precise way to forecast at-risk accounts.

This kind of accuracy is vital for any SaaS team watching their MRR. Consider datasets like Kaggle's Credit Card Customers, where 16.07% of users had already churned—a clear example of the imbalanced reality of retention. You can get more details about how machine learning is used to predict customer churn to see how these methods have evolved.

This flowchart shows a typical thought process for choosing the right model after your features are ready.

As the flow illustrates, the choice of model—from simpler regression to more complex Random Forest or Gradient Boosting methods—depends on the complexity of the signals you've created. By investing your time in smart feature engineering, you empower even the simplest models to deliver powerful, actionable insights into which customers are about to leave.

From Prediction to Action: Revenue Recovery Playbooks

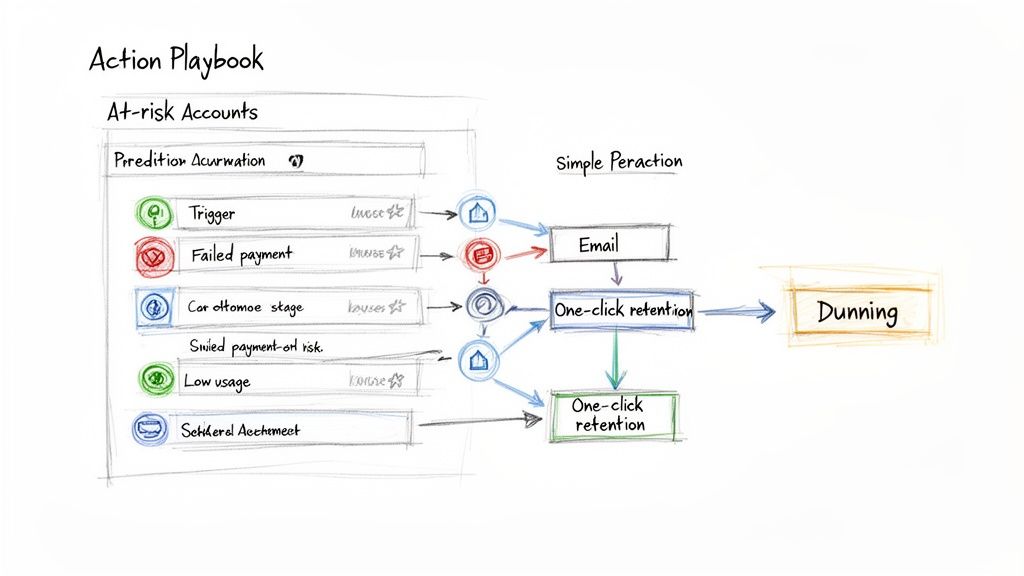

A churn prediction model is a powerful tool, but it doesn't save a single dollar of MRR on its own. The real value unlocks when you bridge the gap between identifying an at-risk customer and launching a swift, effective retention effort.

This is where actionable revenue recovery playbooks come in.

These aren't vague strategies. They are specific, battle-tested sequences of actions your team can deploy the moment an account gets flagged. The goal is to shift from a reactive "Oh no, they canceled" mindset to a proactive, "We saw this coming, and here's the plan" approach. It's about arming your team with a prioritized list of at-risk accounts and the exact steps to win them back.

Segmenting Risks To Personalize Outreach

Not all churn risks are created equal. A customer with a failed payment needs a completely different intervention than one whose product usage is steadily declining. Your first move should be to segment at-risk accounts based on the primary churn signal. This is how you deploy highly relevant, personalized campaigns that actually address the root cause of the problem.

For example, a high-risk score driven by a past_due Stripe status should immediately trigger a smart dunning campaign. This isn't just a generic "update your card" email. A smart campaign might involve a sequence of emails, in-app notifications, and even an SMS reminder to maximize the chance of payment recovery before the subscription is canceled.

On the other hand, a customer flagged for low engagement needs a value-based approach. The playbook here could involve an automated email showcasing a new, relevant feature they haven't tried or a case study highlighting how similar customers find success. The key is always matching the intervention to the specific problem.

Building Your Core Retention Playbooks

To make this process fast and scalable, you need a set of pre-defined playbooks that can be launched with a single click from a dashboard. Speed is your ally here; the faster you can act on a churn signal, the higher your odds of success.

Here are a few essential playbooks every SaaS team should have ready to go.

The "Smart Dunning" Playbook For Failed Payments

This is your first line of defense against involuntary churn, which can account for 20-40% of all churn.

- Trigger: Stripe subscription status becomes

past_dueorunpaid. - Action 1: Immediately send an email with a direct link to the billing update page.

- Action 2: Display a prominent but non-intrusive in-app banner for active users.

- Action 3: After 3 days, send a follow-up email with a slightly different subject line.

- Goal: Recover the payment and prevent subscription cancellation with minimal customer friction.

The "Re-engagement" Playbook For Declining Usage

This is for the "quiet quitters"—customers who are slowly drifting away.

- Trigger: A customer's health score drops due to low login frequency or poor feature adoption.

- Action 1: Trigger an automated email from a "Customer Success Manager" highlighting a specific, underutilized feature relevant to their use case.

- Action 2: If engagement doesn't improve in 7 days, add them to a segment for a live webinar on "advanced tips and tricks."

- Goal: Remind the customer of the value your product delivers and guide them back to a "sticky" workflow.

A well-executed playbook does more than just prevent a single cancellation. It actively rebuilds the customer's relationship with your product by demonstrating that you understand their needs and are invested in their success.

The "Proactive Support" Playbook For Frustration Signals

This playbook targets users showing signs of frustration, like frequent support tickets or repeat errors.

- Trigger: A spike in support tickets or negative survey feedback.

- Action 1: A real person from your support or success team sends a personalized email: "I noticed you were having some trouble with X. Can I help?"

- Action 2: Offer a short, 15-minute one-on-one call to walk them through their issue.

- Goal: Intercept a negative experience and turn it into a positive, loyalty-building interaction before it leads to churn.

The following table outlines how you can map different churn signals to specific, actionable playbooks. Think of it as a starting point for building out your own retention engine.

Actionable Retention Playbooks for At-Risk Segments

| Churn Risk Signal | Primary Playbook Action | Secondary Action | Goal |

|---|---|---|---|

| Failed Payment | Trigger smart dunning email sequence | In-app notification with "update billing" link | Recover MRR from involuntary churn |

| Low Login/Usage | Send value-driven email with feature spotlight | Invite to an educational webinar or office hours | Drive re-engagement, remind of value |

| Price Sensitivity | Offer a short-term discount (e.g., 3 months) | Offer a plan downgrade as an alternative | Prevent churn by addressing budget concerns |

| Spike in Support Tickets | Proactive, personalized email from CSM | Offer a 1:1 "health check" call | Resolve frustration, build loyalty |

| Competitor Mention | CSM outreach to understand their needs | Share a competitive battlecard/case study | Reaffirm your unique value proposition |

By having these playbooks documented and ready to deploy, you ensure that every churn prediction is met with a swift, appropriate response, turning your data from a passive report into an active growth driver.

For more in-depth guidance on this, exploring proactive churn marketing strategies can provide a great framework. These systems help you build a machine where every prediction automatically kicks off a tailored, revenue-saving campaign, turning your model into a true growth engine.

Answering Your Top Churn Prediction Questions

When I talk to founders about building a churn prediction system, the same handful of questions always come up. It's totally understandable—you're thinking about data, accuracy, and whether the whole effort will even be worth it.

Let's break down the most common concerns I hear from SaaS leaders who are just getting started.

The first and most important question is always about data privacy and security. Letting any third-party system access your customer data is a big step, and it should be handled with extreme care.

A properly built churn prediction platform never needs access to Personally Identifiable Information (PII) or raw financial data. The connection should be read-only, pulling only the necessary subscription metadata from a platform like Stripe—things like plan status or trial end dates—along with anonymized product usage events.

The core principle here is simple: a churn model needs to know that a subscription became

past_due, not who the customer is or how much they pay. This privacy-first approach gives you the predictive power you need without ever compromising your customers' trust.

What's a Realistic Accuracy Rate?

Next, everyone wants to know how accurate these models actually are. It's tempting to chase perfection, but aiming for 100% accuracy is a fool's errand. In the real world, a great churn prediction model for a SaaS company will land somewhere in the 80-90% accuracy range.

And honestly, that's more than enough to be incredibly effective. It gives your team a reliable, prioritized list of at-risk accounts, so they can focus their energy where it will make the biggest difference. Trying to squeeze out that last few percentage points usually just creates a "black box" model that's too complex to be useful.

When we talk about accuracy, we're really balancing two key metrics:

- Precision: Of all the customers your model flags as "at-risk," what percentage actually churns? This tells you if your team is chasing down false alarms.

- Recall: Of all the customers who actually churned, what percentage did your model catch? This shows you how many at-risk users you successfully identified ahead of time.

A good system finds the sweet spot between the two.

How Fast Can I Expect to See an ROI?

Finally, the big question: what's the payback? The great news is that the ROI on churn prediction is usually fast and easy to measure. Once your system is up and running, you can start acting on the insights right away.

For most SaaS companies, saving just one or two high-value accounts flagged by the model can easily cover the cost of the system for an entire year. The real value, though, builds over time as you dial in your retention playbooks. This leads to a steady, measurable drop in your churn rate and a much healthier business.

Stop letting revenue slip through the cracks. LowChurn uses AI to analyze your Stripe and product data, predicting which customers will churn and giving you the tools to win them back. Get your early-warning system today.