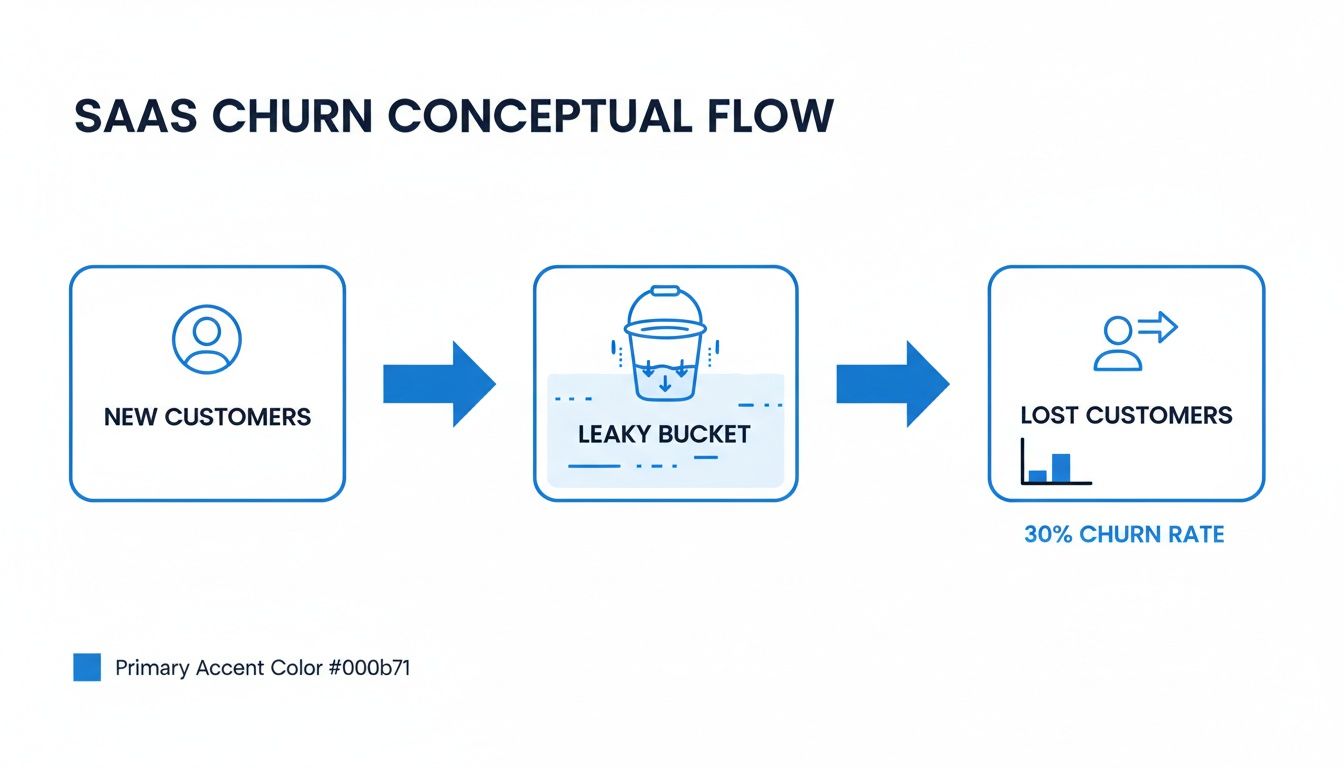

Think of your SaaS business like a bucket you're desperately trying to fill with water. Every new customer you sign is another cup of water poured in. But what if that bucket has a hole? That leak, that constant drip-drip-drip, is your SaaS churn rate.

It’s the percentage of customers who cancel their subscriptions within a certain timeframe, and it's the silent killer of growth. You're working twice as hard on sales and marketing just to keep the water level from dropping, let alone filling the bucket.

Why Your SaaS Churn Rate Is the Silent Killer of Growth

That leaky bucket isn't just a metaphor—it's a perfect picture of how churn quietly sabotages your business. A small leak might not seem like a big deal at first. What's a 1% monthly churn, really?

The problem is, it compounds. That tiny 1% leak every month means you've lost over 11% of your entire customer base by the end of the year. It's a relentless drag on your progress, systematically undermining every dollar you spend on acquisition and making sustainable growth feel like you’re running up a down escalator.

The Leaky Bucket Effect on Your Bottom Line

Churn hits your finances hard, and not just in the ways you’d expect. When a customer leaves, you don't just lose their next subscription payment. You lose their entire future lifetime value, all potential expansion revenue from upsells, and any word-of-mouth referrals they might have sent your way.

This forces you into a hamster wheel of acquiring new customers simply to replace the ones who walked away—a far more expensive and inefficient way to grow.

The financial impact is staggering. Even tiny improvements in churn create huge wins for your unit economics and company valuation. Dropping your annual churn by just one percentage point can dramatically boost your customer lifetime value (LTV). Some studies have even shown that cutting churn by 5 percentage points can increase profits by as much as 95% in certain enterprise models, simply because loyal customers tend to expand their accounts over time. You can see just how tied together these numbers are by exploring other essential B2B SaaS metrics.

A high churn rate is a clear warning sign: you're losing customers faster than you can replace them. For any subscription business, that's the definition of unsustainable. Getting this metric under control isn't optional; it's essential for survival.

Why Every Percentage Point Matters

At its core, your churn rate is a report card on how much value your product delivers and the strength of your customer relationships. A low churn rate is proof of a sticky product and happy, loyal customers. A high rate, on the other hand, is a red flag pointing to deeper problems that demand your attention.

By making churn reduction a priority, you're not just plugging a hole. You're forcing yourself to get better at the things that truly matter:

- Nailing your product-market fit

- Creating a genuinely great customer experience

- Building a revenue engine that can actually last

Managing your SaaS churn rate isn't just about stopping a leak; it's about fundamentally building a stronger, more resilient business from the ground up.

How to Accurately Calculate Your Churn Rate

Figuring out your churn rate is more than just a math problem—it’s about listening to the financial signals your customers are sending. Think of it like a pilot in a cockpit. One gauge shows your altitude (revenue), while another shows your engine temperature (customer satisfaction). You need to watch all the dials to understand the health of the flight.

The same goes for your business. A single, top-level churn number doesn't tell the whole story. To truly get a handle on customer retention, you need to look at it from a few different angles.

At its core, churn is often visualized as a "leaky bucket." You're always pouring new customers in the top, but some are inevitably dripping out the bottom.

This simple model makes it clear: if the leaks are bigger than what you're pouring in, you've got a serious problem. That's why measuring the leaks accurately is the first step.

Distinguishing Logo Churn From MRR Churn

The first and most fundamental split in churn calculation is whether you're counting customers or counting dollars. This is the difference between Logo Churn and MRR Churn.

Logo Churn (often called customer churn) is the most straightforward measurement. It’s simply the percentage of customers you lost in a given period. It's a headcount.

The formula is pretty simple:

(Customers Lost in Period / Total Customers at Start of Period) x 100

MRR Churn (or revenue churn), on the other hand, measures the percentage of monthly recurring revenue you lost from those same cancellations.

The formula looks similar but focuses on money, not people:

(MRR Lost from Churned Customers / Total MRR at Start of Period) x 100

So, why does this matter? Imagine you lose ten small startups paying $50/month and one big enterprise client paying $5,000/month. In terms of Logo Churn, you lost 11 customers. Annoying, but maybe not alarming. But in terms of MRR Churn, that single enterprise account completely changes the story, revealing a massive financial hit. You need both numbers to see the full picture.

Gross MRR Churn vs. Net MRR Churn

To get even sharper insights, you need to break down revenue churn further into gross and net. This is where you can start to see the hidden power of a healthy, growing customer base.

Gross MRR Churn: This is the raw, unfiltered total of recurring revenue you lost from cancellations and downgrades. It’s a pure measure of revenue leakage, with no silver lining.

Net MRR Churn: This metric starts with that same lost MRR but then subtracts any expansion MRR you gained from your existing customers—think upgrades, add-ons, or new seats.

This is a critical distinction. Net MRR Churn tells you about the net effect on your revenue from your existing customer base. For a deep dive into the math, our complete guide on churn rate calculation methods breaks it all down.

The SaaS Holy Grail: Net Negative Churn This is the goal. You hit Net Negative Churn when the revenue you gain from existing customers (expansion MRR) is greater than the revenue you lose from customers churning or downgrading. Your current customers are spending so much more with you that it completely offsets your losses. It means your business would grow even if you didn't land a single new customer this month.

Comparing Key Churn Calculation Methods

To put it all together, let’s quickly compare these four essential churn metrics. Each one provides a different lens through which to view your business performance.

| Churn Type | What It Measures | Best For Understanding | Example Scenario |

|---|---|---|---|

| Logo Churn | The percentage of customers who cancel. | The overall satisfaction and stickiness of your product. | "We lost 5% of our customers last month." |

| Gross MRR Churn | The total revenue lost from cancellations and downgrades. | The direct financial impact of customer departures. | "We lost $10,000 in MRR from cancellations." |

| Net MRR Churn | Revenue lost from churn minus revenue gained from upgrades. | The true momentum of your existing customer base. | "We lost $10k but gained $8k in upgrades, so our net churn was only $2k." |

| Net Negative Churn | When expansion MRR is greater than churned MRR. | How well you're growing revenue within your customer base. | "We lost $10k in churn but gained $15k in expansion, achieving -5% net churn." |

By tracking these different types of churn, you can move from a vague feeling of "we're losing customers" to a precise, data-backed diagnosis. And that clarity is the foundation for building a retention strategy that actually works.

What Is a Good SaaS Churn Rate?

So you’ve calculated your churn rate. The next question that always pops into your head is, "Is this number good or bad?"

If you're looking for a simple, one-size-fits-all answer, you won't find one. The truth is, a "good" SaaS churn rate depends entirely on your business: how old you are, how big you are, and who you're selling to.

Think of it this way: comparing an early-stage startup to a behemoth like Salesforce is like comparing a speedboat to an ocean liner. They're both in the water, but their size, speed, and how they handle the waves are worlds apart. What’s considered a good churn rate for one would be an absolute disaster for the other.

Benchmarks Evolve as Your Company Grows

The biggest factor in defining a "good" churn rate is your company's size, which we usually measure in Annual Recurring Revenue (ARR). The difference in expectations for a company under $10M ARR versus one that's sailed past that mark is massive.

Younger, smaller companies are still figuring things out. They're dialing in their product-market fit, experimenting with onboarding, and often serving smaller customers who are, frankly, more likely to churn. It's just the nature of the beast.

Once a company gets bigger, things change. They have brand recognition, lock customers into longer contracts, and have entire teams dedicated to customer success. As you'd expect, their churn is much lower.

This isn't just a gut feeling; the data backs it up. Industry studies consistently show that companies with less than $10M ARR have a median annual churn rate hovering around 20%. For businesses over that $10M ARR threshold, that number drops to a much healthier 8.5%.

Your Target Market Changes Everything

Who you sell to is just as important as how big you are. Your churn rate will—and should—look completely different if you're selling to small businesses versus massive enterprises.

Selling to SMBs: These customers are a different breed. They're usually on month-to-month plans with smaller budgets. They might go out of business, change their strategy on a dime, or jump to a competitor for a better deal. It's a faster-moving world, so a monthly logo churn of 3-7% is often considered pretty standard.

Selling to Enterprises: These are the big fish. They sign annual or multi-year contracts, face huge costs if they want to switch, and weave your product deep into their daily operations. Because they're so locked in, their churn should be incredibly low. For enterprise SaaS, anything under 5% annual churn is considered healthy.

In short, a “good” churn rate is a moving target. It’s not about hitting some universal magic number. It’s about understanding what’s realistic for your specific business and then crushing the average for companies just like yours.

Finding a Realistic Churn Target for Your Business

Okay, so what number should you actually aim for?

Forget about chasing some arbitrary benchmark you read on a blog. Start with context. Figure out where you fit. Are you a seed-stage startup selling to other startups? A mid-market player focused on established companies?

Once you know who you are, you can set a goal that actually makes sense. If you're an early-stage company, a 5% monthly churn might be a realistic, if painful, starting point. Your goal is to systematically chip away at that number. But if you're an established enterprise player, a 1-2% monthly churn should set off alarm bells.

The table below breaks down median churn rates based on company size and customer focus, giving you a much clearer picture of what "good" looks like in your neighborhood.

Annual Churn Rate Benchmarks by Company ARR

| Company Size (ARR) | Target Market | Median Annual Churn Rate |

|---|---|---|

| < $10M | SMB / Mid-Market | 14% |

| < $10M | Enterprise | 10% |

| > $10M | SMB / Mid-Market | 15% |

| > $10M | Enterprise | 6% |

As you can see, the expectations vary widely. To get an even more granular breakdown and find the right comparison for your business, check out our complete guide on SaaS churn rate benchmarks.

Ultimately, a good SaaS churn rate is whatever number allows your business to grow sustainably. It’s the rate that ensures you’re not just pouring new customers into a leaky bucket, but actually raising the water level, month after month.

Uncovering the Root Causes of Customer Churn

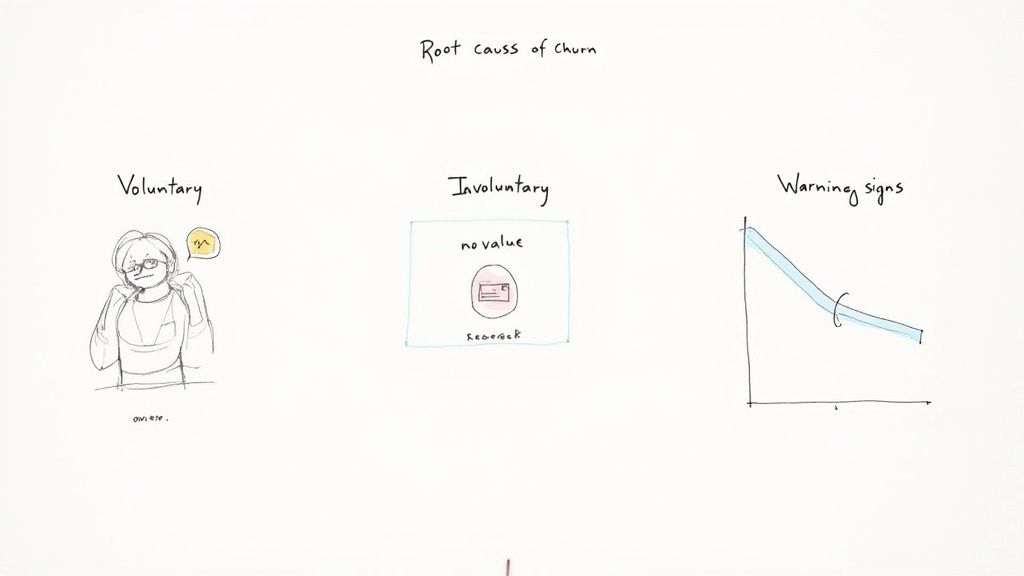

Calculating your SaaS churn rate is like checking your business's vital signs—it tells you what is happening. But to actually improve your company's health, you have to play detective and figure out why it's happening. Customer churn isn't a single problem; it's a symptom with a few key root causes, which usually fall into two buckets: voluntary and involuntary.

Getting a handle on this distinction is the first real step toward building a retention strategy that works. You can't fix a leaky bucket until you know where the holes are.

When Customers Choose to Leave

Voluntary churn is what happens when a customer actively decides to hit the "cancel" button. This is the type of churn that keeps founders up at night because it almost always points to a problem with the product or the customer experience.

A few common culprits are usually behind most voluntary cancellations.

- A Confusing Onboarding Process: Those first few days with your product are everything. If users feel lost, overwhelmed, or can't figure out how to get the value you promised, they'll check out before you ever had a real chance.

- Poor Product-Market Fit: Sometimes, you've simply attracted the wrong person. They might sign up thinking your tool does one thing when it does another, or they find it just doesn't solve their specific problem. This mismatch is a classic driver of early-stage churn.

- Failure to Demonstrate Ongoing Value: That "aha!" moment can't be a one-time thing. Customers need to keep seeing the benefit of using your product. If they feel like they’ve gotten all they can out of it or have outgrown your solution, they’ll start shopping around.

- Subpar Customer Service: When someone runs into a problem, their experience with your support team can make or break the entire relationship. Slow responses, unresolved issues, or a simple lack of empathy can sour even the most loyal customers.

The Churn You Can Actually Prevent

While voluntary churn gets all the attention, involuntary churn is the silent revenue killer. This is when a customer's subscription gets canceled because of a payment failure, not because they actually wanted to leave.

Think of it as accidental churn. It’s caused by simple operational hiccups—an expired credit card, an old billing address, or a temporary freeze from their bank. The customer often has no idea it even happened until they're locked out of their account.

Involuntary churn represents one of the biggest opportunities for quick revenue recovery. These are customers who want to stay with you but are being pushed away by correctable billing issues. Fixing these operational leaks is often the lowest-hanging fruit in churn reduction.

Analysts often separate these two types to figure out where to focus their retention efforts. One report, for instance, broke down a 3.5% average monthly churn into roughly 2.6% voluntary and 0.8% involuntary. That split shows just how much revenue is on the table if you can just tighten up your payment collection and dunning processes. You can discover more insights about how churn analysis shapes retention strategy on revenera.com.

Spotting the Early Warning Signs

The best way to fight churn is to get ahead of it. Instead of waiting for the cancellation email to land in your inbox, you need to learn how to spot the leading indicators that a customer is at risk. These are the subtle shifts in behavior that tell you someone is disengaging and might be heading for the door.

Identifying these warning signs lets you move from a reactive to a proactive retention mindset. Key indicators to keep an eye on include:

- Declining Product Usage: A sudden drop in how often someone logs in or uses key features is one of the strongest predictors of churn.

- Changes in Support Tickets: An uptick in frustrated support tickets—or even worse, radio silence from a previously active account—can signal trouble.

- Ignoring Key Features: If a customer isn't using the "sticky" features that deliver the most value, their risk of churning is way higher.

By tracking these signals, you can step in with targeted outreach, offer some extra training, or have a customer success manager check in before the customer decides to leave. That's how you turn a potential loss into a retention win.

Proven Strategies and Playbooks to Reduce Churn

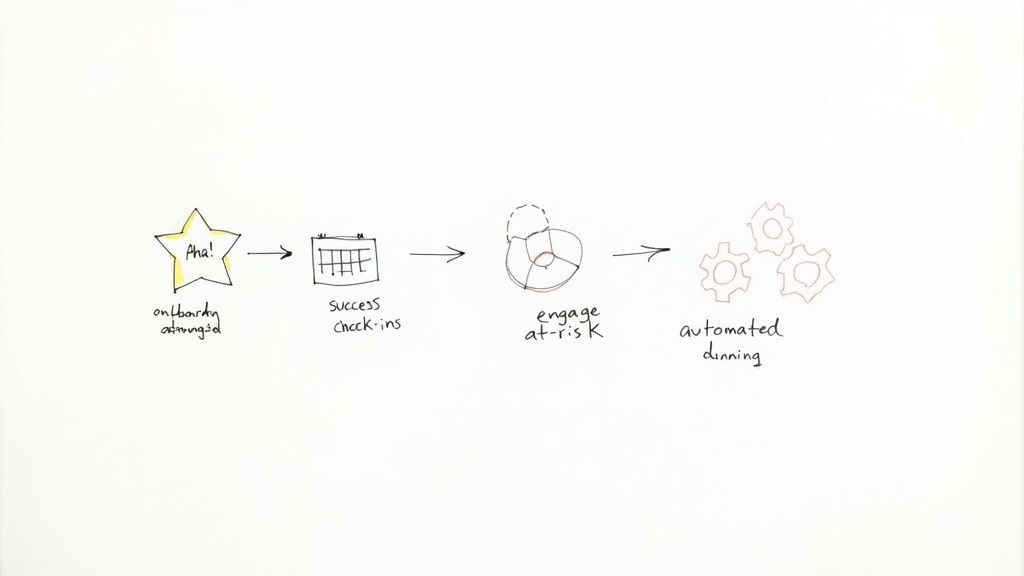

Knowing why customers churn is one thing. Actually stopping them is another game entirely. To really cut down your SaaS churn rate, you need a tactical playbook with strategies for every stage of the customer journey. This isn't about one grand gesture; it's about a series of consistent, proactive efforts to show value and build real relationships.

This means rolling out the red carpet for new users, constantly checking in with existing customers, and having a plan ready the moment someone looks like they might be slipping away. It also means plugging the stupidly simple leaks that cause involuntary churn.

Master the First Impression with Flawless Onboarding

Those first 90 days? They're everything. A clunky, confusing, or hands-off onboarding experience is one of the fastest ways to lose a customer before they've even started. Your one and only goal here is to get users to their first "aha!" moment—that flash of insight where they get your product's value—as fast as humanly possible.

A rock-solid onboarding playbook needs to include:

- A Welcome Sequence: Don’t just send a receipt. Kick off an automated email or in-app message series that welcomes them, reinforces why they made a great choice, and shows them what to do next.

- Guided Product Tours: Use interactive walkthroughs and checklists to steer new users through the critical first steps. You want them to do something valuable, not just look at a bunch of features.

- Proactive Help: Offer help before they even have to ask. If a user is lingering on a page, trigger a popup with a link to a quick tutorial or a live chat prompt.

This initial phase sets the tone for the entire relationship. Nail it, and customers feel successful and invested from day one.

Proactively Engage and Retain Existing Customers

Okay, so they're onboarded. Great. Now the real work begins. Retention isn't passive; you have to consistently prove your product is an essential part of their day-to-day.

The most important thing for every SaaS company is to retain existing customers while also onboarding new ones. If your typical customer does not stick around long enough for you to earn back what you spent to acquire them, then you're in trouble.

To keep customers engaged for the long haul, you have to get in the trenches with them:

- Conduct Proactive Success Check-ins: Don't wait for the support ticket. Have your customer success team schedule regular calls to talk about their goals, share best practices, and find new ways for them to get more from your tool.

- Gather and Act on Feedback: Use surveys, in-app feedback forms, and simple conversations to keep a finger on the pulse. The magic trick? Actually closing the loop. Let them know you heard them and show them what you’re building based on their ideas.

- Build a Strong Community: Create a hub—a Slack channel, a forum, a user group—where customers can talk to each other and your team. A thriving community builds incredible loyalty and turns users into your biggest fans.

These strategies shift your role from a software vendor to a true partner who's genuinely invested in their success.

Slash Involuntary Churn with Smart Automation

Involuntary churn is often the lowest-hanging fruit in the fight to lower your SaaS churn rate. These are customers who want to stay but are leaving because a payment failed. It sounds minor, but research shows this preventable churn can account for a staggering 20-40% of your total churn.

Thankfully, this is a problem technology is fantastic at solving. A solid dunning management system isn't a nice-to-have; it's essential.

Here’s a simple but incredibly effective playbook:

- Automated Payment Retries: Never give up after one failed payment. Set up a "smart retry" schedule that hits the card at different times over a couple of weeks. You'd be surprised how often it's just a temporary bank issue.

- Pre-Dunning Notifications: Automatically email customers whose credit cards are about to expire. A quick heads-up can prevent the failure from ever happening.

- Clear Card Update Journeys: When a payment does fail, the follow-up email needs to be crystal clear. Include a direct, one-click link to a secure page where they can update their info without any hassle.

By automating these simple processes, you can recover a ton of MRR that would have otherwise vanished, giving your bottom line a nice boost with very little effort.

Using AI and Modern Tooling to Predict and Prevent Churn

Let's be honest: trying to manually track customer behavior to guess who might churn is a losing battle. As your business grows, keeping an eye on every single login, feature click, and support ticket becomes completely unmanageable. This is where technology completely changes the game, shifting churn reduction from a reactive fire-drill into a proactive, data-driven strategy.

Instead of just waiting for that dreaded cancellation email to land in your inbox, AI and machine learning models can analyze thousands of user data points in real time. They're designed to spot the subtle, almost invisible patterns that signal a customer is drifting away—long before a human ever could. This gives you a crucial head start.

Predictive Modeling and Churn Risk Scores

The heart of this modern approach is predictive churn modeling. Think of it as an AI system that constantly sifts through behavioral data—like how often a user logs in, which features they’ve actually adopted, and their recent support history—to build a health profile for each account.

Based on these patterns, the model assigns a dynamic churn risk score to every single customer. This isn't just a one-time grade; it's a live indicator of customer health. It automatically flags accounts that are showing early warning signs, which allows your team to focus their precious time and energy where it will have the biggest impact. For a deeper dive into the mechanics, our guide on customer churn prediction explains exactly how these models are built.

By assigning a risk score to each account, you replace guesswork with a prioritized action list. Your customer success team knows exactly who to contact today, turning a vague retention goal into a clear, actionable playbook.

Integrating Practical Tools Like Stripe

This predictive intelligence becomes even more powerful when you connect it with the practical tools you already use every day. For any SaaS business running on Stripe, a surprising amount of churn is purely operational. This is the real low-hanging fruit of churn reduction, often caused by simple, preventable payment failures.

Stripe’s built-in billing and recovery tools are your first line of defense against this accidental, or involuntary churn.

Here’s a glimpse of the kind of recovery dashboard you can find within modern payment platforms.

This dashboard illustrates how features like smart dunning sequences and automated credit card updaters can actively recover failed payments, directly saving revenue that would otherwise have just disappeared.

By automating these simple processes, you immediately plug some of the most obvious leaks in your revenue bucket.

But the real magic happens when you combine these two worlds. Subscription and payment data from Stripe can be fed directly into an AI model, creating a powerful feedback loop:

- Stripe handles involuntary churn: Its automated dunning and card updaters minimize cancellations caused by failed payments.

- AI predicts voluntary churn: It analyzes user behavior and payment history to flag customers who are actively disengaging and considering leaving.

Together, these technologies create a comprehensive system that tackles both accidental and intentional churn. You can automatically save customers who want to stay while getting an early warning about those who are on the fence, giving you the best possible chance to step in and protect your bottom line.

A Few Lingering Questions About SaaS Churn

Even with a solid grasp of the basics, a few specific questions always seem to pop up when teams start getting serious about their churn rate. Let's tackle some of the most common ones that can trip people up.

Think of this as a quick-reference guide for those tricky, real-world scenarios.

How Should I Handle Churn in a Freemium Model?

This is a classic. It's tempting to lump everyone together, but for a freemium model, you should only track churn on your paid customers.

Free users are technically part of your acquisition funnel, not your revenue base. The key metric for them is the free-to-paid conversion rate. Churn, on the other hand, is purely about the erosion of your paying customer base and the revenue they represent. Keep those two metrics separate but give them both serious attention.

Should I Calculate Churn Monthly or Annually?

The best answer is both, but for different reasons. You should calculate churn monthly but report on it annually.

Tracking it monthly gives your team a real-time pulse on what's happening. It’s your early warning system, letting you see the immediate impact of a new feature, a price change, or a competitor's new campaign.

But for strategic planning and talking with investors, the annualized number tells the real story. It smooths out the monthly bumps and shows the powerful, compounding effect churn has on your business over a full year.

Don't let a "low" monthly churn number fool you. A 2% monthly churn rate feels small, but it means you're losing nearly a quarter (21.5%) of your customers over the course of a year. Always understand the annual impact.

What Is the First Step for a New Startup?

If you're just getting off the ground, don't get buried in complex spreadsheets. Your absolute first step is to track one thing consistently: monthly logo churn.

Simply ask, "How many paying customers did we lose this month compared to how many we started with?" This number is your canary in the coal mine. It's the purest signal you have on whether your product is delivering value and if you're achieving product-market fit. You can worry about MRR churn and segmentation once you've nailed this.

Ready to stop guessing who will churn and start saving them? LowChurn uses AI to predict at-risk customers with over 85% accuracy, giving you the early warning you need to act. Connect your Stripe account in one click and see your churn risks today.