Let's be honest, payment failures happen. A credit card expires, a bank flags a transaction, or funds are temporarily low. The dunning process is simply the systematic way a business communicates with a customer to resolve these failed payments and keep their subscription active.

Think of it less like a collections agency and more like a helpful, automated customer service agent. It's your safety net for recurring revenue.

Understanding the Dunning Process in SaaS

We've all been there. You get a polite email from a service like Netflix or Spotify saying, "Oops, we couldn't process your payment." They don't immediately lock you out of your account; instead, they give you a gentle nudge and a simple way to fix the problem. That's dunning in its most common form.

For any subscription business, especially in SaaS, this isn't just a nice-to-have feature—it's absolutely critical. It's your primary weapon against involuntary churn, which is one of the most frustrating ways to lose customers. This isn't someone actively deciding to cancel; it's a customer you lose by accident because of a simple, fixable payment glitch.

The Real Cost of Failed Payments

Don't underestimate the damage a single failed payment can cause. When left unaddressed, these small hiccups can snowball into a massive problem. In fact, for many SaaS companies, failed payments can be responsible for up to 50% of their total churn. That's a huge, preventable revenue leak.

A well-structured dunning process isn't about chasing debt. It's about providing a seamless customer experience that prevents a minor payment issue from ending a valuable customer relationship.

To give you a better sense of how this works in practice, let's break down the essential components.

Core Components of a Dunning Process

A good dunning system isn't just one email; it's a series of carefully timed actions designed to recover the payment without annoying the customer. Here’s a quick look at the typical stages.

| Stage | Primary Goal | Common Action |

|---|---|---|

| Initial Failure | Immediate recovery | Retry the payment automatically within 24 hours. |

| Pre-Dunning | Proactive prevention | Send a heads-up email about an expiring card. |

| Dunning | Customer notification | Send a sequence of emails and SMS alerts. |

| Grace Period | Retain customer access | Keep the subscription active for a set period. |

| Final Action | Minimize loss | Cancel the subscription or move it to a free plan. |

Each stage plays a specific role, guiding the customer toward updating their details and keeping them on board.

Recovering Revenue and Retaining Customers

Ultimately, the goal is twofold: get paid and keep the customer. A thoughtful dunning strategy automates this perfectly, using a series of emails, in-app notifications, and even SMS messages to gently guide customers toward a resolution.

This proactive approach makes a real, measurable difference. We've seen from analyzing millions of transactions that a smart dunning strategy can recover one out of every four failed payments. That means you can reclaim up to 25% of revenue that would have otherwise been lost for good. You can find more data on dunning effectiveness from sources like Chargebee. It’s a direct boost to your bottom line, all while preserving the customer relationships you worked so hard to build.

How an Automated Dunning Sequence Unfolds

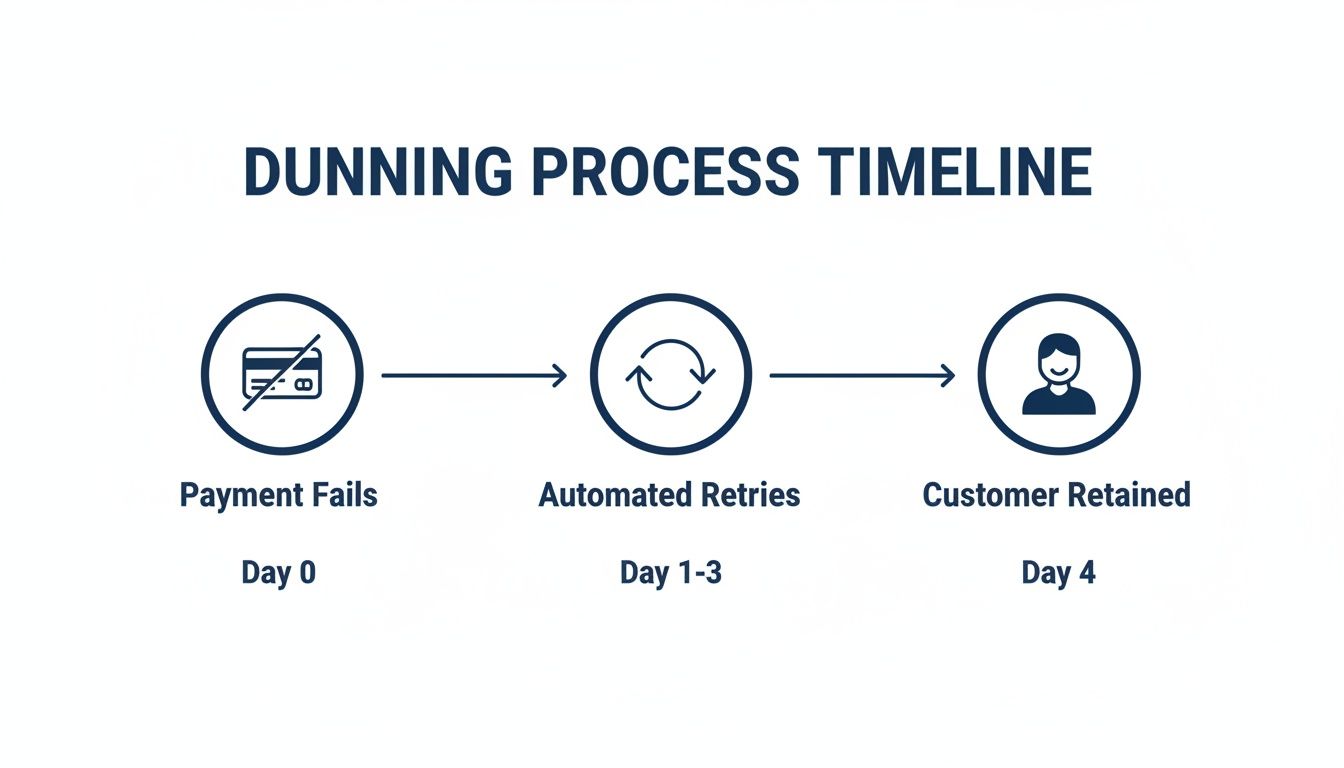

So, what does dunning actually look like in practice? Let’s walk through the life of a single failed payment. Think of it as a carefully choreographed sequence of events, all automated, designed to bring a customer back into the fold without any heavy lifting on your end.

The whole thing starts the instant a payment fails. We'll call this Day 0. Instead of sounding the alarms and locking the customer out, a smart dunning system quietly gets to work.

Day 0-3: The Gentle Nudge

The first move isn't even to contact the customer. It's an intelligent, automated retry. Payment processors like Stripe have gotten really good at this, using their own data to figure out the best time to try the card again. Sometimes it’s a temporary network glitch or a card that’s just over its limit for a few hours.

If that first clever retry doesn't work, then the first email goes out. This message is key. The tone should be light and helpful—more "oops, something went wrong" than "where's our money?" The goal is to let them know there's a problem and give them an incredibly simple way to fix it, usually with a single click to update their card info.

A seamless link to a self-service portal is non-negotiable here. Make it easy, and a surprising number of customers will sort it out themselves right away. If you want to dive deeper, we have a whole guide on building a great customer self-service portal.

Day 4-10: Ramping Up the Reminders

Okay, so the first few attempts didn't stick. Now the system starts to apply a bit more pressure, but still in a helpful way.

- Email 2 (Day 4): A friendly follow-up that gently reminds them of the value they're about to lose.

- In-App Notification (Day 7): Now, when they log in, they might see a small, non-annoying banner reminding them to update their billing info.

- Email 3 (Day 10): This one is more direct. It clearly states the date their service will be suspended, which creates a real sense of urgency.

Using multiple channels like this—email and in-app messages—is a smart way to make sure your message gets seen. It’s also worth seeing how others approach this; there are some great examples of how companies use automated payment reminders to improve cash flow.

This timeline gives you a good visual of how the whole process plays out.

As you can see, it's a structured journey from a failed payment back to a happy, paying customer.

Day 11+: The Final Step

If you've sent multiple emails and in-app nudges and there's still no response, it’s time for the final automated step. This is typically when the subscription is officially canceled or maybe downgraded to a free tier.

But even this isn't necessarily the end of the road. A final "goodbye for now" email that confirms the cancellation but also includes an easy one-click reactivation link can sometimes bring a customer back weeks or even months later. This whole sequence takes what could be a messy, manual collections process and turns it into a smooth, automated system for keeping the customers you worked so hard to win.

How to Know If Your Dunning Strategy is Actually Working

Setting up an automated dunning sequence is one thing, but knowing if it's actually saving you money is another. How can you tell if your efforts are paying off?

The answer is in the data. Without tracking the right metrics, you’re just guessing. You need to know which emails get opened, how much revenue you’re actually recovering, and where customers are falling through the cracks. Let's break down the key performance indicators (KPIs) that tell you the real story.

Core Dunning Performance Metrics

To get a clear picture of your dunning health, you need to focus on a few key numbers that tie directly to revenue and retention. Think of these as your command center dashboard.

Recovery Rate: This is the big one. It’s the percentage of failed payments you successfully collect after your dunning process kicks in. A low number here is a major red flag, pointing to problems with your messaging, timing, or the payment update experience itself.

Involuntary Churn Reduction: How much Monthly Recurring Revenue (MRR) are you actually saving? This metric puts a dollar amount on your efforts. By specifically tracking churn caused by payment failures, you see the direct financial impact of a solid dunning strategy.

Message Engagement: Are people even opening your emails or clicking the links? Low open or click-through rates mean your subject lines are falling flat or your call-to-action is confusing. This is an early warning sign that your recovery rate is about to suffer.

Watching these KPIs helps you diagnose problems before they get out of hand. For example, if your engagement is high but your recovery rate is low, the issue might be a clunky or broken payment update page. These metrics, when viewed together, are also crucial inputs for a broader view of a customer's overall satisfaction, which is often tracked using a customer health score.

To get a comprehensive view, it's best to track these KPIs in a structured way. Here are the essential metrics every SaaS business should monitor.

Essential Dunning Performance Metrics

| Metric | What It Measures | Industry Benchmark (Target) |

|---|---|---|

| Recovery Rate | The percentage of failed payments successfully collected. | 20% - 40% |

| MRR Saved | The total monthly recurring revenue protected from involuntary churn. | Varies by company size |

| Involuntary Churn | The percentage of customers lost due to payment failure. | Reduce by 15% - 25% |

| Message Open Rate | The percentage of dunning emails that are opened by customers. | 25% - 35% |

| Click-Through Rate | The percentage of recipients who click the payment update link. | 3% - 5% |

These benchmarks give you a target to aim for. If your numbers are falling short, it's a clear signal that it's time to refine your approach.

Benchmarking Your Dunning Success

Knowing your own numbers is a great start, but context is everything. How do you measure up against other companies? This is where benchmarks are so valuable—they help you set realistic goals and spot opportunities to improve.

A good dunning process has a massive impact. Industry averages for recovery rates typically fall between 20-40%, while a solid message engagement rate is around 25-35%. Companies that really dial in their strategy often see involuntary churn drop by 15-25%.

Some of the best-run SaaS teams even recover over 50% of failed payments on the very first retry attempt.

By consistently tracking these metrics, you turn dunning from a simple collections chore into a powerful revenue retention engine. You get the insights needed to make smart decisions that directly protect your bottom line.

How to Write Dunning Messages That Actually Work

The way you talk to your customers during the dunning process is a make-or-break moment. A poorly worded email can come off as accusatory, making a customer feel defensive and more likely to churn. But a helpful, empathetic message? That can actually make them feel valued and strengthen the relationship.

Remember, the goal isn't just to collect a payment. It's to keep a happy customer.

To do that, your communication needs to nail three things: a helpful tone, a dead-simple call-to-action, and a touch of personalization. Think of yourself less like a bill collector and more like a helpful guide pointing them back on the right path.

Master the Tone and Timing

Your tone sets the stage for the entire conversation. The very first message should always come from a place of understanding, assuming the payment failure was a simple accident. Use friendly, gentle language that doesn't place any blame.

As the dunning sequence continues, you can gradually shift to be more direct to create a sense of urgency. But it should never, ever become aggressive.

Timing is just as important. A payment reminder at 2 AM feels weird and intrusive, while a message sent mid-morning fits naturally into most people's work routines. And be respectful with frequency—blasting someone with daily emails is a great way to get marked as spam, not to get your invoice paid.

Make It Incredibly Easy for Them to Pay

This is probably the single most important part of any dunning message: give them a clear, one-click way to fix the problem. If a customer has to go searching for your website, try to remember their password, reset it, and then navigate through four different account screens, you've already lost. They'll just give up.

Every dunning message needs a big, obvious, direct link to a secure page where they can update their payment information on the spot. The less friction you create, the higher your recovery rate will be.

Ideally, this link takes them to a page where they're already logged in. Your job is to remove every single obstacle standing between their intention to pay and a successful transaction.

Dunning Email and SMS Templates

You don't need to reinvent the wheel. Starting with proven templates gives you a solid foundation you can tweak to match your brand's voice. The core structure, however, is designed for one thing: getting a result.

Here are a few examples for different points in the dunning process.

Email 1: The Gentle Nudge (Day 1)

- Subject: Action Required: There's an issue with your [Product Name] payment

- Body: Hi [First Name], We had trouble processing the payment for your [Product Name] subscription. This happens all the time for simple reasons, like an expired card. You can update your payment info here to keep your account active: [Link to Update Payment]

SMS 1: The Quick Alert (Day 4)

- Body: Hi [First Name], it's [Company Name]. Just a quick heads-up: we couldn't process your recent payment. Please update your card here to avoid any service interruption: [Short Link]

Email 2: The Urgent Reminder (Day 10)

- Subject: Your [Product Name] account is scheduled for suspension

- Body: Hi [First Name], We still haven't been able to process your payment. To make sure you don't lose access to your account and all your work, please update your billing details before [Date]. Update your card now: [Link to Update Payment]

When you combine a helpful tone with a simple call-to-action and smart timing, the dunning process stops being a collections chore. It becomes a powerful tool for keeping the customers you’ve worked so hard to win.

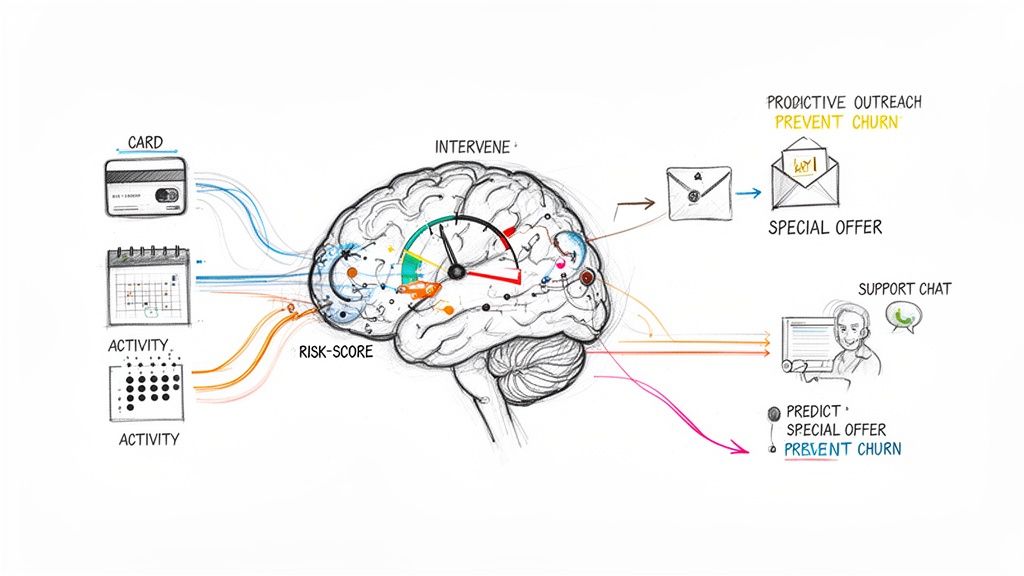

What Comes After Dunning? Thinking Proactively with AI

A well-tuned dunning process is essential for recovering revenue after a payment fails. But here’s the thing: it’s entirely reactive. You're essentially waiting for a fire to start before you grab the extinguisher.

What if you could spot the customers most likely to churn before their payment ever fails? This is where the strategy shifts from simple recovery to proactive retention. Think of it as an early-warning system for your revenue, giving you the power to act before a problem even materializes.

From Reactive Recovery to Proactive Retention

This is where AI-powered platforms like LowChurn change the game entirely. By connecting to your Stripe account, these tools go beyond payment data, analyzing a rich mix of subscription history and actual product usage. The goal is to catch the subtle signals that appear long before both voluntary and involuntary churn.

Instead of just looking at card expiration dates, this approach analyzes behavioral clues:

- Declining Engagement: Is a user logging in less often?

- Reduced Feature Use: Have they stopped using the features that deliver the most value?

- Subscription History: Is there a history of failed payments or frequent plan changes?

This is a world away from where dunning started, which was basically just manually chasing down unpaid invoices. For SaaS, it evolved into an automated way to deal with failed subscriptions—a critical function when you realize that up to 9% of annual revenue can vanish due to payment failures. You can see how far we've come in Stripe’s own deep dive on the topic.

By crunching all this behavioral data, AI models generate a customer health score, flagging accounts that are on a path to cancel. This foresight is powerful. You can get a better sense of how this works by reading up on predictive analytics for customer retention.

Proactive AI doesn’t replace dunning; it supercharges it. Dunning saves customers who have a payment problem. AI saves customers before they even realize a problem is brewing.

Creating a Complete Revenue Protection System

When you combine proactive retention with reactive dunning, you build a powerful safety net for your MRR. As soon as your AI system flags a customer as "at-risk," you can step in. You don't have to wait for a "payment failed" notification.

For instance, you could trigger a targeted email offering a tutorial on a new feature, a personalized discount, or even an invitation for a quick call with a customer success manager. These actions aren't about collecting a payment; they're about reminding the customer of your product's value and fixing the real reason they might be drifting away.

This creates a perfect partnership: the AI works to prevent voluntary churn by spotting disengagement, while your automated dunning process is there to catch the inevitable payment issues. Together, they form a complete system that protects your revenue from every angle, helping you hold onto the customers you worked so hard to win.

Your Blueprint for Protecting MRR

If you want to protect your Monthly Recurring Revenue (MRR), you need a real strategy—one that goes way beyond simply reacting when a payment fails. This blueprint is all about combining the best of both worlds: reactive recovery and proactive retention, giving you a complete defense for your subscription business.

The first thing to get right is your mindset. An effective dunning process isn't just a collections chore; it's a core retention function. You should measure its success not just by the revenue it recovers, but by the involuntary churn it stops in its tracks. Automation is your best friend here, turning what used to be a manual, time-sucking follow-up process into a systematic and customer-friendly workflow.

Building a Holistic System

But a truly top-tier system doesn't just sit around and wait for payments to fail. It pairs that reactive dunning with proactive, AI-driven churn prediction. This is the game-changer. It lets you spot and engage at-risk customers before they drift away or their card gets declined, tackling the real reason they might churn in the first place.

For any SaaS business, protecting MRR is everything. While a solid dunning process is crucial for handling failed payments, a complete strategy means being prepared for more serious issues, as you can see in a comprehensive guide to SaaS chargebacks.

The ultimate goal is to create an unbeatable defense where proactive insights from tools like LowChurn prevent voluntary churn, and a smart, automated dunning process catches the inevitable payment failures.

This two-pronged approach shifts you from just putting out payment fires to truly securing your revenue stream. It frees you up to stop worrying about leaks and focus on what really matters: sustainable growth.

Your Dunning Questions, Answered

Let's dig into some of the practical questions that pop up when SaaS founders and revenue leaders start thinking seriously about dunning.

How Long Should a Typical Dunning Cycle Last?

There's no single magic number, but for most SaaS businesses, the sweet spot for a dunning cycle falls between 7 and 21 days. The right length really hinges on your business model and your customers.

For B2C products, where customers can whip out a credit card and fix the problem in minutes, a shorter cycle of 7-14 days often works best. But in the B2B world, things can move a bit slower. A longer cycle of 14-21 days gives your customers the breathing room they might need for internal approvals or to get an expense report sorted. It's all about finding a balance—giving them enough time to act without letting that revenue slip away for too long.

Can Dunning Negatively Impact Customer Relationships?

It absolutely can, but only if it’s handled poorly. An aggressive, robotic, or confusing dunning process is a surefire way to frustrate a good customer and tarnish your brand's reputation. Nobody likes feeling like they're being chased down.

But when you get it right, a thoughtful dunning strategy can actually do the opposite—it can strengthen the relationship. Think about it: by sending empathetic messages, providing crystal-clear instructions, and making it dead simple to update a payment method, you're not demanding money; you're providing a helpful service. You're saving them from an unintentional service disruption they almost certainly don't want.

Frame your messages as helpful reminders, not demands for payment. This simple shift in perspective is crucial for maintaining a positive relationship and showing that you value them as a customer, not just a transaction.

What Is the Difference Between Dunning and Collections?

It's easy to lump these two together, but they operate with completely different goals in mind.

Dunning is all about customer retention. It’s a proactive, service-focused process designed to fix a failed payment for an active subscription. The main goal is to keep the customer happy and their service uninterrupted. It’s a relationship-saver.

Collections is about debt recovery. It's a reactive process that kicks in after a service has already been canceled. The focus here isn't on winning the customer back; it's purely about recovering the money that's owed.

In short, think of dunning as a tool to keep your customers, and collections as a tool to recover a debt.

Ready to move beyond reactive dunning? LowChurn uses AI to predict which customers are at risk of churning before their payment fails. See how much MRR you can save by visiting https://www.lowchurn.com.