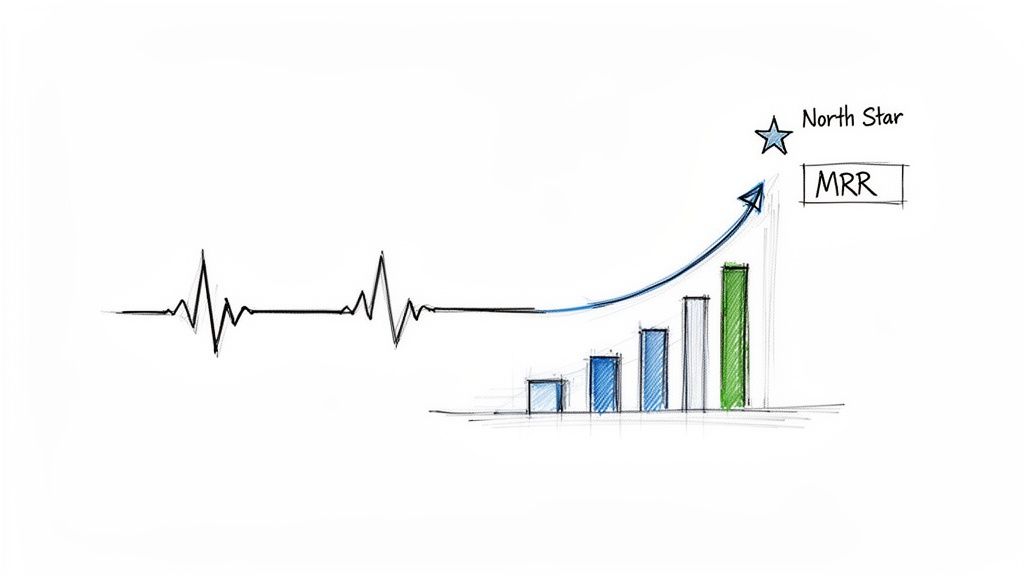

Let's cut right to it. Monthly Recurring Revenue (MRR) is the predictable income your business can count on every single month from all active subscriptions. It's the financial pulse of your company—a single, powerful number that tells you how healthy your business really is.

Understanding Your Business Heartbeat

Think about the difference between one-time sales and subscriptions. One-off purchases create a chaotic revenue graph with sharp peaks and sudden valleys, making it nearly impossible to plan for the future. MRR smooths all that out, giving you a stable baseline to build upon.

This is what turns a series of disconnected transactions into a sustainable, scalable business. For SaaS founders, especially those using a platform like Stripe, MRR is the metric that lets you forecast your cash flow, confidently plan new hires, and make smart decisions about growth.

That stability and predictability are exactly why MRR is considered a North Star metric for any subscription business. It’s more than just a figure on a dashboard; it’s a direct reflection of your business's momentum. A consistently growing MRR signals to investors that you’ve found a solid product-market fit and built a loyal customer base. A flat or declining MRR, however, is your canary in the coal mine—an early warning that something needs fixing.

To get a quick grasp of the core ideas, here's a simple breakdown.

MRR At A Glance

| Concept | Brief Explanation |

|---|---|

| Definition | The total predictable revenue a company expects from active subscriptions in a given month. |

| Why It Matters | It provides a clear, consistent measure of financial health and growth momentum. |

| Core Function | Enables reliable financial forecasting, performance tracking, and strategic planning. |

| Key Audience | Founders, investors, and leadership teams use it to gauge business viability and scale. |

Ultimately, this metric is about understanding the fundamental health and trajectory of your subscription business.

Why MRR Is A Founder’s Best Friend

When you start focusing on MRR, your perspective shifts from just chasing sales to managing the long-term health of your entire business. It plays a few critical roles:

- Financial Forecasting: A predictable income stream means you can make much smarter calls on your budget, hiring plans, and product development investments.

- Performance Measurement: It cuts through the noise of one-time payments and special offers, giving you a clean, consistent way to measure real growth month over month.

- Investor Confidence: For any startup seeking funding, a strong and growing MRR is one of the most convincing arguments for a viable and scalable business model.

- Valuation Driver: In the SaaS world, company valuations are very often calculated as a direct multiple of MRR or its annual counterpart, ARR.

A focus on MRR shifts your mindset from short-term gains to long-term value creation. It forces you to build a product that customers want to keep paying for, month after month.

For founders just starting this journey, a good guide on how to build a SaaS business from idea to first dollar can be an invaluable resource. In the end, truly understanding MRR is the first and most critical step toward building a resilient company. It’s not just about the money; it’s about creating predictable, sustainable success.

How to Calculate Your MRR the Right Way

Getting your Monthly Recurring Revenue calculation right is non-negotiable for any subscription business. If the number is off, your entire strategy could be built on a shaky foundation, giving you a misleading picture of your company's health. The good news is that the core formula is pretty simple.

At its heart, calculating MRR is about multiplying how much customers pay on average by the total number of customers you have.

The Basic MRR Formula:

- (Average Revenue Per User) x (Total Number of Paying Customers) = MRR

Let's walk through a quick, practical example to see how this plays out.

Putting the MRR Formula to Work

Imagine you run a project management tool called "TaskFlow." You offer two simple pricing plans: a "Starter" plan for $25/month and a "Pro" plan for $75/month.

Let’s say in April, your customer base looks like this:

- 100 customers are on the Starter plan

- 40 customers are on the Pro plan

First, you'll calculate the revenue from each individual plan.

- Starter Plan Revenue: 100 customers × $25/month = $2,500

- Pro Plan Revenue: 40 customers × $75/month = $3,000

Then, you just add them up.

$2,500 (from Starter) + $3,000 (from Pro) = $5,500 Total MRR

That $5,500 is the predictable, recurring revenue you can count on for the month. It's the financial baseline that tells you where you stand.

If you're using a platform like Stripe for billing, this is all calculated for you. Their dashboard even breaks it down visually.

Notice how the chart separates "New" from "Existing" MRR? That's a super helpful way to see exactly where your growth is coming from at a glance.

What Not to Include in Your MRR

Knowing what to exclude from your MRR calculation is just as critical as knowing what to include. Your MRR needs to be a pure reflection of predictable, recurring revenue. Tossing in one-off payments will inflate your numbers and make accurate forecasting impossible.

Make sure you leave these out of your MRR calculation:

- One-Time Setup Fees: These are not recurring. They're a one-and-done deal.

- Consulting or Professional Services: Any project work that isn't tied to an ongoing subscription.

- Variable Usage Charges: Things like per-minute fees or API call charges aren't predictable, so they don't belong in MRR.

- Trial Users: Until they pull out their credit card and become a paying customer, they contribute exactly $0 to your MRR.

It’s also crucial to understand the difference between revenue that's been committed versus revenue that's actually been recognized. For a deeper dive on that topic, check out our guide on the differences between revenue vs bookings. Keeping your MRR clean from these non-recurring items ensures it remains a reliable metric for tracking the real momentum of your business.

Understanding The Four Forces That Shape Your MRR

Your Monthly Recurring Revenue is never a static number. It’s a living metric, constantly telling the story of your business's momentum. Think of it like the water level in a reservoir; knowing the current level is one thing, but understanding the rivers feeding it and the drains pulling from it is what really matters.

These dynamics are driven by four fundamental forces. When you isolate and track each one, you stop just looking at what your MRR is and start understanding why it’s changing. This simple shift turns a vanity metric into a powerful diagnostic tool for your company's health.

The Four Pillars of MRR Change

To truly get a handle on your revenue, you need to see how these four pieces fit together. Each one tells a different part of your growth story, from new wins to painful losses.

| MRR Component | What It Is | Example | Impact on Growth |

|---|---|---|---|

| New MRR | Revenue from brand-new customers joining this month. | A new company signs up for your $150/month Pro plan. | Positive. The primary engine of acquisition-based growth. |

| Expansion MRR | Additional revenue from existing customers upgrading or adding services. | An existing Pro plan user upgrades to the $400/month Enterprise plan, adding $250 in MRR. | Positive. A powerful sign of customer satisfaction and product value. |

| Contraction MRR | Revenue lost from existing customers downgrading or removing services. | An Enterprise user downgrades from $400/month to the $150/month Pro plan, losing $250 in MRR. | Negative. A warning sign that a customer's needs are changing or they see less value. |

| Churned MRR | Revenue lost when existing customers cancel their subscriptions entirely. | A customer on the $150/month Pro plan cancels their account. | Negative. The most destructive force; revenue that's completely gone. |

Now, let's break down exactly what each of these means for your business.

New MRR: The Engine of Growth

New MRR is the lifeblood of a growing SaaS company. It’s the total monthly recurring revenue you gain from brand-new customers in a given month. Plain and simple, this is the direct result of your sales and marketing efforts hitting their mark.

For instance, when a new business signs up for your "Pro" plan at $150/month, you’ve just added $150 in New MRR. This is your primary growth engine, proving you're effectively attracting and converting new leads. A healthy, consistent stream of New MRR is a clear signal that your product has found its place in the market.

As you can see, every new customer directly adds to your total MRR, building your revenue base one subscription at a time.

Expansion MRR: Deepening Customer Value

Expansion MRR is the extra monthly revenue you generate from your existing customer base. Smart companies know that selling to a happy customer is far easier than acquiring a new one, and that's where expansion comes in.

This growth typically happens in a few ways:

- Upgrades: A customer moves from a basic plan to a more premium one.

- Add-ons: They buy more seats, extra features, or premium support.

- Cross-sells: You convince them to subscribe to another one of your products.

Let's say an existing customer on your $150/month "Pro" plan needs more power and upgrades to the "Enterprise" plan at $400/month. That single action just created $250 in Expansion MRR ($400 - $150).

Many experts call Expansion MRR "negative churn" because it actively fights against revenue loss. It’s a fantastic indicator of customer satisfaction and product stickiness—it proves your customers are finding so much value, they're willing to invest even more.

Contraction MRR: The Slow Leak

On the flip side of expansion, you have Contraction MRR. This is the revenue you lose when existing customers downgrade to a cheaper plan or remove a paid add-on. While it’s not as devastating as a full cancellation, it’s definitely a warning sign.

Imagine a customer on that $400/month "Enterprise" plan decides to scale back, moving down to the $150/month "Pro" plan. This creates $250 of Contraction MRR. This "leak" is a signal that their needs have changed, or worse, they're not seeing the value they once did. Keep a close eye on these accounts, as they can become a churn risk down the road.

Churned MRR: The Revenue Killer

Finally, we have the one everyone dreads: Churned MRR. This is the total monthly recurring revenue lost from customers who cancel their subscriptions completely. This is the most damaging force your business faces.

If that customer on the $150/month "Pro" plan cancels their account, you lose the entire $150 from your MRR. It's not just a downgrade; that revenue is gone. Now you have to work twice as hard just to get back to where you were.

Minimizing this number is job number one for any subscription business. If you're serious about growth, you need to understand your churn rate for SaaS and take active steps to reduce it.

By breaking your MRR down into these four components, you get a crystal-clear, multi-dimensional view of your business. Strong New MRR shows great acquisition, while high Expansion MRR proves you’re delighting your customers. At the same time, Contraction and Churned MRR are red flags that demand immediate attention, pointing you toward the exact spots where your product, pricing, or customer experience might be failing.

Avoiding The Common Traps In MRR Tracking

Monthly Recurring Revenue seems simple enough on the surface, but the road to tracking it accurately is full of potholes. It's surprisingly easy to misinterpret what should—and shouldn't—be included. This isn't just about sloppy bookkeeping; getting it wrong gives you a false sense of security and can lead to some seriously misguided business decisions.

Even tiny, honest mistakes can snowball over time, creating a warped view of your company's financial health. An inflated MRR might make you feel confident enough to hire that new developer or double down on ad spend, only to face a cash flow crunch later. Let's walk through the most common traps and how to sidestep them.

The Annual Contract Illusion

One of the first hurdles founders face is how to handle annual contracts. Picture this: a new customer loves your product and signs up for a yearly plan, paying $1,200 upfront. The cash is in the bank, and it feels great. The temptation is to count all $1,200 as revenue for that month.

Resist that temptation. That payment covers a full year of service. For MRR, you need to normalize it to a monthly value.

Divide the total contract value by the number of months in the term. For that $1,200 annual plan, you would add just $100 ($1,200 / 12 months) to your MRR for each of the next 12 months.

This keeps your MRR from getting artificial, lumpy spikes and gives you a true measure of the value you're delivering each month.

Counting Chickens Before They Hatch

Another classic mistake is including people who aren't actually paying you yet (or at all) in your MRR calculations. This happens in a few ways, but the end result is always the same: an unreliable, inflated metric that you can't build a strategy on.

Be ruthless about excluding these groups:

- Trial Users: Someone kicking the tires on a free trial is a prospect, not a paying customer. They contribute $0 to your MRR until they pull out their credit card and officially convert.

- Freemium Users: Likewise, users on your "forever free" plan are not part of your recurring revenue base. They only count once they upgrade to a paid subscription.

- One-Time Payments: Did a customer make a single purchase for a one-off service or setup fee? That’s great for your overall revenue, but it’s not recurring, so it has no place in your MRR.

Your MRR has to be a pure reflection of the predictable income you can expect from customers committed to paying you month after month.

The Discount And Promotion Dilemma

Discounts and special offers are fantastic for bringing in new customers, but they do make MRR tracking a bit trickier. The golden rule is simple: always book the revenue you actually receive, not the full sticker price.

Let's say your standard plan costs $100/month. You run a promotion giving new signups 20% off for their first six months. For that initial period, their contribution to your MRR is $80/month, not $100.

It’s a mistake to either:

- Book the full $100: This just flat-out overstates your revenue.

- Ignore the discount: This hides the real-world impact of your pricing strategies.

The right way is to track the $80 as MRR. You can even note the $20 difference as a "discount" in your financial model for more context. Once the promotion ends and the customer starts paying the full price, you can recognize that as a $20 bump in Expansion MRR. This approach keeps your reporting honest and gives you a clear-eyed view of your business.

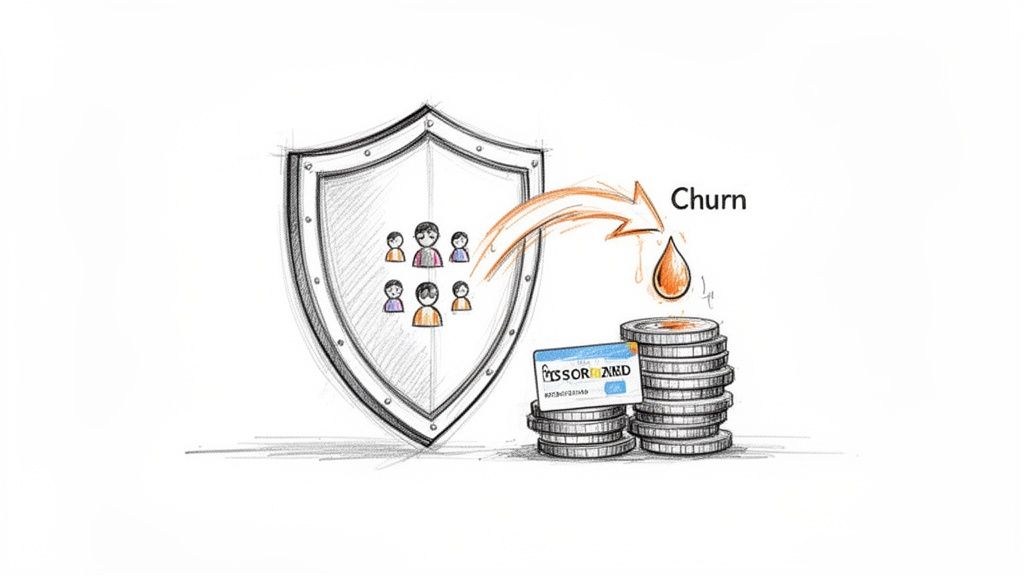

Why Protecting MRR Is More Important Than Acquiring It

Landing a new customer is a great feeling. There’s a real thrill in adding a new logo to your website and seeing that bump in New MRR. But the unglamorous secret to building a SaaS business that lasts isn't just about winning new deals—it's about obsessively defending the revenue you already have.

The constant chase for new customers can easily mask a much deadlier problem: churn. Think of your business as a bucket you're trying to fill with MRR. Acquisition is the faucet pouring water in, but churn is a hole in the bottom. You can open that faucet as wide as you want, but if you don't plug the leaks, the bucket will never stay full.

The Compounding Disaster of Churn

A small monthly churn rate doesn't seem like a big deal. A 3% monthly churn sounds manageable, right? But the compounding effect is what makes it so devastating. Let's look at what that really means for a company with $20,000 in MRR.

- Month 1: You lose $600 in Churned MRR. No sweat.

- Month 6: The cumulative loss is now much more than just six times that amount. A significant chunk of your original customer base is gone.

- End of Year 1: That "small" 3% monthly churn means you've lost over 30% of the MRR from your starting customer group.

This means you have to acquire $6,000 in New MRR next year just to break even. All your sales and marketing efforts are spent just treading water instead of actually growing. This is why churn is the silent killer of so many promising SaaS companies.

Protecting your existing Monthly Recurring Revenue isn't just a defensive move; it's your most powerful growth strategy. Every dollar of MRR you save from churning is a dollar you don't have to re-acquire through expensive marketing and sales efforts.

This mindset shift—from acquisition-at-all-costs to proactive retention—is what separates businesses that struggle from those that scale sustainably.

Shifting From Reactive to Proactive Retention

For too long, companies have treated churn as a lagging indicator—a number to analyze after a customer has already walked out the door. By then, it’s too late. The real goal is to build an early-warning system that flags at-risk customers long before they even think about hitting the "cancel" button.

This is where a proactive approach becomes a total game-changer. Instead of waiting for a cancellation email to land in your inbox, you can use data to spot the subtle behavioral shifts that signal churn risk.

These warning signs might include:

- A sudden drop in product usage or engagement with key features.

- Fewer team members logging in over the past few weeks.

- A drop-off in support tickets, which can paradoxically mean a customer has given up trying to solve their problems.

A critical part of protecting your MRR is knowing how to keep your existing customers happy and engaged. For founders looking to build a robust retention strategy, this is non-negotiable. An excellent external resource with actionable steps is this practical guide to reducing customer churn from FeedbackRobot.

Turning Retention into Your Biggest Growth Lever

Once you know how to spot these at-risk signals, you can actually do something about them. This is where modern tools designed for SaaS businesses come into play. If you're running on Stripe, managing subscriptions is straightforward, but predicting what your customers will do next is the hard part.

Platforms like LowChurn are built to solve this exact problem. By connecting directly to your Stripe account, LowChurn uses AI to analyze product usage patterns right alongside subscription data. It doesn't just show you who churned last month; it predicts who is likely to churn in the next 7-30 days.

This gives your team a prioritized list of at-risk accounts, complete with a dynamic health score for every single customer. Suddenly, you're no longer flying blind. You can see the storm clouds gathering and have enough time to intervene with targeted outreach, extra support, or a quick check-in to solve a problem they haven't even told you about.

Protecting your monthly recurring revenue has a massive impact on other vital metrics, too. For a deeper dive into this connection, you can learn more about how retention influences Customer Lifetime Value (CLTV) in our detailed guide.

By saving just a handful of customers each month, a tool like this can easily pay for itself, turning retention from a cost center into a profitable growth engine. It transforms churn from an unavoidable tax on growth into a manageable, predictable part of your strategy, ensuring the MRR you work so hard to acquire actually stays and compounds over time.

Got Questions About MRR? We’ve Got Answers.

Once you start digging into subscription metrics, you'll find that the real world is full of tricky little scenarios. Even with a solid grasp of the basics, founders and their teams often get tripped up by the details of applying Monthly Recurring Revenue to their specific business.

This section is your go-to guide for those common "what if" questions. Think of it as a quick reference for clarifying the edge cases and making sure you're tracking this critical SaaS metric the right way.

MRR vs. Revenue: What’s the Real Difference?

This is probably the most fundamental distinction you need to make, and it’s a big one. While Monthly Recurring Revenue (MRR) and total revenue are related, they tell two completely different stories about the health of your business.

Total revenue is the whole pot—every single dollar that comes into the business in a given month. It includes one-time setup fees, professional services, consulting gigs, and, of course, subscriptions. It's the full financial picture.

MRR, however, is laser-focused. It only counts the predictable, repeatable income you get from your active subscriptions. It intentionally strips away all the one-off payments to give you a clean, stable look at your company's core momentum.

Here’s the bottom line: MRR is the predictable heartbeat of your business, while total revenue is the full body scan. Smart investors and operators fixate on MRR because its predictability is the clearest sign of sustainable, long-term growth.

How Do I Handle Annual Plans in My MRR?

This is a classic question that trips up a lot of people, but the rule is simple and non-negotiable for accurate reporting. When a customer pays you for a year upfront, you have to spread that revenue out over the entire contract.

Let's say a customer signs an annual plan and pays you $1,200 today. You absolutely do not add $1,200 to this month's MRR. If you did, your growth charts would look like a wild, unpredictable rollercoaster, masking your true trajectory.

Instead, you normalize it. You take the total contract value and divide it by the number of months in the term.

- Total Annual Payment: $1,200

- Contract Term: 12 months

- MRR Contribution: $1,200 / 12 = $100 per month

You’ll recognize $100 in MRR from this customer every single month for the next year. This method smooths everything out, ensuring your MRR reflects the consistent value you deliver over time—not just when the cash happens to hit your bank account.

What’s a Good MRR Growth Rate for a SaaS Company?

There's no single magic number here. What's considered "good" really depends on your company's age, market, and how much funding you've raised. That said, there are some solid benchmarks that can help you see where you stand.

For early-stage startups, especially those at the pre-seed or seed stage, investors want to see aggressive growth. It's the clearest signal of product-market fit. A month-over-month growth rate of 15-20% is often what they're looking for.

As a company gets bigger and your revenue base grows, that percentage naturally comes down. For a more established business—say, Series A and beyond—a steady 5-10% monthly growth is considered very healthy and sustainable.

But no matter your stage, the underlying principle is the same.

A healthy business is one where your New MRR and Expansion MRR consistently add up to more than your Contraction MRR and Churned MRR combined. That final "Net New MRR" number is the ultimate report card on your growth engine.

Does Stripe Calculate MRR for Me Automatically?

Yes, it does! For anyone using Stripe for subscriptions, this is one of its most valuable features. The built-in analytics suite automatically calculates your MRR and all its key components right out of the box.

Stripe handles all the tricky stuff that can lead to manual errors:

- Normalizing annual or quarterly plans into their proper monthly values.

- Calculating upgrades (Expansion MRR) and downgrades (Contraction MRR).

- Automatically accounting for prorations and subscription changes.

- Tracking Churned MRR when a customer finally cancels.

This saves a ton of time and gives you a reliable dashboard to see your financial pulse in real-time. But it's crucial to understand what Stripe is—and what it isn't. Stripe is a fantastic system of record; it tells you what already happened with your revenue.

It wasn't built to tell you what's going to happen next.

That's where specialized tools come in to add a critical layer of foresight. A platform like LowChurn, for instance, connects to your Stripe data and analyzes it alongside product usage patterns. By looking at both subscription signals and user behavior, it can forecast which customers are at high risk of churning before they hit the cancel button. This gives you a window of opportunity to step in and save the very MRR that Stripe is so good at tracking.

Ready to stop reacting to churn and start preventing it? LowChurn connects to your Stripe account in seconds, using AI to predict which customers are at risk of canceling. Get the early-warning system you need to protect your monthly recurring revenue and drive sustainable growth. Start your free trial of LowChurn today!