At the heart of SaaS finance, the distinction between bookings and revenue boils down to a single, critical factor: timing. Get this wrong, and you could be steering your business with a faulty map.

Think of it like this: bookings are the promise of future income, while revenue is the income you’ve actually earned by delivering on that promise.

The Critical Difference Between Revenue and Bookings

For any SaaS business, grasping the difference between revenue and bookings isn't just an accounting exercise—it's fundamental to survival. Confusing the two can give you a dangerously misleading picture of your company's health, easily hiding problems like high customer churn or growth that's built on sand.

It’s an easy trap to fall into, especially for founders watching cash hit the bank through a payment processor like Stripe. Seeing a large upfront payment from an annual subscription feels like a huge win, but that money isn't entirely yours just yet.

Bookings: The Forward-Looking Metric

A booking is the total value of a contract a customer commits to. It's the moment they sign on the dotted line, agreeing to pay for your service over a specific period. This is a forward-looking metric that gives you a pulse on sales momentum and potential future cash flow.

So, when a new customer signs up for a $2,400 annual plan, you've just locked in a $2,400 booking. That number is incredibly valuable for:

- Sales Forecasting: It populates your pipeline with committed, predictable income.

- Growth Measurement: A steady stream of new bookings shows your sales and marketing efforts are paying off.

Revenue: The Earned Reality

Revenue, on the other hand, is the portion of that booking you can officially claim as "earned" under accounting principles like ASC 606. You can only recognize revenue once you’ve delivered the service for that period.

Following our example, that $2,400 annual booking doesn't translate to $2,400 in revenue on day one. Instead, you'll recognize just $200 in revenue each month for a year ($2,400 / 12 months). The rest of that cash sits on your balance sheet as deferred revenue, which is technically a liability until you earn it. This is why a deep dive into how ACV and ARR are calculated is so valuable for understanding long-term company health.

A high booking number feels great, but it’s recognized revenue that pays the bills and proves your business model is sustainable. The gap between these two figures often tells the real story of customer retention.

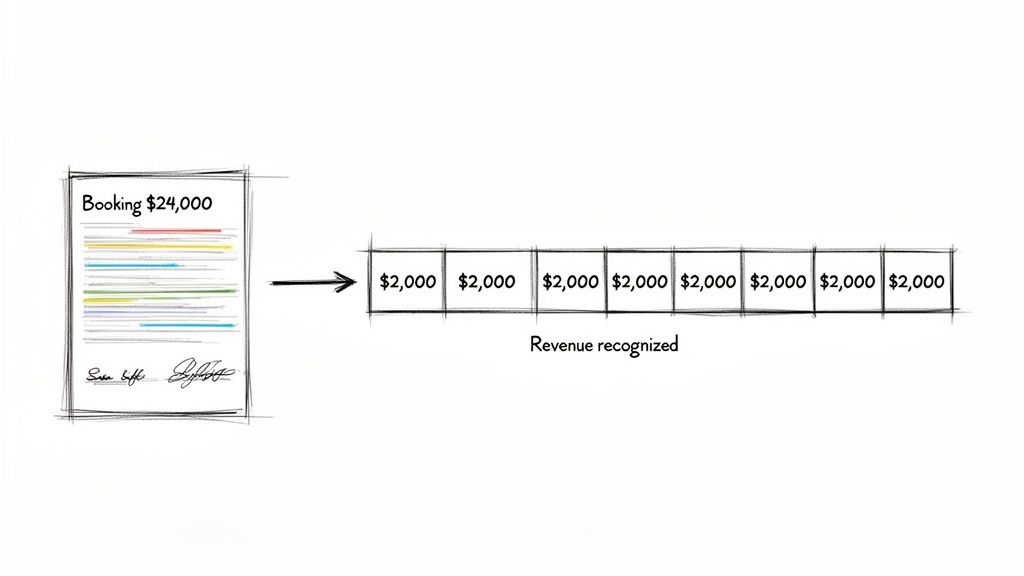

The image below perfectly illustrates this process—a single, large commitment broken down into earned, bite-sized pieces over time.

To make this even clearer, here’s a quick breakdown of how these two metrics function within a SaaS financial model.

Key Differences At a Glance

| Attribute | Bookings | Revenue |

|---|---|---|

| Timing | Recorded upfront when a contract is signed. | Recognized incrementally as the service is delivered. |

| Financial Statement | Not directly on the income statement; a leading sales metric. | Reported on the income statement as earned income. |

| Indicator Of | Sales commitment and future growth potential. | Actual business performance and operational health. |

| Example | A customer signs a $12,000 annual contract on Jan 1. | $1,000 is recognized as revenue each month for a year. |

In short, bookings measure your ability to sell, while revenue measures your ability to deliver and retain. Both are essential, but they tell very different stories about your business.

Understanding the Accounting Rules for Revenue

Just because a customer pays you doesn't mean you've earned the money yet—at least, not in the eyes of an accountant. This is the heart of revenue recognition, a crucial set of accounting standards that ensures your financial reports paint an accurate picture of your company's health.

Getting this right isn't just about compliance; it's about truly understanding your business's performance over time.

The main framework here is ASC 606 (Revenue from Contracts with Customers). Its core rule is simple: you can only recognize revenue when you've delivered the service you promised. For a SaaS company, that service is delivered bit by bit, every single day the customer has access to your platform. It’s a marathon, not a sprint.

What is Deferred Revenue?

Let’s say a customer prepays for an annual subscription. That cash hits your bank account, but you haven't earned it all upfront. Instead, that payment is recorded on your balance sheet as deferred revenue.

Think of deferred revenue as a liability—it’s a promise of future service you owe to your customer. As each month of the subscription term passes, you "earn" a fraction of that prepaid cash. Only then does it move from the liability account on the balance sheet to become recognized revenue on your income statement.

This is the bridge between a big upfront booking and the steady, earned revenue you report each month. Deferred revenue is the official accounting mechanism that makes it all work.

To really get a handle on revenue recognition, you need a solid grasp of the foundational principles of double-entry bookkeeping. It’s the system that keeps everything in balance and creates a clear, auditable financial trail.

A Practical Example: From Booking to Recognized Revenue

Let's break this down with a real-world example. A new customer signs up on January 1st for your annual plan, paying $24,000 upfront.

- The Booking: On January 1st, you have a $24,000 booking. Your cash balance goes up, but your recognized revenue for that day is still $0.

- The Initial Entry: The entire $24,000 is recorded in a Deferred Revenue account. This is a liability on your balance sheet.

You'll earn this revenue over the next 12 months. That $24,000 translates to $2,000 in earned revenue each month.

At the end of January, your accountant (or accounting software) will make a journal entry that looks something like this:

- Reduce the Liability: You’ve delivered one month of service, so you decrease what you owe the customer.

- Debit Deferred Revenue: $2,000

- Increase Earned Revenue: That amount is now officially earned and can be reported on your income statement.

- Credit Sales Revenue: $2,000

You'll repeat this exact process every month for the entire year. By December 31st, the full $24,000 will have been moved from the deferred revenue liability account to your recognized revenue account. This is precisely why the cash you collect (like your Stripe gross volume) can look so different from the actual revenue you report each month.

How Stripe Data Maps to Your Financial Metrics

One of the most common hurdles for SaaS founders is figuring out how to translate the raw data from their Stripe dashboard into financial metrics that actually mean something. Let's get one thing straight: your Gross Volume in Stripe shows cash collected, not revenue you’ve earned. To build an accurate picture of your company's health, you have to map specific Stripe events to the proper accounting concepts of bookings and revenue.

When a customer signs up, Stripe kicks off a series of events that mark different points in the financial lifecycle. For instance, a subscription.created event for a new annual plan is a crystal-clear signal of a booking. It represents the customer's total commitment, but you haven't earned that money yet.

Recognized revenue, on the other hand, isn't tied to a single, neat event in Stripe. It’s a calculated metric that you earn over time. You get there by systematically taking the value of a booking (which sits on your books as deferred revenue) and recognizing it bit by bit over the service period.

Interpreting Stripe Events

The first step is knowing which Stripe events signal a booking. The moment a customer is contractually obligated to pay you, you’ve got a booking.

subscription.created: This is your most obvious indicator. When a customer commits to a new annual or multi-year plan, the total contract value (TCV) is your booking.invoice.payment_succeeded: For an annual plan paid upfront, this event confirms you've collected the cash for that booking. But for a monthly plan, this event acts as both a booking and recognized revenue for that specific month.- One-Time Charges: If you have a separate charge for something like a setup fee (created via the Charges API), that's also part of the initial booking. The revenue from that fee, however, often needs to be recognized over the customer's expected lifetime, not all at once.

The key takeaway here is that your Stripe dashboard is a log of cash-related events. It tells you what happened and when, but it's on you to interpret those events through the lens of accrual accounting to see what's really going on.

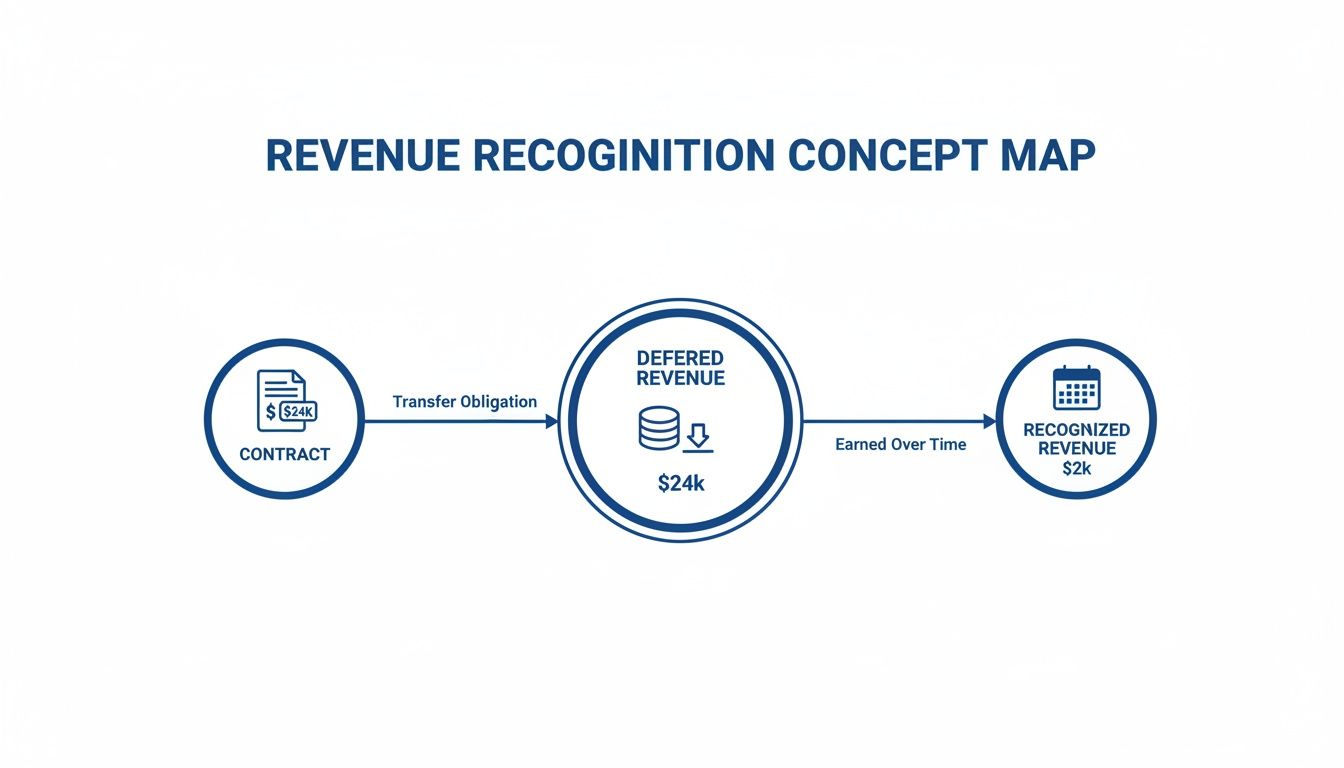

This concept map shows how a single contract flows through your financials, starting as a large commitment and becoming smaller, recognized chunks of revenue each month.

As the diagram shows, that initial $24,000 contract value is first recorded as a deferred revenue liability. Only then is it earned in $2,000 increments each month.

From Data to Insight

In the world of SaaS, the gap between bookings and revenue can make or break your growth, especially if you’re using Stripe and trying to keep churn low. Bookings capture the full value of new deals—like a $24,000 annual subscription that bumps up that month's bookings by the whole amount. Revenue, or more specifically MRR, only gets to recognize $2,000 of that each month as you deliver the service.

This difference is critical. Bookings give you a forward-looking glimpse of sales momentum, but they don’t guarantee cash if customers leave early. A three-year, $300,000 contract with a $30,000 setup fee hits your bookings at $330,000 on day one, yet your ARR is only $100,000.

Companies that track bookings versus revenue closely often see 20-30% better forecasting accuracy. If your revenue consistently trails your bookings, it’s a red flag for retention problems—a sign you need to implement some effective SaaS customer retention strategies. For bootstrapped founders, that huge Q1 bookings number can evaporate if churn is high, making it essential to connect bookings to actual MRR health.

Ultimately, you have to look beyond Stripe's gross volume. Building an accurate financial model means connecting Stripe's event-based data to a proper accounting framework. This is the only way to monitor both your sales momentum (bookings) and your actual earned performance (revenue) with total clarity.

Connecting Metrics to Your Company's Health

While bookings track your sales team's success in landing future commitments, revenue is what reflects your company’s actual, earned performance right now. Understanding how these two distinct metrics feed into core SaaS indicators like Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), and Net Revenue Retention (NRR) is critical for gauging the true health of your business.

Think of bookings as a powerful leading indicator. A spike in annual contract bookings today gives you a glimpse into next year's growth, signaling strong future ARR. But it's recognized revenue that forms the bedrock of your current financial stability—it's the foundation upon which MRR and ARR are actually built.

The Bookings-to-Revenue Gap

The space between your total bookings and your recognized revenue is one of the most revealing diagnostic tools a SaaS company has. A healthy, growing business will almost always have a gap, especially when selling annual or multi-year contracts. That deferred revenue is a good thing.

The danger isn't the gap itself, but how it behaves over time.

A consistently widening gap where revenue growth stagnates despite soaring bookings is a massive red flag. This dynamic almost always points to a single, devastating problem: customer churn.

Imagine your sales team closes $2M in new annual bookings this quarter, but your recognized revenue only creeps up slightly. This discrepancy strongly suggests that while new customers are signing up, existing customers are canceling before you can recognize their full contract value as revenue.

The bookings-to-revenue gap is where churn hides in plain sight. An overemphasis on new bookings can create a dangerous blind spot, masking retention issues that are actively eroding your company's foundation.

This is exactly why a deeper analysis of revenue vs. bookings is so vital. Bookings are promises, but revenue is reality. A $330,000 three-year deal with setup fees gets booked entirely on day one, but the revenue is only recognized over time, perhaps at $110,000 annually. To truly understand your company's trajectory, it helps to learn from others' experiences, like these insights on achieving key revenue milestones like 10k MRR.

Connecting the Dots to MRR and NRR

Your MRR isn't a simple number; it's a composite of new sales, expansion from existing customers, and losses from churn. Bookings primarily fuel the "New MRR" piece of the puzzle, but they don't tell the whole story.

Let's walk through a common scenario to see how this plays out.

Scenario: High Bookings with Stagnant Revenue

- Bookings: Your sales team is on fire, consistently hitting 120% of its quota for new annual contracts.

- MRR Growth: Despite the sales success, your net new MRR is flat or barely growing.

- The Problem: High churn is canceling out your new business wins. For every $10,000 in New MRR you add from bookings, you might be losing $8,000-$9,000 in churned MRR from existing customers.

In this situation, celebrating booking numbers alone is like trying to fill a leaky bucket. No matter how much water you pour in (new bookings), you'll never make progress until you plug the holes (reduce churn).

This is where Net Revenue Retention (NRR) emerges as the ultimate health metric. NRR shows you what percentage of revenue you retained from the same customer group a year ago, factoring in both upsells and churn. Top-tier SaaS companies often boast NRR figures well over 100%, proving that revenue from existing customers is growing faster than it's being lost.

A persistent gap between bookings and recognized revenue almost always correlates with poor NRR. It's a clear sign that the value promised in your bookings is failing to convert into long-term, retained, and expanding revenue. This is why SaaS leaders obsess over conversion—a 15% shortfall between bookings and revenue can correlate to 8-12% higher churn.

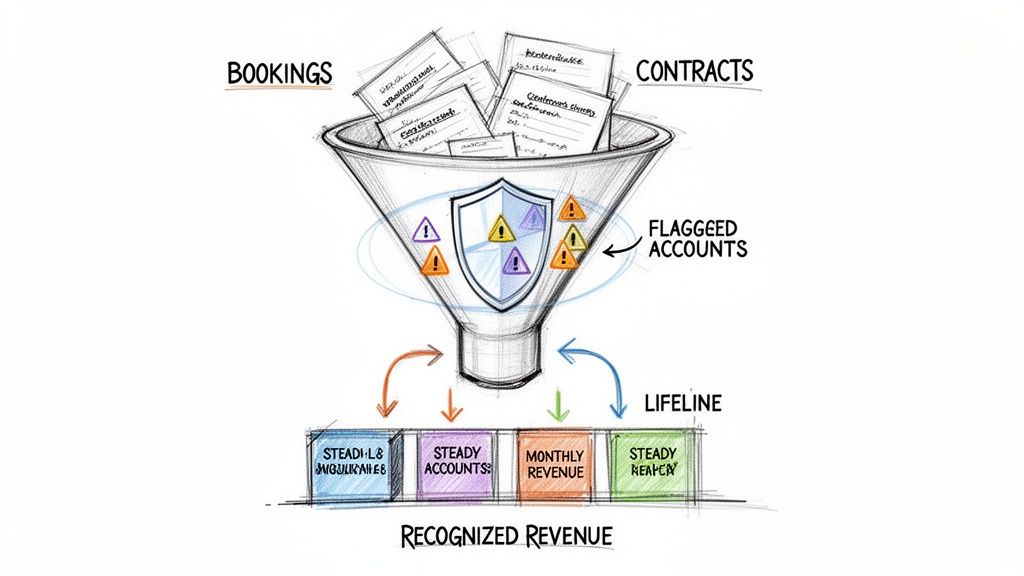

For a platform like LowChurn, this gap is a key signal used to identify at-risk accounts. By flagging these discrepancies, we help users recover 10-20% of MRR weekly by tackling the underlying issues before they snowball into cancellations.

How to Protect Booked Revenue from Churn

The ever-present gap between your bookings and your recognized revenue? Nine times out of ten, that gap has a name: churn. Bookings represent a customer's commitment—a promise to pay. But that promise only holds value if they stick around long enough for you to actually earn the full contract value.

Simply tracking churn after it happens is like looking in the rearview mirror. It only tells you about the money you’ve already lost. The real game-changer is proactively making sure the value you've booked successfully converts into revenue month after month. This means shifting from a reactive "what happened?" mindset to a predictive one that answers, "what's about to happen?"

This is where modern retention tools come into play. By digging into customer usage signals and pairing them with subscription data from a payment processor like Stripe, you can catch the subtle behavioral shifts that almost always come before a customer cancels.

Moving From Reactive to Predictive Churn Management

Traditional churn analysis is a look back in time. Who canceled last month, and what reasons did they give? While useful for tweaking long-term strategy, it does absolutely nothing to save the accounts that are on the chopping block right now.

Predictive churn prevention, on the other hand, is all about leading indicators. It's about spotting customers whose product engagement is slipping, who are hitting roadblocks, or whose credit cards are about to expire. This foresight gives your team a critical window to step in with the right kind of help—be it targeted support, a helpful tutorial, or a timely discount.

Key signals that predictive tools keep an eye on include:

- Decreased Product Usage: A customer who used to log in daily is now showing up once a week. Red flag.

- Feature Disengagement: They've stopped using the core features that once made your product sticky.

- Support Ticket Volume: A sudden flood of support tickets often signals growing frustration.

- Failed Payments: Involuntary churn from expired cards is a silent killer of revenue.

When you catch these signs early, you can flip a potential churn event into a retention win, effectively building a firewall around your future revenue. A thorough customer churn analysis is the foundational first step in building this kind of predictive engine.

The Financial Impact of Proactive Retention

The delicate dance between bookings vs. revenue in SaaS really drives home the powerful ROI of retention. Bookings are a measure of what you've sold; revenue is what you've earned after delivering the service. As the SaaS market grows, the companies that thrive are the ones who masterfully shrink the gap between these two numbers.

Consider this: while median SaaS companies convert 85-90% of bookings to revenue annually, the best-in-class hit over 120% Net Revenue Retention (NRR) by actively preventing churn and driving expansion. This is absolutely critical when you realize that even a "low" churn rate can quietly erase 10-15% of your bookings if left unchecked—a massive hit for any growing business.

For founders, tracking the delta between bookings and revenue on a weekly basis is your most effective early-warning system. It’s the clearest indicator you have for protecting future growth and ensuring financial stability.

By directly connecting your sales performance (bookings) to your customer success outcomes (revenue realization), you create a powerful feedback loop. This doesn't just protect your bottom line; it aligns your entire team around the one goal that truly matters: delivering undeniable, sustained value to your customers.

Building a Revenue Protection Workflow

Protecting booked revenue isn't about a one-time fix. It’s a continuous, automated process. With a platform like LowChurn, you can put much of this on autopilot.

The system hooks into your Stripe account, analyzing both payment signals and user behavior to assign a real-time "health score" to every single customer. This lets you immediately focus your energy on the accounts that are most likely to leave.

A simple but incredibly effective workflow looks something like this:

- Identify At-Risk Accounts: The dashboard flags customers with low health scores, showing you exactly where your revenue is leaking.

- Diagnose the Problem: Drill down to see why they're at risk. Is it a drop-off in engagement, a string of failed payments, or a history of negative feedback?

- Launch a Retention Campaign: Use pre-built playbooks to act fast. This could be an automated email sequence offering a helping hand, a dunning campaign to get payment info updated, or a simple alert to your customer success team to make a personal call.

This approach transforms churn management from a historical report card into an actionable, real-time strategy. It’s how you ensure the promises captured in your bookings become the hard financial reality on your income statement, securing your company’s long-term health and growth.

Common Questions About Bookings and Revenue

When you're in the trenches of running a SaaS business, the financial jargon can get confusing. Let's clear up some of the most common questions that pop up when founders are trying to get a handle on the difference between bookings and revenue.

Getting these concepts right isn't just about accounting—it's about making smarter decisions for your company's growth.

Are One-Time Setup Fees Bookings or Revenue?

A one-time setup fee is absolutely a booking. The moment a customer signs the contract and agrees to pay it, that fee becomes part of the Total Contract Value (TCV). It’s a clear signal of the customer's total financial commitment.

Revenue recognition, however, is a different story. Accounting standards like ASC 606 have specific rules here. If your setup service is just part of the onboarding process and not a standalone product, you can't recognize that fee as revenue all at once.

Instead, that setup fee revenue has to be spread out over the expected customer lifetime. So while a $1,000 setup fee gets logged as a booking on day one, the actual revenue might be recognized in small increments over several years, matching the value you deliver over that period.

How Do I Calculate Bookings for Monthly Plans?

For businesses that run on month-to-month plans, the lines between bookings and revenue can feel a bit blurry, but the distinction is still there. When a new customer signs up for your $100/month plan, you've secured a $100 booking for that first month.

In this case, the recognized revenue for the month is also $100, since you deliver the service within that same period. The numbers match up, which keeps things simple.

This is why tracking bookings really starts to show its value when you introduce annual or multi-year contracts. A long-term commitment creates a big, upfront booking that looks very different from your monthly recognized revenue. For purely monthly businesses, focusing on New MRR is often a more direct way to measure sales performance.

For monthly plans, bookings and revenue are nearly identical in the short term. The real value of tracking bookings emerges when you introduce annual contracts, which create a deferred revenue liability and a clearer picture of long-term customer commitment.

Can Bookings Ever Be Lower Than Revenue?

Yes, and when this happens, it’s often a fantastic sign. This scenario usually plays out in businesses with healthy net negative churn, where the revenue you gain from existing customers expanding their plans is greater than the revenue you lose from churn.

Picture a quarter where your sales team doesn't sign a single new customer, giving you $0 in new bookings. But during that same time, your existing customers upgraded their plans, adding $10,000 in expansion MRR, while you only lost $5,000 to churn.

Your total recognized revenue still grew by a net $5,000, even with zero new bookings. This shows you have an incredibly sticky product that customers love and want more of. It's proof that your business can grow significantly just by keeping your current customers happy.

Does My Stripe Dashboard Show Revenue or Bookings?

This is a critical point that trips up so many founders. Your Stripe dashboard does not show you bookings or recognized revenue. The big "Gross Volume" number you see is simply your cash flow—the total amount of money you successfully collected in a given period.

If a customer pays $1,200 upfront for an annual plan, Stripe will show a $1,200 payment. That amount is your cash collected and also serves as your $1,200 booking.

But your recognized revenue for that month is only $100 (the total divided by 12 months). Relying on Stripe’s gross volume as your revenue figure is a common and dangerous mistake. It completely ignores accrual accounting principles, inflates your monthly performance, and gives you a warped view of your company's financial health.

Understanding and predicting churn is the first step to protecting your revenue. LowChurn uses AI to analyze your Stripe data and customer behavior, identifying at-risk accounts 7-30 days before they cancel. Stop reacting to lost revenue and start proactively saving it. Discover how LowChurn can secure your MRR today.